CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

05/10/2019

Amid a deluge of new issue supply and a weaker macroeconomic backdrop, we can finally say that the investment grade credit markets experienced a week of notable spread widening. The spread on the corporate index closed Thursday at 116, 4 basis points wider on the week and 7 basis points off the lows from mid-April. China trade headlines have dominated the tape this week which has led to volatility in the equity markets that has subsequently spilled over into the credit markets. The impact to corporate credit has been relatively muted thus far but we would welcome short term bouts of volatility in our market as that has the potential to allow us to be more opportunistic in our purchases for the portfolios we manage.

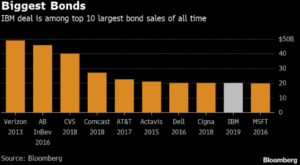

$45.65bln of new corporate debt was issued this week led by Bristol-Myers and IBM. On Tuesday, BMY printed $19bln in new bonds which at the time was the largest deal of 2019 and the 10th largest of all time. BMY was bested by IBM a mere 24 hours later as Big Blue printed $20bln in new debt to fund its purchase of Red Hat, tied for the 7th largest bond deal of all time. It is worth noting that, although CAM is a regular participant in the new issue market, we did not see value in either of these deals so we remained on the sidelines awaiting better opportunities. $51.9bln of new corporate debt has been priced in the month of May and the year-to-date tally of new issuance is up to $439bln according to data compiled by Bloomberg.

According to Wells Fargo, IG fund flows during the week of May 2-May 8 were +$3.3bln. This brings YTD IG fund flows to +$103.614bln. 2019 flows to this juncture are up 4% relative to 2018.

Bloomberg) IBM Sells $20 Billion of Bonds as Market Defies Trade Drag

- International Business Machines Corp. sold $20 billion of bonds, propelling the corporate-debt market to its busiest week in at least eight months despite turbulence across asset classes worldwide.

- The senior unsecured bonds will help fund the computer-services giant’s acquisition of Red Hat Inc. The longest portion of the offering, a 30-year security, will yield 1.45 percentage points more than Treasuries, after initial talk of around 1.55 percentage points, according to a person with knowledge of the matter, who asked not to be identified as the details are private.

- The order book for IBM’s eight-part bond sale was just shy of $40 billion, suggesting some investor indigestion following Tuesday’s offering from Bristol-Myers Squibb Co. The drugmaker managed to sell $19 billion of bonds, one of the biggest sales of the year.

- The U.S. investment-grade corporate bond market reached record highs on Tuesday, shrugging off the trade war fears that have weighed on stocks and oilthis week. High-grade issuance this week could top $40 billion, the most since September, according to data compiled by Bloomberg. High-yield issuers are also taking advantage of the frenzy — they collectively had their busiest day in three months.

- More big bond offerings are coming. T-Mobile US Inc. and Fidelity National Information Services Inc. are expected to issue debt in the coming weeks to fund their respective acquisitions.

- Companies are tapping the bond market to finance acquisitions after having shied away from that kind of issuance for much of the year. Just over $60 billion of investment-grade corporate debt was sold for that purpose in the first four months of the year, including about $2 billion in April, according to data compiled by Bloomberg. That’s out of $445.4 billion of total issuance over that period. Companies instead focused on selling bonds to refinance maturing securities and fund capital expenditure, among other corporate uses.

- Bond-sale volume linked to acquisitions is increasing now in part because borrowing has grown even cheaper: the average high-grade company bond yielded 3.6% on Tuesday, according to Bloomberg Barclays index data, close to its lowest level since early 2018. The debt has gained 5.9% this year.

(Bloomberg) Boeing Sends 737 Max to Brand Rehab to Avoid Fate of Ford Pinto

- Boeing Co.’s 737 Max is about to join the list of brands trying to come back from ignominy.

- Analysts are digging into decades-old safety scares for clues to the future of the jetliner — and Boeing’s finances. There’s the Chevrolet Corvair rollovers that launched Ralph Nader as a consumer advocate in the 1960s, gas-tank explosions that sank Ford Motor Co.’s Pinto in the 1970s, and the Tylenol poisonings of 1982 that spurred tamper-proof packaging.

- But there’s little precedent for the tangle of safety, regulatory and financial issues buffeting a workhorse jet that’s vital to sustaining the surge in global air travel. After two crashes of the aircraft model in five months and a grounding that’s nearing the two-month mark, some nervous passengers are vowing to avoid the Max. Boeing has added to the mess by not fully explaining the apparent flaws in the best-selling jet in company history.

- Longtime Boeing watcher Nick Cunningham said he’s starting to wonder if “this has become too serious and too protracted for the Max to escape unscathed.” The accidents in Indonesia and Ethiopia killed 346 people. Nader’s own grand niece was among the victims.

- The longer the crisis drags on, the greater the risk that the cumulative effect “will have acted to permanently lock it into people’s memories,” said Cunningham, founding partner at Agency Partners.

- Boeing is finalizing an update to software linked to both crashes, which it will submit to the Federal Aviation Administration in a crucial step toward getting the plane back in the air. A May 23 summit of global regulators “may lay out a path towards certifying fixes and removing the grounding,” Morgan Stanley analyst Rajeev Lalwani said in a note Thursday.

- Rebuilding consumer confidence is an urgent priority, as the Chicago-based company works with airlines to prepare resuming flights of the 737 model over the next few months. Boeing must also win over pilots, flight attendants and fractious regulators.

(Bloomberg) Chevron’s Mr. Discipline Sizes Up Costs as Anadarko Bid Ends

- Chevron Corp. Chief Executive Officer Mike Wirth’s decision to abandon his $33 billion offer for Anadarko Petroleum Corp. bolsters his reputation as one of the oil industry’s consummate financial disciplinarians.

- Anadarko was looking for Chevron to beat or at least match Occidental Petroleum Corp.’s $38 billion proposal, people familiar with the matter said Wednesday. But Wirth, whose deputies already had held integration meetings with counterparts at Anadarko, declined to escalate the bidding war and bowed out on Thursday.

- “Make no mistake about it, we had the financial capacity to easily outbid Occidental,” Wirth said in an interview. “But an increased offer would have eroded value to our shareholders and would have diminished returns on our capital. We’re serious about being disciplined.”

- The decision to cede Anadarko to a rival one-fifth of its size would have been unthinkable even five years ago, in the heady days of $100 a barrel oil when the world’s largest energy companies were focused on growth at almost any cost. But the crude price collapse, ascendance of of shale and a recognition that big deals often destroy shareholder value has changed Big Oil’s mindset.