Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$0.7 billion and year to date flows stand at $16.2 billion. New issuance for the week was $12.8 billion and year to date HY is at $90.8 billion, which is +14% over the same period last year.

(Bloomberg) High Yield Market Highlights

- S. junk issuers continue to rush in as if the window is closing, pricing another $3 billion in bonds yesterday despite secondary market weakness. This week’s $12 billion total makes it the busiest since September 2017.

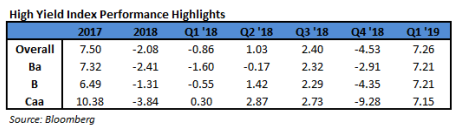

- The high-yield index fell 0.22%, the biggest decline since March 8 and the fourth straight day of losses, as stocks fell and VIX rose

- Yesterday’s new issuance was oversubscribed as investors fought for allocation

- Junk bond returns dropped across ratings for 4 straight sessions, the first time since early March, with the exception of BBs which turned positive one day of the week

- Yields surged across the risk spectrum and saw the biggest jump in almost seven weeks

- BB yields rose to a more than 3-month high, saw biggest rise in 12 weeks

- Energy returns were negative for the 10th session with a 1-day break on Friday last, the longest streak since December 13-26

- Energy return YTD 9.040%, ex-energy 8.19%

- CCCs lost most, falling 0.23%

- CCCs are up 8.6% YTD

- Junk bond returns are 8.31% YTD

- BBs have returned 8.03%, single-Bs 8.41%

- Loans have returned 5.61% YTD

(Business Wire) AmeriGas Reports Second Quarter Results

- GAAP net income of $219.1 million, compared with $191.8 million in the prior-year period; adjusted net income of $203.1 million, compared with $222.7 million in the prior-year period

- Adjusted EBITDA of $290.3 million, compared with $309.5 million in the prior-year period

- AmeriGas expects to be at the low end of its fiscal 2019 Adjusted EBITDA guidance range of $610 million – $650 million

- Hugh J. Gallagher, president and chief executive officer of AmeriGas, said, “Overall, AmeriGas experienced weather that was colder than the prior year, however our results were impacted by warm weather during the critical heating months in the southeastern U.S. During the quarter, we remained focused on our growth drivers and built on our history of solid volume and customer additions in our Cylinder Exchange and National Accounts programs. Our team did a great job managing expenses throughout the entire heating season and we continue to look for additional opportunities to improve efficiencies. AmeriGas remains on pace to deliver adjusted EBITDA towards the low end of its guidance range.

- While degree days for the quarter were 4% colder than normal and 5% colder than last year, January and February were a combined 17% warmer than normal in the southeastern U.S.

- Retail volumes sold decreased by 4% primarily due to warm weather in the southeastern U.S. during critical heating months

(PR Newswire) TransDigm Group Reports Fiscal 2019 Second Quarter Results

- During the quarter, on March 14, 2019, TransDigm completed the acquisition of Esterline Technologies Corporation, a supplier of products to the global aerospace and defense industry.

- Also during the quarter, on February 13, 2019TransDigm completed the private offerings of $4.0 billion aggregate principal amount of 6.25% Senior Secured Notes due 2026 and $550 million aggregate principal amount of 7.50% Senior Subordinated Notes due 2027.

- The net proceeds of the $4.0 billionsecured notes were used to both fund the purchase price of the Esterline acquisition and to allow for substantial near term financial flexibility.

- The net proceeds from the $550 millionof subordinated notes were used to redeem all of the Company’s outstanding senior subordinated notes due 2020 and replaced them with notes due 2027.

- These events above significantly impacted certain year-over-year comparisons.

- Net sales for the quarter rose 28.2%, or $262.8 million, to $1,195.9 millionfrom $933.1 million in the comparable quarter a year ago. Organic sales growth was 11.0%. Acquisition sales contributed $160.4 million, of which $122.0 million were from Esterline for the 17 days of ownership in the quarter.

- EBITDA for the quarter increased 15.9% to $509.4 millionfrom $439.4 million for the comparable quarter a year ago. EBITDA As Defined for the period increased 23.5% to $571.8 million compared with $463.1 million in the comparable quarter a year ago. EBITDA As Defined as a percentage of net sales for the quarter was 47.8%. Esterline contributed $26.7 million of EBITDA As Defined in the current quarter. Excluding Esterline, EBITDA As Defined as a percentage of net sales for the quarter was 50.8%.

- “We are pleased with our second quarter results and the strength of our base business,” stated Kevin Stein, TransDigm Group’s President and Chief Executive Officer. “Organic revenue growth was 11% in the quarter driven by good growth across all major end markets. Our core EBITDA As Defined, excluding the dilutive impact of Esterline and the acquisitions completed in fiscal 2018, continued to expand sequentially and over the prior year period to 51.5% in the quarter.

- In addition to the focus on our base business, it was a busy quarter with the completion of the Esterline acquisition, our largest acquisition to date. Our second quarter results include $122 millionof revenue and $27 million of EBITDA As Defined reflecting 17 days of Esterline ownership. Please note the implied Esterline margin from this short period is higher than should be expected for the balance of the fiscal year primarily due to an elevated level of shipments at quarter end.”

- He continued, “Lastly, our decision in the quarter to borrow substantial additional funds impacted our quarterly net income, but we believe the significant near term flexibility and attractive cost will serve us well in the future.”

(Bloomberg) EQT and Digital Colony Agree to Buy Zayo for $14.3 Billion

- Fiber network owner Zayo Group Holdings Inc. has agreed to be acquired by Digital Colony Partners and EQT Partners for $14.3 billion including debt in a deal that will

take the fiber-network owner private. - The deal values Zayo at $35 per share in cash and includes $5.9 billion in debt, Zayo said in a statement Wednesday, confirming an earlier Bloomberg report.

- Zayo struggled through organizational changes and concerns that the market for fiber lines was becoming overcrowded. In March, Zayo announced that they were evaluating strategic alternatives.

- “I am confident this partnership with EQT and Digital Colony will empower Zayo to accelerate its growth and strengthen its industry leadership,” Chief Executive Officer Dan Caruso said in the statement.

- The transaction is scheduled to close in the first half of 2020, pending regulatory clearance and approval by Zayo shareholders.

(Bloomberg) Investors Suing JPMorgan May Redefine the Leveraged Loan Market

- A group suing JPMorgan Chase & Co. and other Wall Street banks over a loan that went sour four years ago is alleging the underwriters engaged in securities fraud. If successful, the lawsuit could radically transform the $1.2 trillion leveraged lending market.

- The defendants say there’s one key problem — unlike bonds, loans aren’t securities. As a result, they’ve filed a petition asking the court to dismiss the suit on those exact grounds.

- “There are absolutely enormous market consequences if a court determines that leveraged loans are securities,” said J. Paul Forrester, a partner at law firm Mayer Brown who’s not involved in the litigation. “Leveraged loans and lenders would be potentially subject to the same offering and disclosure requirements as securities and would face the same regulatory oversight and enforcement consequences.”

- The suit stems from a $1.8 billion loan that JPMorgan and others arranged for Millennium Health LLC — then owned by private-equity firm TA Associates — and sold to investors in 2014. Within a matter of months, lenders saw the value of their loan plunge as the company disclosed that federal authorities were investigating their billing practices. Millennium agreed to pay $256 million to resolve the probe, and would go on to file for bankruptcy.

- JPMorgan knew U.S. officials were investigating Millennium when it sold the loan, but didn’t tell investors who were about to buy the debt, Bloomberg reported in 2015. The bankers did not provide the information because Millennium told them it wasn’t material at the time.

- “Styled as ‘leveraged loans,’ the debt obligations that defendants sold to the investors back in April 2014 have all the attributes of and, in fact, constituted credit agency-rated and tradeable debt ‘securities,’” the lender trustee wrotein the 2017 suit. As such, the defendants are liable “for sponsoring the materially false presentation of Millennium’s financial condition and business practices.”

- “The sophisticated entities that lent Millennium money now try to classify the loan as a ‘security’ and the loan syndication as a ‘securities distribution’ in an attempt to manufacture a securities fraud claim where none is viable, and to avoid the express language of the contracts into which they willingly entered,” JPMorgan and Citigroup wrote in a memorandum last month.

The Finance Companies, Energy, and Utilities sectors were the best performers during the quarter, posting returns of 9.00%, 8.27%, and 7.81%, respectively. On the other hand, Other Financial, Insurance, and Transportation were the worst performing sectors, posting returns of 5.12%, 6.33%, and 6.34%, respectively. At the industry level, refining, oil field services, pharma, and supermarkets all posted the best returns. The refining industry (12.20%) posted the highest return. The lowest performing industries during the quarter were retail REITs, office REITs, airlines, and life insurance. The retail REIT industry (2.86%) posted the lowest return.

The Finance Companies, Energy, and Utilities sectors were the best performers during the quarter, posting returns of 9.00%, 8.27%, and 7.81%, respectively. On the other hand, Other Financial, Insurance, and Transportation were the worst performing sectors, posting returns of 5.12%, 6.33%, and 6.34%, respectively. At the industry level, refining, oil field services, pharma, and supermarkets all posted the best returns. The refining industry (12.20%) posted the highest return. The lowest performing industries during the quarter were retail REITs, office REITs, airlines, and life insurance. The retail REIT industry (2.86%) posted the lowest return.