CAM Investment Grade Weekly

09/21/2018

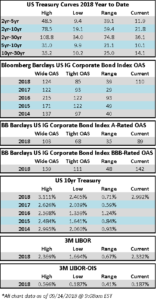

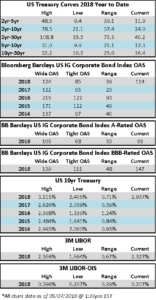

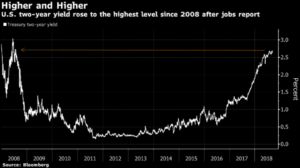

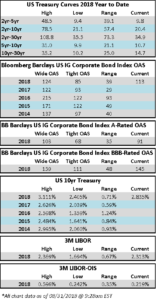

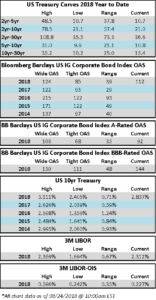

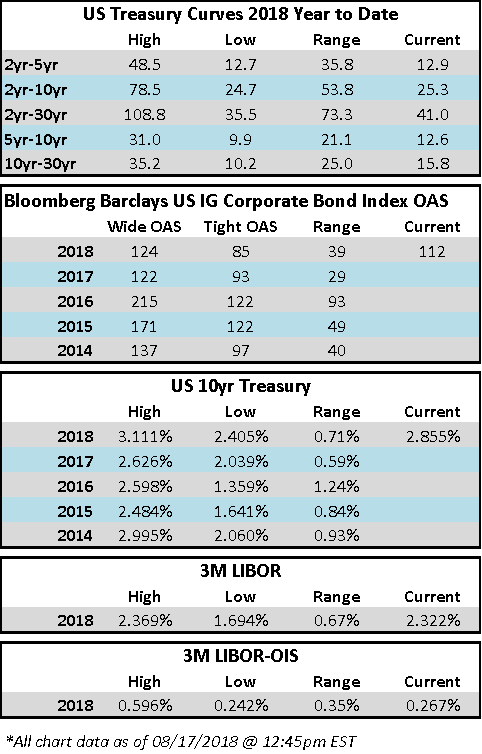

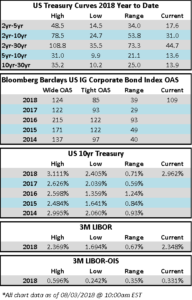

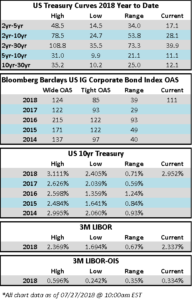

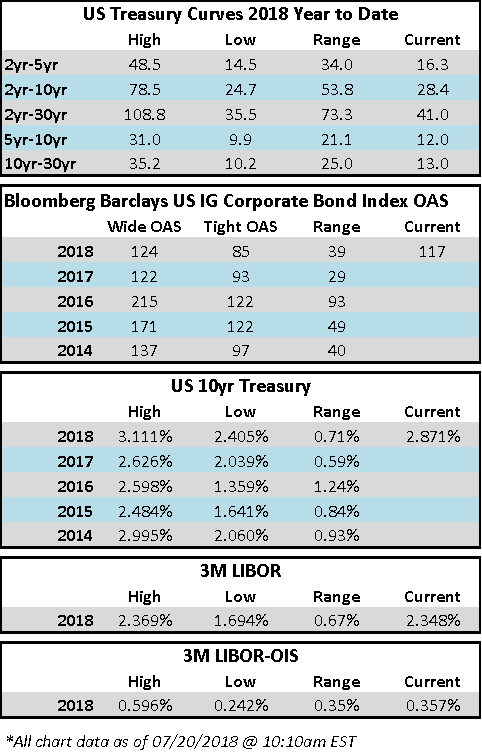

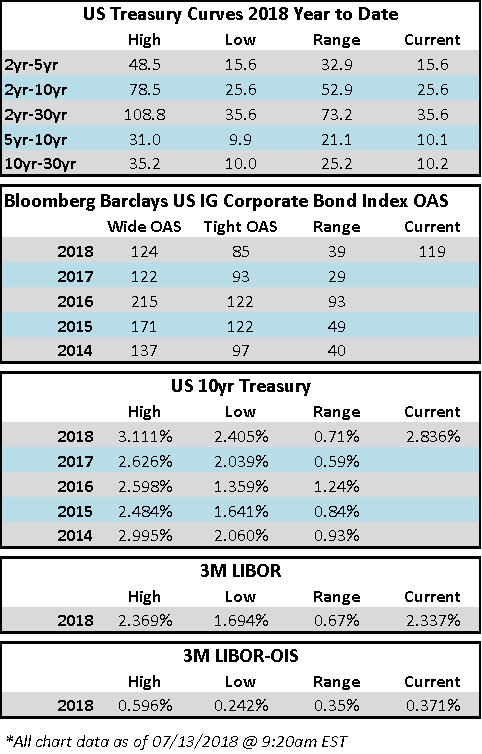

Corporate credit spreads are generically 3 bps tighter on the week and the 10-yr Treasury is 8 bps higher than last weeks close. At 3.08%, the 10-yr is close to retesting year-to-date highs of 3.11%.

According to Wells Fargo, IG fund flows decelerated during the week of September 13-September 19 and were +$1.0 billion. IG fund flows are now +$96.361 billion YTD.

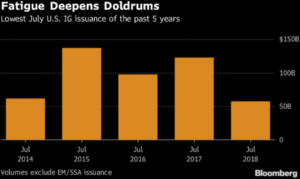

According to Bloomberg, issuance on the week topped $29bln which brings the September new issuance tally to $110.2bln and the YTD tally to $883.134bn.

(WSJ) Comcast, Fox to Settle $35 Billion Takeover Battle for Sky in Weekend Auction

- Comcast Corp. and 21st Century Fox Inc. will settle their takeover battle for Sky PLC in a weekend auction run by British regulators, setting up a dramatic climax to a 21-month sale process that has pitted some of the world’s biggest media giants against each other.

- The U.K. Takeover Panel, which polices deal making in the country, laid out Thursday rules for the auction. It is a process the regulator hasn’t run many times previously—and never before with such a large company as the prize. London-listed Sky has a market value of some $35 billion.

- Auctions of big, publicly traded companies are extremely rare elsewhere, too. In 1988, private-equity giant KKR & Co. won a tumultuous auction for tobacco and food giant RJR Nabisco. It beat out a group led by the company’s management in a $25 billion deal, ending a takeover battle immortalized in the book and film “Barbarians at the Gate.”

- The Sky auction pits Rupert Murdoch’s 21st Century Fox, which already owns 39% of Sky, against Comcast. Walt Disney Co. has separately agreed to buy a big chunk of Fox, including its Sky stake, for $71 billion.

- That puts Disney Chief Executive Bob Iger and Mr. Murdoch on the same team, bidding against Comcast CEO Brian Roberts. Because Fox already owns a big stake in Sky, the Disney-Fox team has an interest in driving up the bidding, even if it doesn’t ultimately win. That would make the stake more valuable should it decide to sell it to Comcast.

- Mr. Murdoch has long sought to consolidate his holding in London-based Sky. Disney and Comcast see Sky as a way to expand internationally. The broadcaster also sells wireless, TV and internet services throughout Europe, and it is a media company that produces its own news, entertainment and sports programming.

- The auction will run through the day Saturday, and consist of a maximum three rounds of bidding. The winner will be announced shortly after the auction ends Saturday evening. If there is a third and final round, it will be conducted with sealed bids—secret, final offers made to the regulator.

- Fox first offered in December 2016 to buy the rest of Sky it didn’t already own for £10.75 ($14.22) a share. After Fox’s merger proposal hit regulatory and political delays, Comcast made a surprise offer last February, for £12.50 a share.

- Comcast made the most recent offer in July, for £14.75 ($19.49) a share, valuing Sky at $34 billion. That is above Fox’s current bid, also made in July, of £14 a share.

(Bloomberg) Sempra Energy to Sell U.S. Solar Assets to Consolidated Edison

- Sempra Energy today announced that it has entered into an agreement to sell its U.S. non-utility operating solar assets, solar and battery storage development projects and one wind facility to Consolidated Edison, Inc. for $1.54 billion in cash, subject to adjustments for working capital and pre-closing cash contributions.

- “This sale represents an important step forward in the portfolio-optimization plan we announced in June to support market growth opportunities,” said Joseph A. Householder, president and chief operating officer of Sempra Energy. “We plan to work closely with Consolidated Edison to ensure a smooth transition.”

(Bloomberg) Fitch Upgrades Merck’s Rating to ‘A+’; Outlook Stable

- Fitch Ratings-Chicago-20 September 2018: Fitch Ratings has upgraded Merck & Co., Inc.’s (Merck) Long-Term Issuer Default Rating (IDR) to ‘A+’ from ‘A’. The Rating Outlook is Stable. The ratings apply to roughly $23.5 billion of debt outstanding at Jun. 30, 2018. A complete list of Fitch’s rating actions follow at the end of this press release.

- KEY RATING DRIVERS

- Leverage Consistent with ‘A+’ Rating: Merck has reduced its leverage (total debt/EBITDA) since year-end 2015 through a combination of EBITDA growth and debt reduction. Merck’s leverage was 1.4x at June 30, 2018, compared to 1.8 at Dec. 31, 2015. The company reduced debt by roughly $2.9 billion and increased EBITDA by approximately $2.1 billion during the same period. Improving operations, particularly with the performance of Keytruda (cancer), has helped drive EBITDA growth.

- New Products/ Growth Opportunities: Products approved during the last three years should help to drive intermediate- to long-term, top-line growth for Merck. In addition, Keytruda (cancer) continues to expand, supported by an ongoing stream of clinical data. However, it will continue to face competition from Bristol-Myers and Pfizer/Bayer, which have similar-acting drugs. Merck is also evaluating Keytruda’s safety and efficacy in other cancers and in combination with other cancer therapies. Recent approvals to treat diabetes, cancer and infectious diseases should help to augment long-term growth and diversify sources of revenue.

-

- Expanding Late-Stage Pipeline: Fitch expects Merck to continue to build its late-stage pipeline with new therapies to treat cancers, infectious diseases and cardiovascular disorders. While the majority of these projects are internally developed, Merck also partners with innovator firms to take advantage of technological advancements that were discovered externally. Given the breadth and pace of new drug discovery and development, Fitch believes that it is advantageous for firms to look externally as well as internally to optimally build their pipelines.

- Patent Exposure Manageable: Merck is facing generic and biosimilar competition to Zetia, Vytorin and Remicade. However, Fitch views the risk as manageable with roughly 9% of firm sales at risk. Remicade, which accounts for about 2.1% of total firm sales, is a biologic that will likely continue to experience less rapid sales losses to biosimilar competition, compared to traditional small-molecule pharmaceuticals when a generic enters the market. Interestingly, Merck recently launched its own biosimilar version of Remicade in the U.S. Vytorin and Zetia are small molecules and account for roughly 5.2% of total revenues. Sales erosion for these two drugs has been rapid.

- Solid Free Cash Flow Expected: Fitch forecasts that Merck will generate $4.0 billion – $4.2 billion in free cash flow (FCF) during 2018. Gradually increasing margins driven by an improving sales mix and decent cost control should augment moderate near-term, top-line growth. Fitch expects FCF to incrementally increase during the multi-year forecast period due to moderately improving margins and stronger top-line growth

- Targeted Acquisition Likely: Fitch looks for Merck to pursue mainly targeted acquisitions in the intermediate term. The company has improved its operational and financial prospects through successfully gaining regulatory approvals on late-stage pipeline projects and has continued to back fill its pipeline with new and advancing projects. An improved growth and profitability profile decreases the need for the company to execute large strategic business combinations in order to fill pipeline gaps or offset sales losses from patent expiries.

- Payers Increasingly Demanding Value: While drug pricing is always near the top of contentious issues in healthcare, it has become increasingly so during the past three years. Some of the scrutiny has been self-inflicted by a few firms pursuing significant price increases on long-established drugs. Other concerns surround the high price points of recently approved innovative drugs. Regardless, pharmaceutical manufacturers will increasingly need to demonstrate the value of their therapies to payers, patients and providers with strong clinical outcomes driven by increased safety and efficacy. This dynamic will place further pressure on the research and development efforts of innovative biopharmaceutical firms.

(Bloomberg) Lilly’s Elanco Rises After $1.5 Billion Animal-Health IPO

- Pricing the deal higher than expected is a good sign in what will be a test of investor appetite for large, standalone animal-health businesses. The first one to be taken public by a pharmaceutical giant has rewarded investors with a tripling in stock price. Elanco faces the challenge of showing that it can follow suit five years after rival Pfizer Inc. listed its animal-health business, Zoetis Inc.

- LLY expects to completely sell down its stake in Elanco in 2019 (CAM Comment)

(SEC Filing 8k) Abbot Deleveraging

- Abbott Ireland Financing DAC, a wholly-owned subsidiary of Abbott Laboratories (“Abbott”), intends to offer senior unsecured notes in an offering exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), subject to market and other conditions. Abbott will fully and irrevocably guarantee the notes on a senior unsecured basis. Abbott intends to use the net proceeds from the offering of the notes to refinance all or portions of Abbott’s outstanding 2.00% Notes due 2020, 4.125% Notes due 2020, 3.25% Notes due 2023, 3.4% Notes due 2023, and 3.75% Notes due 2026, and for fees, expenses, and other costs associated therewith.

- Abbott’s forthcoming EUR issuance is expected Monday and proceeds will be used to reduce USD debt. We expect this to be a leverage neutral transaction, but would not be surprised to see ABT reduce more USD debt than the proceeds (CAM Comment)

- On the last earnings call (7/18/18), CEO Miles White commented “And you say at some point, well, how far would you take debt down? How far would you pay down debt? What are you going to do when you hit the point where you think that that’s enough? And I’m going to give a couple of answers to that. A lot of people seem to get comfortable somewhere between $15 billion and $20 billion. I remember with $15 billion worth of debt is still a hell of a lot of debt.” and further emphasized, “So I think our platter right now says we can afford to just be opportunistic. I don’t have big M&A on the radar screen or big transactions on the radar screen I’d say from a capital or cash allocation standpoint. I’m going to keep paying down debt, because I think that’s a prudent path for now.” (CAM comment)

- ABT had just over $20bn of debt after repaying just over $7bn in the first six months of this year as of the end of last quarter ended June 30, 2018. (CAM Comment)