CAM Investment Grade Weekly

04/26/2019

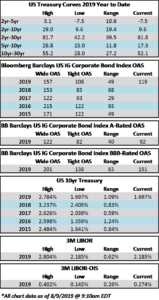

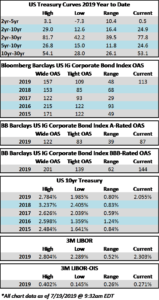

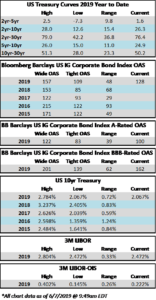

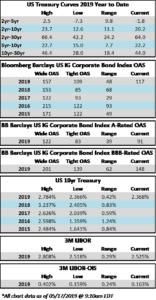

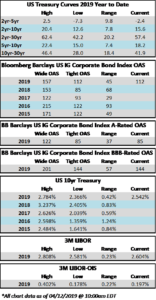

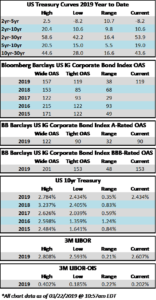

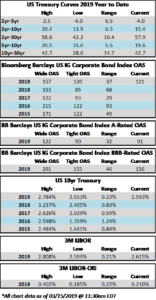

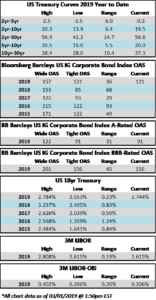

The investment grade credit market traded sideways this week as the OAS on the corporate index looks to finish relatively unchanged. Spreads continue to remain near their tightest levels of 2019 which has been the case since mid-April. It was a busy week for earnings and it was feast or famine for some large-cap firms. Companies like Microsoft and Amazon produced some exceptional results while on the other hand Intel and 3M had lackluster earnings prints. On the Treasury front, rates are lower by 3-5 basis points across the curve on the back of an economic release that showed inflation measures are slowing.

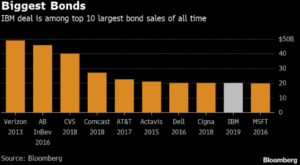

It was an extremely quiet week for corporate issuance as companies brought just $5.65bln of new corporate bonds. Earnings blackout periods will likely continue to have an impact on issuance for the next several weeks. $50.8bln of new corporate debt has been priced in the month of April and the year-to-date tally of new issuance is up to $371bln according to data compiled by Bloomberg.

According to Wells Fargo, IG fund flows during the week of April 18-April 24 were +$6.7bln, which was the second largest weekly inflow thus far in 2019. This brings YTD IG fund flows to +$97.6bln. 2019 flows to this juncture are up 3.8% relative to 2018.

(Bloomberg) A 48-Hour Reporting Delay Could Be Coming for Corporate Debt

- The Financial Industry Regulatory Authority will likely test the market impact of delaying the disclosure of large corporate bond trades after some of the biggest investors argued that such a move would improve liquidity.

- Finra last week proposed running a pilot program that would give traders 48 hours before having to reveal their so-called block trades to other investors. The effort would allow the industry-funded brokerage regulator, which is overseen by the U.S. Securities and Exchange Commission, to evaluate how delayed transparency might affect corporate bond trading.

- Current rules require that block trades be reported within 15 minutes. Brokers and investment firms such as BlackRock Inc. and Pacific Investment Management Co. have long said that such rapid disclosure can make it harder for a dealer to offload securities it’s bought, because market participants know exactly what was bought and at what price.

- The idea for the pilot was suggested by a group of industry executives that advises the SEC. The Securities Industry and Financial Markets Association, Wall Street’s biggest trade group, has expressed support for the proposed test as did JPMorgan Chase & Co. and Eaton Vance, according to Finra. At the same time, the regulator said that two market makers for exchange-traded funds have expressed concern that the changes would reduce price transparency.

(Bloomberg) Wall Street Said to Accelerate Shake-Up in Market for New Bonds

- Wall Street is moving closer to modernizing the clubby $2 trillion market for new corporate bond issues while seeking to retain control of a lucrative business that’s being eyed by the tech sector.

- A group of banks led by Bank of America Corp., Citigroup Inc. and JPMorgan Chase & Co., has set up a company and appointed a chief executive officer to develop an electronic system for investors to request allocations of new debt, according to people familiar with the matter.

- Other banking heavyweights including Barclays Plc, BNP Paribas SA, Deutsche Bank AG, Goldman Sachs Group Inc. and Wells Fargo & Co. have also joined the founders in backing the platform that was originally conceived more than a year ago, the people said, asking not to be identified because it isn’t public.

- Bloomberg talked to 10 people familiar with the initiative. While many of its details are yet to be finalized, Bloomberg reported a year ago the banks plan to focus initially on U.S. investment-grade bonds.

- The new system, dubbed Project Mars, aims to modernize the process of buying new corporate bonds, streamlining communication in a market that still relies on phone calls, instant messaging and emails to handle billions of dollars in orders from investors.

- Investors have pushed banks for years to streamline the market and make it more transparent amid mounting frustration at current practice where they often over-order to secure a quota of bonds that’s close to what they want. Bond allocation has become a high-stakes game, as demonstrated by Saudi Aramco’s recent $12 billion deal which saw investors place orders for more than $100 billion.

(Bloomberg) Ford Shares Surge After Q1 Earnings Beat as U.S. Sales Offset Global Weakness

- Ford Motor Co. shares were traded sharply higher Friday after the carmarker posted stronger-than-expected first quarter earnings thanks to a surge in U.S. demand for its iconic pick-up trucks that offset weakening international demand.

- Ford said earnings for the three months ending in March rose nearly 52% from the same period last year to a forecast-beating 44 cents a share even as total revenues edged 3.9% lower to $40.34 billion as key markets in China continue to weaken.

- S. sales, however, held steady at $25.4 billion. with healthy demand for trucks and SUVs in the company’s home market providing $2.2 billion of its overall $2.4 billion in operating earnings for the quarter.

(Bloomberg) U.S. Growth of 3.2% Tops Forecasts on Trade, Inventory Boost

- S. economic growth accelerated by more than expected in the first quarter on a big boost from inventories and trade that offset slowdowns in consumer and business spending, bolstering hopes that growth is stabilizing after its recent soft patch.

- Gross domestic product expanded at a 3.2 percent annualized rate in the January-March period, according to Commerce Department data Friday that topped all forecasts in a Bloomberg survey calling for 2.3 percent growth. That followed a 2.2 percent advance in the prior three months.

- But underlying demand was weaker than the headline number indicated. Consumer spending, the biggest part of the economy, rose a slightly-above-forecast 1.2 percent, while business investment cooled. A Federal Reserve-preferred inflation measure, the personal consumption expenditures price index excluding food and energy, slowed to 1.3 percent, well below policy makers’ 2 percent objective.

(Bloomberg) Occidental’s $38 Billion Anadarko Offer Starts Permian Fight

- After being rebuffed several times, Occidental Petroleum Corp. on Wednesday made public a $38 billion offer to buy Anadarko Petroleum Corp., seeking to break up a proposed takeover by Chevron Corp. The $76 per share cash-and-stock bid for The Woodlands, Texas-based oil and natural gas producer is 20 percent more than Chevron’s $33 billion April 12 agreement.

- For Occidental, which has a market value of about $46 billion, the acquisition would be its largest ever and the biggest purchase of an oil producer anywhere in at least four years. It would pull together two second-tier oil and natural gas producers, as opposed to Chevron’s bid to create another “ultramajor” to rival Exxon Mobil Corp. It would require Anadarko to pay a $1 billion breakup fee to Chevron.

- In an email, Chevron spokesman Kent Robertson said the company was “confident the transaction agreed to by Chevron and Anadarko will be completed.”

- A tie-up would help Occidental maintain its leading position in the Permian Basin of West Texas and New Mexico, where it currently faces being overtaken by Chevron, which has ambitious growth plans for the region. The Permian is the world’s fast-growing oil major patch and has helped to turn the U.S. into a net exporter, also making it a bigger producer than Saudi Arabia.

- Chief Executive Officer Vicki Hollub said in a Bloomberg Television interview that the offer is the same it made to Anadarko in January 2018. The company has also made three bids since late March, she said Wednesday in a letter to Anadarko’s board of directors. Occidental said it has completed its due diligence on the deal and has financing lined up with Bank of America Merrill Lynch and Citigroup Inc.