CAM Investment Grade Weekly Insights

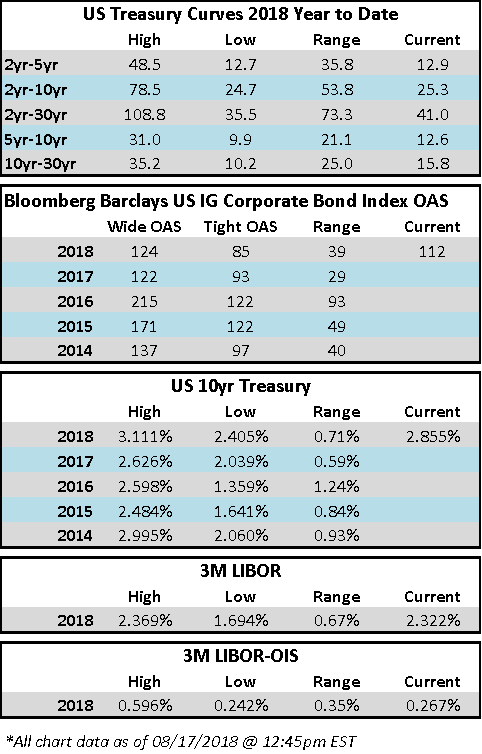

Investment grade corporate spreads drifted wider mid-week before firming on Thursday and into Friday morning. As we go to print, spreads for the corporate index are now unchanged for the week.

According to Wells Fargo, IG fund flows for the week of August 9-August 15 were +$910 million. IG flows are now +$88.544 billion YTD.

Per Bloomberg, $29.950 billion of new issuance printed during the week. Relatively speaking, this was a robust week for issuance considering that it is mid-August, a time that is typically associated with lower levels of supply. In fact, the consensus issuance figure for August was $60bln and that has already been surpassed with $66.2bln in new issuance month to date. Bloomberg’s tally of YTD total issuance stands at $763.684bn.

Despite a relative deluge of supply, dealer inventories remain very low, near their lowest levels since 2013.

(PR Newswire) Aircastle Corporate and Senior Unsecured Credit Ratings Upgraded to Baa3 by Moody’s

- Company now one of only two industry players with investment grade ratings from the three major credit rating agencies

- Mike Inglese, Aircastle’s Chief Executive Officer, stated, “Aircastle is now part of a select group of global aircraft leasing companies with investment grade credit ratings from all three major rating agencies. We are very pleased that Moody’s, S&P and Fitch recognize the strength of Aircastle’s business platform and our unique position in the industry.” Mr. Inglese continued, “As the leading investor in the secondary aircraft market, Aircastle is positioned to continue to grow in a disciplined and profitable manner. We believe that three investment grade credit ratings will substantially broaden Aircastle’s liquidity base and funding access, and should enable us to efficiently raise competitively priced capital in the global markets to further drive profitable growth.”

(Bloomberg) Bayer Vows Stronger Roundup Defense as It Absorbs Monsanto

- The German drug and chemical giant said it will formally absorb the U.S. company after selling some crop-science businesses to competitor BASF SE to resolve regulatory concerns. Because U.S. authorities insisted that the businesses operate separately until that sale was complete, Bayer said it previously had been barred from steering Monsanto’s legal strategy.

- That will now change as the stakes mount in the U.S. battle over Roundup. Bayer is facing $289 million in damages after Monsanto lost the first court case stemming from claims that the weed killer causes cancer. Even if a judge overturns or reduces the award, the trial will probably be the first of many: More than 5,000 U.S. residents have joined similar suits.

- “Bayer did not have access to detailed internal information at Monsanto,” the Leverkusen, Germany-based company said in a statement. “Today, however, Bayer also gains the ability to become actively involved in defense efforts.”

- The move to integrate the companies came as Bayer shares continued their slide in the wake of the court ruling, falling as much as 6.6 percent on Thursday. The company has lost about 16 billion euros ($18 billion) in market value this week, since the jury’s award in the Roundup case.

- Bayer said on Thursday it’s considering its options for further legal action regarding the California listing, saying it “requires judicial intervention and correction.”

- Bayer is also facing lawsuits in the U.S. over dicamba, another herbicide in Monsanto’s portfolio. The German company said it will also take an active role in any claims for damages over dicamba.

(The Canadian Press) Constellation Brands spending $5 billion to boost stake in Canopy Growth

- Constellation Brands has signed a deal to invest $5 billion in Canopy Growth Corp. to increase its stake in the marijuana company to 38 per cent and make it its exclusive global cannabis partner.

- The owner of Corona beer described the deal as the biggest investment yet in the burgeoning marijuana industry.

- “Over the past year, we’ve come to better understand the cannabis market, the tremendous growth opportunity it presents, and Canopy’s market-leading capabilities in this space,” Constellation Brands chief executive Rob Sands said in a statement.

- “We look forward to supporting Canopy as they extend their recognized global leadership position in the medical and recreational cannabis space.”

- Makers of alcoholic beverages, searching for new sources of growth as their traditional business slows in many developed markets, are looking to cannabis as Canada and some U.S. states ease regulations. Molson Coors Brewing Co. has started a joint venture with Hydropothecary Corp. to develop non-alcoholic, cannabis-infused beverages for the Canadian market. Heineken NV’s Lagunitas craft-brewing label has launched a brand specializing in non-alcoholic drinks infused with THC, the active ingredient in marijuana.