CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

04/12/2019

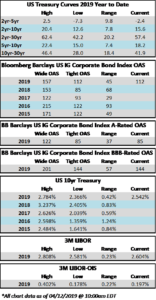

The investment grade credit market continues to benefit from the euphoria of risk-on sentiment that is flooding the capital markets. The OAS on the index closed Thursday at its tightest level of the year. Segmenting the index out by quality, both the A-rated portion of the index and the BBB-rated portion are now trading at year-to-date tights. The market also feels quite strong as we go to print on Friday morning and it looks likely that the corporate bond index will close the week even tighter still. On the Treasury front, rates are higher across the curve, with the 5yr Treasury up 6 basis points over the past week and the 10yr Treasury up 5 basis points.

Corporate issuance was somewhat muted as borrowers brought just $10.15bln of new debt during the week. Corporate issuance is likely to remain light in the weeks to come as many companies are now in earnings blackout periods. The big story of the week on the new-issuance front was non-corporate borrower Saudi Arabian Oil Co, which priced $12bln of new debt across 5 tranches. The Saudi bonds were soaked up by yield chasers across the globe on no other analysis other than it was “cheap for the rating.” According to Bloomberg, the order book for the new issue was allegedly in excess of $100bln which is quite strong relative to the $12bln size of the deal. However, all 5 tranches of debt immediately traded wider on the break and all remain wider on the bid side as we go to print. The 10yr tranche in particular is sucking wind, and is currently bid at +120 in the street versus its new issue pricing level of +105. This leads us to believe that demand for this deal may have been overstated, possibly by an order of magnitude. $26.2bln of new corporate debt has been priced in the month of April and the year-to-date tally of new issuance is up to $346bln according to data compiled by Bloomberg.

According to Wells Fargo, IG fund flows during the week of April 4-April 10 were +$8.7bln. This brings YTD IG fund flows to +$81bln. 2019 flows to this juncture are up 2.6% relative to 2018.