CAM Investment Grade Weekly Insights

Corporate spreads are modestly tighter on the week.

According to Wells Fargo, IG fund flows for the week of July 12-July 18 were +$2.5 billion. IG flows are now +$76.072 billion YTD.

Per Bloomberg, $31.380 billion of new issuance priced through Friday morning. Banks led the way this week, as they issued $20bln+ in new supply coincident with earnings releases. Bloomberg’s tally of YTD total issuance stands at $682.784bn.

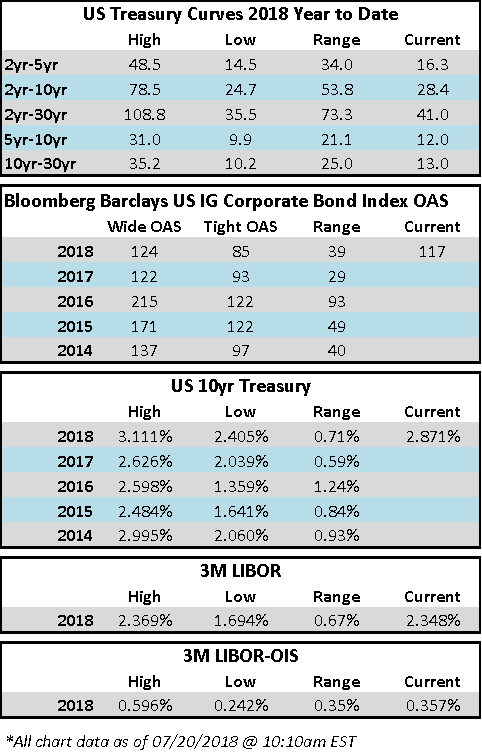

Treasury rates did not change materially this week while curves have added a touch of steepness off the lows.

(Bloomberg) Here’s Exactly What PG&E Wants California to Do About Fires

- Virtually everyone who’s been following the multibillion-dollar problem that California’s power companies are facing in the wake of last year’s devastating wildfire season knows that the biggest among them — PG&E Corp. — is lobbying the state hard to change its wildfire policies.

- And California lawmakers seem receptive: Governor Jerry Brown formed a committee this month to consider changes to regulations that hold utilities liable for the costs of wildfires that their equipment ignite — even if they weren’t negligent. In a telephone interview Thursday, PG&E’s senior vice president of strategy and policy, Steve Malnight, laid out exactly what the company’s lobbying Sacramento for. Here’s the utility’s wish list:

- A change in the way the state applies its so-called inverse condemnation law — the one that holds utilities strictly liable for fire damages regardless of negligence. PG&E thinks it should take into account whether a company acted in a “reasonable way.” Malnight said that’s how local flood control districts are treated today when the state considers flood damage liabilities. “We think that’s a fair standard,” he said.

- A bill that would allow PG&E to issue bonds backed by customer bills that would help pay for costs tied to the deadly Wine Country wildfires last year. (California investigators have already determined that PG&E’s equipment caused several of the blazes.) The legislation wouldn’t shield the utility from costs associated with potential negligence, Malnight said. He estimated that a bond issuance would save PG&E’s customers about a third of the costs of covering damages compared with traditional financing means, such as issuing equity.

- More “comprehensive solutions” to preventing future wildfires. Malnight said the company supports state regulations that go beyond liability rules and speak to the resiliency of infrastructure. He said the committee that Brown formed has already called for the need for broader solutions including forest management.

- Malnight said PG&E has been building a “broad-based” coalition of investor-owned and publicly owned utilities and labor unions to push for reforms.

(Bloomberg) Microsoft Floats to Record Highs as Wall Street Cheers the Cloud

- Microsoft Corp.’s foray into cloud technologies is paying off after revenue for the fiscal fourth quarter bested the highest of analysts’ estimates.

- Thanks to the growing adoption of Microsoft’s cloud offering, Wall Street is rewarding the Redmond, Washington-based software provider with buy reiterations and price target increases. Goldman Sachs, while boosting its price target to $125 from $114, said the company’s bring-your-own-licence program is “starting to bear fruit.”

- Chief Executive Officer Satya Nadella has been overseeing steady growth in the company’s Azure and Office 365 cloud businesses. Surveys of customer chief information officers by both Morgan Stanley and Sanford C. Bernstein published in the past month show an increase in companies signing up for or planning to use Microsoft’s cloud products. Revenue from cloud-computing platform Azure rose 89 percent in the quarter, while sales of web-based Office 365 software to businesses climbed 38 percent. Microsoft also saw a bump from relative improvements in the corporate personal-computer market, which has been stagnant for years.

(Bloomberg) Comcast Drops Out of Bidding War for Fox to Focus on Sky

- Comcast Corp. will no longer seek to compete with Walt Disney Co.’s for a swath of 21st Century Fox Inc.’s entertainment assets, choosing to focus instead on winning control of the British pay-TV service Sky Plc.

- Following a bidding war with Disney, Comcast concluded that the price for the Fox assets was too high, according to a person familiar with the matter who asked not to be identified because the decision process was private. Another hurdle was the regulatory requirement to divest Fox’s regional sports networks as part of any deal, the person said.

- Disney can now go ahead with its offer of $71.3 billion for Fox’s properties, which include a 39 percent stake in Sky. Comcast has offered about $34 billion for the U.K. pay-TV provider, including Fox’s stake, though it’s unclear if Disney will be willing to part with it.

- Comcast bondholders may be relieved if the company abandons its debt-fueled pursuit of Fox’s entertainment assets and limits its M&A activities to the Sky deal. If Comcast were to successfully acquire both Fox and Sky, its debt load would likely increase to the $170 billion range, net leverage would rise to the mid-4x area and its ratings could fall two notches to mid-triple B. In anticipation of such a scenario, Comcast and Fox bonds have been among the worst performers within the communications sector so far this year. Conversely, their bond spreads could narrow if Comcast retains its A3/A- ratings and Fox bonds are assumed by Disney.