CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

03/01/2019

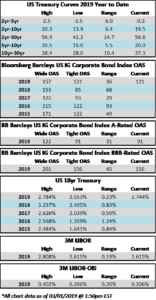

The investment grade credit markets are barreling toward year-to-date tights as the week comes to a close. The OAS on the corporate index closed at 121 at the end of February, which marks a new low for spreads in 2019. Risk assets continue to perform well even as Treasuries have inched higher. The 10yr Treasury is 9 basis points higher as we go to print and sits just a few basis points lower than the 2019 high water mark.

In what seems to be a recurring them, it was yet another solid week of issuance as companies raised nearly $25bln in new debt during the last week of the month. Concessions on new issuance remain thin as most order books are well oversubscribed to the tune of 3-5x deal sizes. $98.21bln of new corporate debt was priced during the month of February, bringing the YTD total to $202.573bln.

According to Wells Fargo, IG fund flows during the week of February 21-February 27 were +$5.6 billion. This brings YTD IG fund flows to +$35.345bln. Flows at this point in the year are modestly outpacing 2018 numbers.