Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$1.0 billion and year to date flows stand at -$61.7 billion. New issuance for the week was $1.2 billion and year to date issuance is at $89.6 billion.

(Bloomberg) High Yield Market Highlights

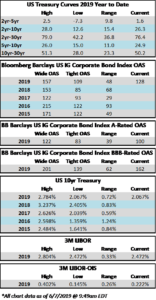

- U.S. junk bonds shrugged off the equity rally as yields climbed toward 10%. CCC yields, the riskiest of junk bonds, jumped to a 30-month high of 15.79% after core US inflation rose by more than forecast, pressuring the Federal Reserve to keep raising interest rates again. Junk bonds are set to end the week with a decline, heading for a fourth weekly loss in five. The bonds were down 1.2% so far this week as yields rose to 9.70%.

- The rise in core consumer price index only reinforced the Fed officials’ commitment to raise rates to a restrictive level in the near term and holding them there to curb inflation.

- The heightened asset volatility, as the Fed is expected to hike another 75bp in November with core inflation at multi-decade highs, increases tail risks for the economy and markets, Barclays’s Brad Rogoff wrote on Friday.

- The losses spanned across ratings in junk bond market, with CCCs posting losses of 1.44% week-to- date, the most in two weeks.

- Macro volatility, steady losses and continuing concern that the Fed may disrupt growth rattled junk bond investors.

- The high yield primary market volume has been low amid rising cost of debt.

- Third quarter supply was a modest $19b, the lowest 3Q volume since 2008.

- New bond sales in September totaled $9b, the slowest September since 2011.

- Year-to- date volume was at $88b, the lowest since 2008 and down about 78% from 2021.

(Bloomberg) Core US Inflation Rises to 40-Year High, Securing Big Fed Hike

- A closely watched measure of U.S. consumer prices rose by more than forecast to a 40-year high in September, pressuring the Federal Reserve to raise interest rates even more aggressively to stamp out persistent inflation.

- The core consumer price index, which excludes food and energy, increased 6.6% from a year ago, the highest level since 1982, Labor Department data showed Thursday. From a month earlier, the core CPI climbed 0.6% for a second month.

- The overall CPI increased 0.4% last month, and was up 8.2% from a year earlier.

- The advance was broad based. Shelter, food and medical care indexes were the largest of “many contributors,” the report said. Prices for gasoline and used cars declined.

- On the heels of a solid jobs report last week, the inflation data likely cement an additional 75-basis point interest rate hike at the Fed’s November policy meeting and spurred speculation for a fifth-straight increase of that size in December. Traders also priced in a higher peak Fed rate for next year.

- Policy makers have responded with the most aggressive tightening campaign since the 1980s, but so far, the labor market and consumer demand have remained resilient. The unemployment rate returned to a five-decade low in September, and businesses continue to raise pay to attract and retain the employees needed to meet household demand.

- The CPI report is the last one before next month’s U.S. midterm elections and poses fresh challenges to President Joe Biden and Democrats as they seek to retain thin congressional majorities. Already, the surge in inflation has posed a serious threat to those prospects.

- Shelter costs — which are the biggest services’ component and make up about a third of the overall CPI index — rose 0.7% for a second month. Both rent of shelter and owners’ equivalent rent were up 6.7% on an annual basis, the most on record.

- Economists see the housing components of the report as being elevated for quite some time, given the lag between real-time changes in rents and home prices and when those are reflected in Labor Department data. Bloomberg Economics doesn’t expect year-over-year rates for the major shelter components to peak until well into the second half of next year.

- While the Fed bases its 2% target on a separate inflation measure from the Commerce Department — the personal consumption expenditures price index — the CPI is closely watched by policy makers, traders and the public.

- Fed officials have repeatedly emphasized in recent weeks the need to get inflation under control, even if that means higher unemployment and a recession. In minutes from their September meeting released Wednesday, many policy makers emphasized “the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action.”

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.