CAM Investment Grade Weekly Insights

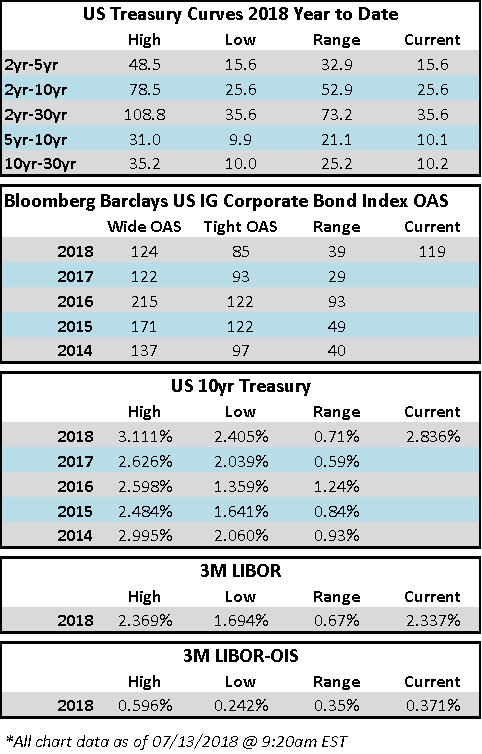

Corporate spreads have moved tighter throughout the week. Generically, most credits are 2-4 basis points tighter on the week while the corporate index is 3 basis points tighter week over week as of Friday morning.

According to Wells Fargo, IG fund flows for the week of July 5-June 11 were +$3.4 billion. IG flows are now +$71.912 billion YTD.

Per Bloomberg, $11.4 billion of new issuance priced through Friday morning. A slow week of issuance is unsurprising given that earnings season has begun, which precludes issuance due to blackout periods. Bloomberg’s tally of YTD total issuance stands at $651.404bn.

Treasury rates did not change materially this week and curves remain near their flattest levels of the year.

(Bloomberg) AT&T Appeal Seen as High-Stakes Shot at Redemption for Enforcers

- The Trump administration’s renewed battle against AT&T Inc.’s Time Warner Inc. deal signals that it still sees a path to undoing the blockbuster merger — even after a stinging rebuke of its case last month.

- Rather than walk away, the Justice Department’s antitrust division took a big gamble Thursday, with a one-sentence notice of appeal filed in federal court in Washington. In doing so, it risks a second defeat that could lead to binding precedent that makes future merger challenges harder.

- But the move offers a tempting shot at redemption after a humiliating loss handed down by U.S. District Judge Richard Leon. The case will be heard by the U.S. Court of Appeals for the District of Columbia Circuit, where President Donald Trump’s recent Supreme Court nominee Brett Kavanaugh sits.

- “Their assessment of the strategic risks may be bad, may be unduly risky — a lot of people said that about this case in the first place,” said Chris Sagers, an antitrust law professor at Cleveland State University. “So far that has all proven true and maybe it will prove true that appealing this decision was also unwise.”

- In last month’s 172-page opinion, Leon ripped apart the government’s case that the $85 billion deal would give AT&T the power to hike prices. The Justice Department argued that the telecom giant would charge its cable-TV competitors more money for Time Warner shows, bringing higher bills to consumers across the country.

- To some observers, the judge’s decision smacked at times of anti-government bias — particularly when Leon admonished Justice Department lawyers not to bother seeking a temporary order halting the merger from proceeding. Obtaining a stay, which the government had a right to seek, “would undermine the faith in our system of justice,” Leon wrote.

- “The judge’s ruling showed an extreme favoritism for AT&T’s arguments and appeared to substantially discount everything the government presented,” said Gene Kimmelman, the head of Public Knowledge, a Washington-based public policy group that opposed the merger. “I’m not surprised the government views it as a totally incorrect ruling.”

- AT&T closed the Time Warner transaction on June 14, two days after Leon’s ruling. The Justice Department had agreed not to seek an emergency court order preventing the deal from closing after AT&T promised to operate Time Warner’s Turner Broadcasting as a separate business unit until 2019. That would make it easier for AT&T to sell Turner if the government ultimately prevails.

(Bloomberg) NAFTA Repeal Would Be ‘Disaster’ for U.S.: Union Pacific CEO

- Repealing the North American Free Trade Agreement would be a “disaster” for the U.S. economy, says Union Pacific CEO Lance Fritz.

- Growing list of tariffs from President Trump’s trade policies threatens “to undo progress” made in economy in recent years, Fritz says at the National Press Club in Washington

- Administration should address China’s impact and modernize NAFTA, but other trade proposals “look as if they’ll do more harm than good”: Fritz

- To change China’s behavior, “we need to work with our allies, not start trade wars,” he says

- “The best thing we can do for American workers is to create new jobs, and the best way to create new jobs is trade”

- Uncertainty over trade is discouraging capital expenditure, he says

- It costs $3m to build a mile of railroad track; costs $3.25m with steel tariffs, he says

- It costs $3m to build a mile of railroad track; costs $3.25m with steel tariffs, he says

(Bloomberg) U.K. Takeover Panel Sets Sky Floor Price in Disney-Comcast Fight

- The body that oversees U.K. takeovers raised the minimum price that Walt Disney Co. must pay for British pay-TV company Sky Plc as Disney battles Comcast Corp. for control of Rupert Murdoch’s media empire.

- Disney would have to bid for all of Sky at 14 pounds ($18.37) a share if it manages to acquire the entertainment assets of Murdoch’s 21st Century Fox Inc. before a bidding war for Sky between Fox and Comcast concludes, the Takeover Panel said in a statement.

- The panel’s decision is unlikely to affect the outcome of the contest as the floor price is in line with Fox’s current bid for Sky and below the 14.75 pounds a share offer from Comcast.

- Disney and Comcast are vying for Fox assets including a 39 percent stake in Sky. The Takeover Panel can uphold the interests of other Sky shareholders by forcing Disney and Comcast to buy them out at a minimum price. That price is calculated by examining the bids for the Fox assets and ascribing an implied valuation to the Sky stake. The Panel’s so-called chain principle mandates a full takeover bid for a company if a buyer acquires more than 30 percent of its shares, even if those shares are acquired as part of a larger deal.

- The panel had previously ruled, following Disney’s initial $52.4 billion bid for Fox, that a Disney offer for Sky would be required at 10.75 pounds a share. Disney has since increased its offer for the Fox bundle by 35 percent.

- Sky is seeking to review the latest ruling, the panel said in the statement, without giving details of Sky’s concerns. “Each of Disney and Fox is considering its position,” it added.