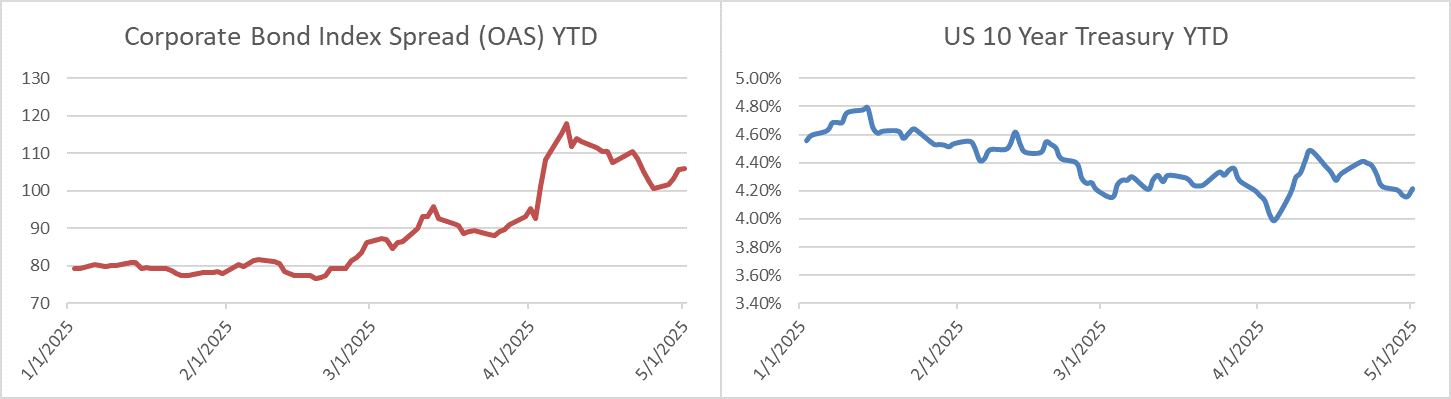

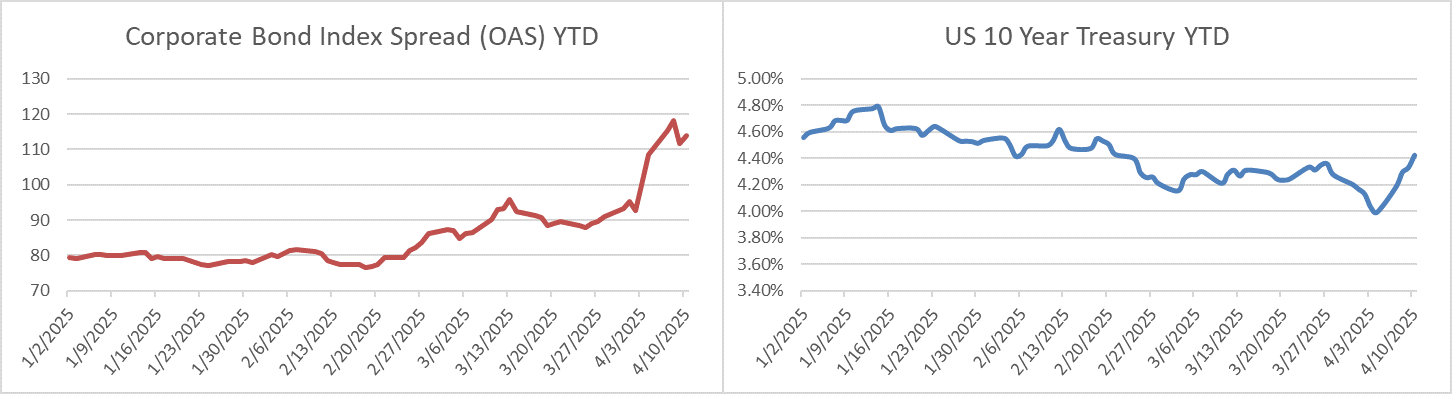

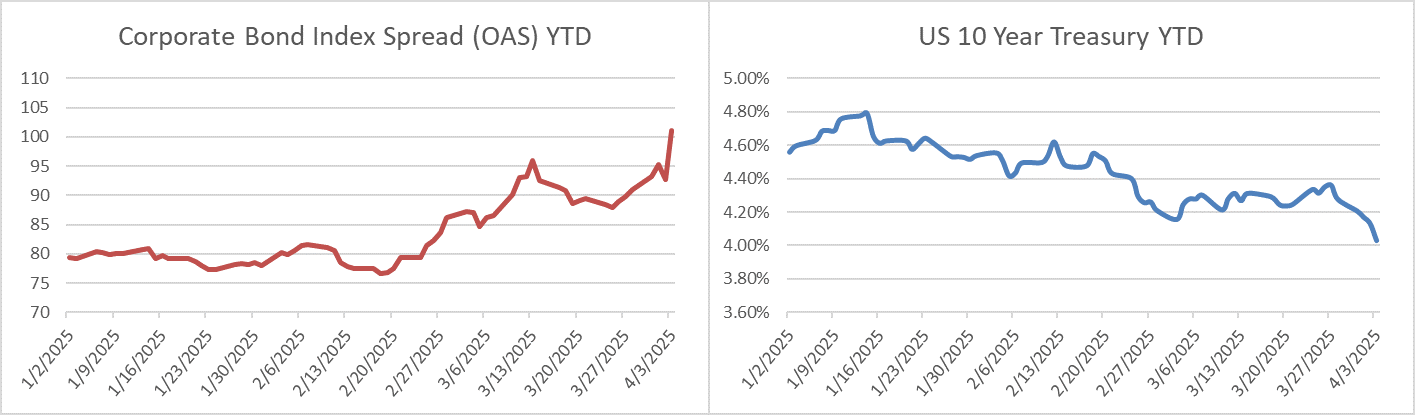

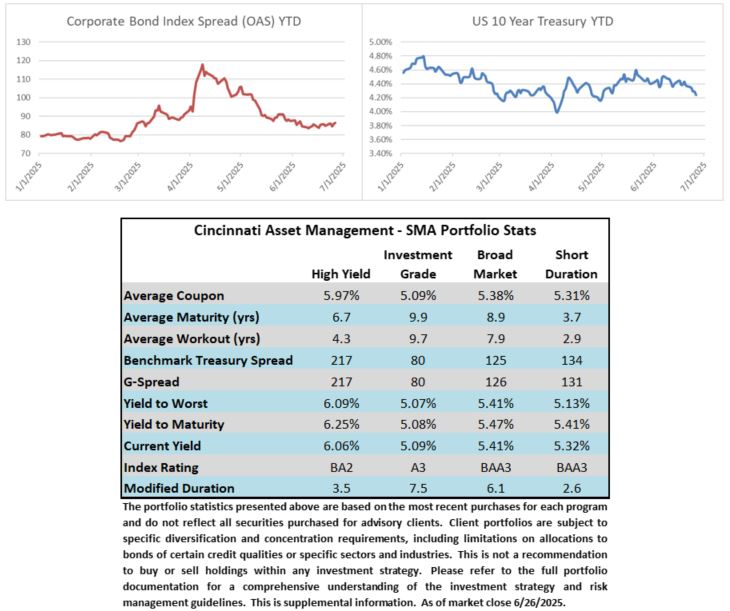

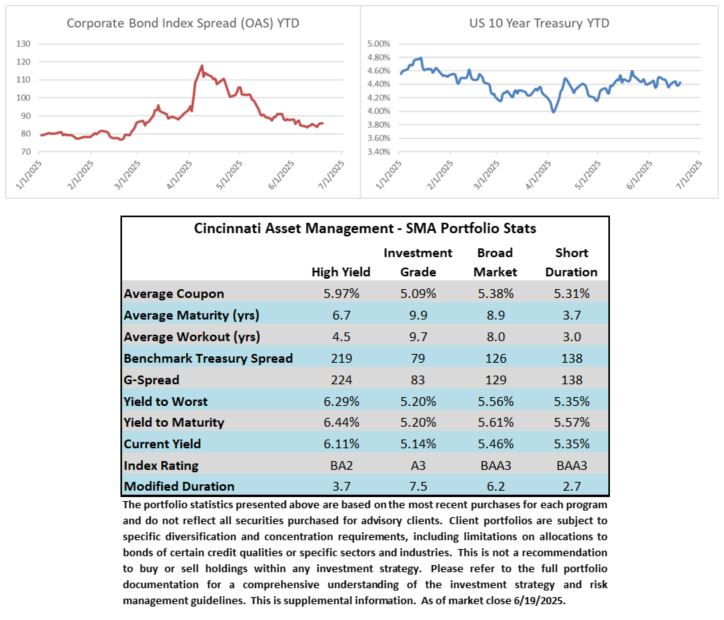

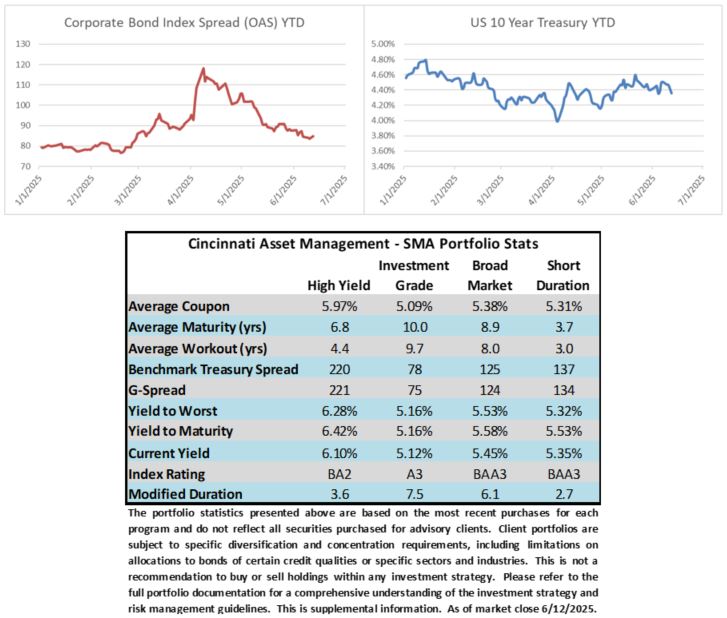

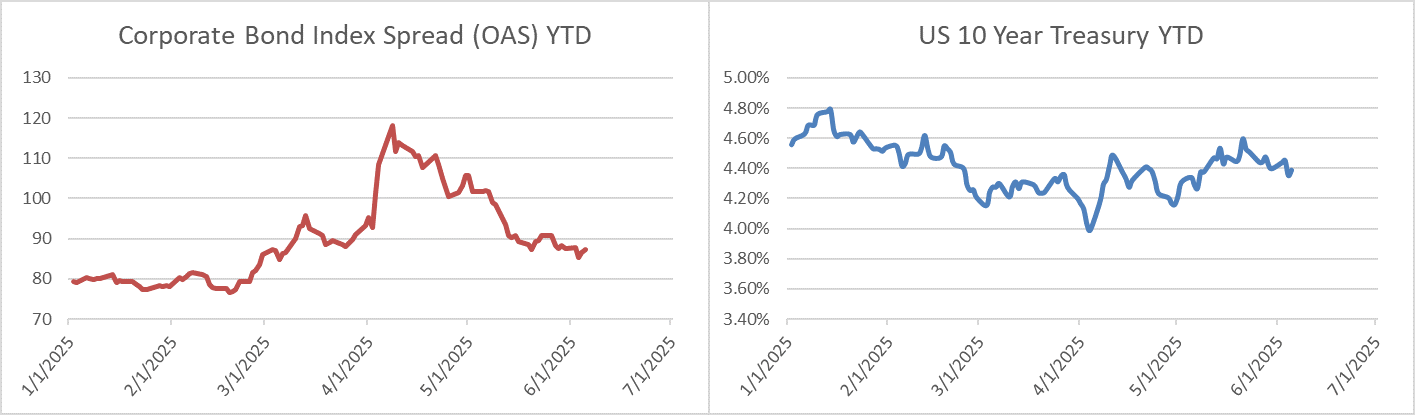

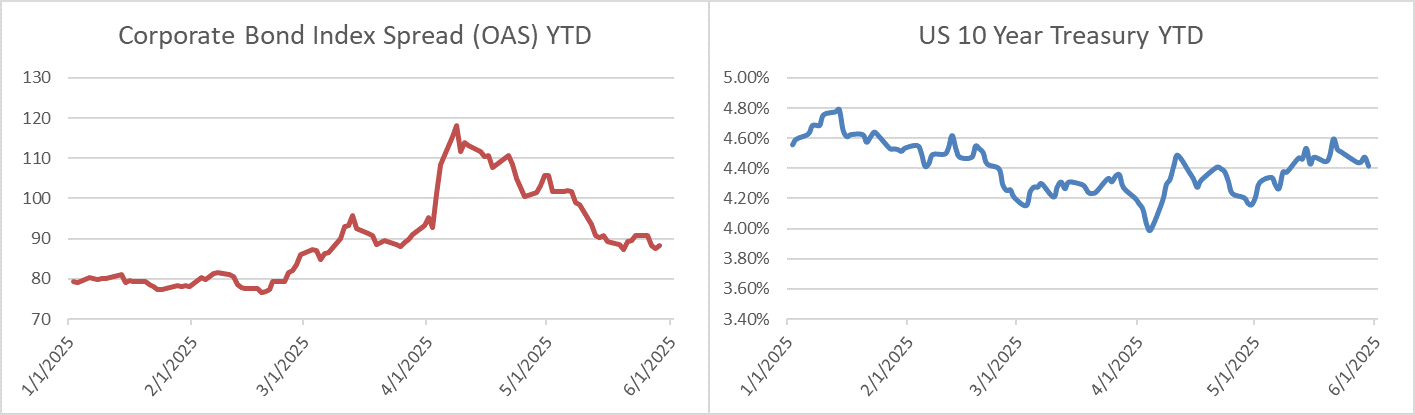

Credit spreads were mostly unchanged this week through Thursday, sitting very near cyclical tights. Technically, the OAS for the US Corporate Bond Index was 1bp wider on the week through Thursday. The index has traded in a tight 5bp range of 84-89 since the final trading days of May. The tone is stable Friday morning as we go to print. The 10yr Treasury yield moved slightly lower throughout the week, from 4.38% last Friday to 4.25% Friday morning. Through Wednesday, the Corporate Bond Index year-to-date total return was +3.85% while the yield to maturity for the Index closed the day at 5.04%.

Economics

It was an interesting week for data. Housing was mixed as existing home sales came in with a slight beat but new home sales numbers were extremely weak as sticky mortgage rates have done little to incentivize buyers to come off the sidelines and were a headwind for affordability. GDP was revised down from -0.2% to -0.5%. Finally on Friday, personal income fell more than expected and spending also declined. Core PCE came in a tick higher than expected but investors were sanguine on the number as most of the inflation came on the services side making it a classic “better than feared” print. Taking it all together, there is still not much evidence in the numbers that show that tariffs are having an outsize impact on inflation but there is some evidence of consumers pulling back on spending. Various Fed commentators lamented during the week (Daly, Waller) that the central bank may indeed need to start cutting its policy rate sooner rather than later. However, there are still numerous FOMC voting members, including Chair Powell, that prefer a more deliberate approach.

Next week, the big highlight is the employment report for the month of June which will be released a day early on Thursday due to the 4th of July holiday.

Primary Market

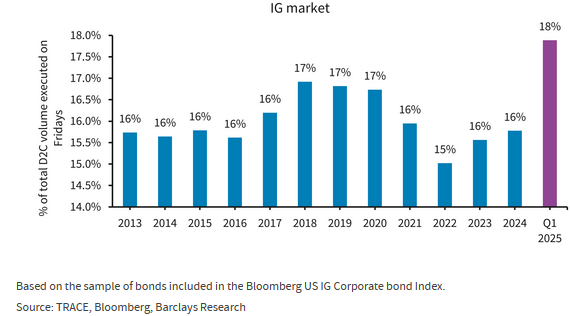

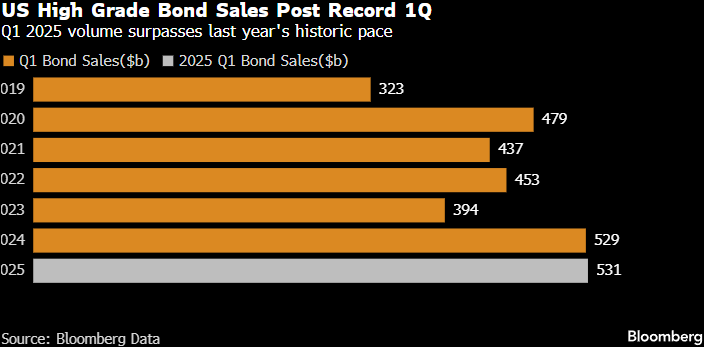

This week was busier than most forecasters had predicted as nearly $37bln of new debt was priced, easily besting the estimate of $25bln. Yankee issuers led the way this week, that is companies that are based in other countries (or foreign governments) that elect to issue $USD in the US corporate market. Next week is expected to be very light with the 4th of July holiday looming at the end of the week. Underwriters are looking for just $5-$10bln of new supply. YTD new issue volume has now crested $890bln which is +3% ahead of 2024’s pace. Recall that 2024 was the second busiest year ever for the primary market, trailing only the pandemic fueled rush for liquidity that occurred during 2020.

Flows

According to LSEG Lipper, for the week ended June 25, investment-grade bond funds reported a net inflow of +$1.3bln. Total year-to-date flows into investment grade were +$18.5bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.

Economics

Economics