2020 Q4 High Yield Quarterly

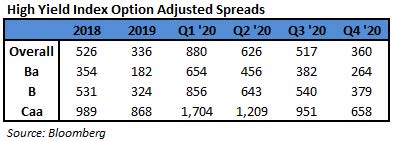

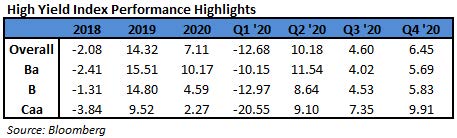

In the fourth quarter of 2020, the Bloomberg Barclays US Corporate High Yield Index (“Index”) return was 6.45% bringing the year to date (“YTD”) return to 7.11%. The CAM High Yield Composite gross total return for the fourth quarter was 4.78% bringing the YTD return to 7.51%. The S&P 500 stock index return was 12.14% (including dividends reinvested) for Q4, and the YTD return stands at 18.39%. The 10 year US Treasury rate (“10 year”) had a steady upward slope throughout the quarter. The rate finished at 0.91%, up 0.23% from the beginning of the quarter. During the quarter, the Index option adjusted spread (“OAS”) tightened 157 basis points moving from 517 basis points to 360 basis points. During the fourth quarter, each quality segment of the High Yield Market participated in the spread tightening as BB rated securities tightened 118 basis points, B rated securities tightened 161 basis points, and CCC rated securities tightened 293 basis points. Take a look at the chart below from Bloomberg to see a visual of the spread moves in the Index over the past five years. The graph illustrates the speed of the spread move in both directions during 2020.

The Energy, Transportation, and Financial sectors were the best performers during the quarter, posting returns of 13.43%, 10.87%, and 8.72%, respectively. On the other hand, Insurance, Technology, and Utilities were the worst performing sectors, posting returns of 3.61%, 3.69%, and 4.14%, respectively. At the industry level, oil field services, integrated oil, REITs, and metals & mining all posted the best returns. The oil field services industry posted the highest return (25.94%). The lowest performing industries during the quarter were health insurance, cable, building materials, and wireless communications. The health insurance industry posted the lowest return (2.74%).

The energy sector performance has bounced around this year moving from a top performer to a bottom performer and is once again a top performer to close out the year. As can be seen in the chart to the left, the price of crude has been fairly stable in the second half of the year compared to the first half. Currently, OPEC+ members are meeting to determine oil production moving forward. It appears that Russia is looking fairly isolated as one of the only members in support of a supply boost. According to a post by Javier Blas, Bloomberg’s Chief Energy Correspondent, the Saudis are looking to push the price per barrel north of $50. In the current environment, a supply boost is not congruent with such an objective.

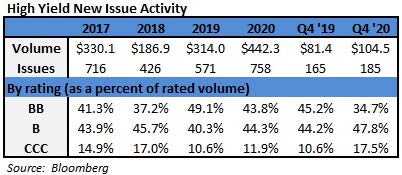

During the fourth quarter, the high yield primary market posted $104.5 billion in issuance. Many companies continued to take advantage of the open new issue market, and 2020 finished with a record $442.3 billion in issuance. Issuance within Consumer Discretionary was the strongest with approximately 23% of the total during the quarter. Consumer Discretionary also had the most issuance in the second quarter and third quarter. Therefore, it showed the most issuance for the year with approximately 23% of the total and far surpassed second place Communications with approximately 15% of the total.

The Federal Reserve maintained the Target Rate to an upper bound of 0.25% at both the November and December meetings. The big news during the quarter was Treasury Secretary Mnuchin’s move to end a handful of lending programs that were rolled out in response to the pandemic. Naturally, there was much political wrangling over the move. Fed Chair Powell went on record to say that while the Federal Reserve had a desire to have more lending programs at their disposal than less, the Treasury and Mnuchin had the legal authority to make the call on the programs in question. At any rate, Congress finally passed an additional stimulus bill. Furthermore, there is little doubt that if the financial markets begin to have liquidity issues like those experienced earlier in 2020, the Treasury, Federal Reserve, and Congress will quickly push forward in an attempt to alleviate the issues.

Intermediate Treasuries increased 23 basis points over the quarter, as the 10-year Treasury yield was at 0.68% on September 30th, and 0.91% at the end of the fourth quarter. The 5-year Treasury increased 8 basis points over the quarter, moving from 0.28% on September 30th, to 0.36% at the end of the fourth quarter. Intermediate term yields more often reflect GDP and expectations for future economic growth and inflation rather than actions taken by the FOMC to adjust the Target Rate. The economic reports were very noisy over the course of 2020. The revised third quarter GDP print was 33.4% (quarter over quarter annualized rate) up from the revised second quarter GDP print of -33.2% Looking forward, the current consensus view of economists suggests a GDP for 2021 around 3.9% with inflation expectations around 2.0%.i

Being a more conservative asset manager, Cincinnati Asset Management Inc. remains structurally underweight CCC and lower rated securities. This positioning generally served our clients well in 2020. However, the lowest rated segment of the market outperformed in the fourth quarter. Thus, our higher quality orientation was not optimal during the period. As noted above, our High Yield Composite gross total return did outperform the Index over the year-to-date measurement period. With the market so strong during the fourth quarter, our cash position was a large drag on overall performance. Additionally, our credit selections within the consumer non-cyclical sector were a drag on performance. Within the energy sector, our higher quality selections were considered a negative to relative performance as the riskiest segment of the sector performed extraordinarily well. Benefiting our performance were our underweight in the communications sector and our credit selections in the finance companies sector. Further, our credit selections within the auto industry were also a positive.

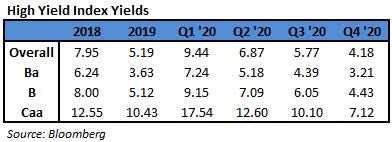

The Bloomberg Barclays US Corporate High Yield Index ended the fourth quarter with a yield of 4.18%. While this yield is a new record low for the high yield market, on a spread basis, the current 360 spread is well off the record low of 232 set back in 2007. The market yield is an average that is barbelled by the CCC-rated cohort yielding 7.12% and a BB rated slice yielding 3.21%. Equity volatility, as measured by the Chicago Board Options Exchange Volatility Index (“VIX”), held a range mostly between 20 and 40 over the quarter with an average of 25. For context, the average was 15 over the course of 2019 and 29 for 2020. The fourth quarter had 8 bond issuers default on their debt. The trailing twelve month default rate was 6.17% and the energy sector accounted for roughly a third of the default volumeii. This is relative to the 3.35%, 6.19%, 5.80% default rates for the first, second, and third quarters, respectively. Pre-Covid, fundamentals of high yield companies had been mostly good and with the strong issuance during Q2, Q3, and Q4, companies have been doing all they can to bolster their balance sheets. From a technical perspective, fund flows were positive every month of the fourth quarter, and September was the only month to show an outflow since Marchiii. High yield certainly had some volatility in 2020; however, the market did ultimately provide a positive total return overcoming a very difficult Q1. For clients that have an investment horizon over a complete market cycle, high yield deserves to be considered as part of the portfolio allocation.

The 2020 High Yield Market is definitely one for the history books. The actions by the Treasury and the Federal Reserve no doubt helped to put in a bottom and provide a backstop for the capital markets to begin functioning amid the Covid pandemic. The High Yield Market was able to absorb over $200 billion in fallen angels with relative ease. This is about double the amount of fallen angels in 2009 and 12x the amount from2019iv. Generally speaking, the market has recovered. The market yield is well through the level at year end 2019, and the market spread is approaching the year end 2019 spread level. However, there are still plenty of matters on the radar that deserve attention. To that end, the ongoing rollout of vaccines and the President-elect taking office mid-January are certainly front and center. Therefore, it is important that we exercise discipline and selectivity in our credit choices moving forward. We are very much on the lookout for any pitfalls as well as opportunities for our clients. We will continue to carefully monitor the market to evaluate that the given compensation for the perceived level of risk remains appropriate on a security by security basis. It is important to focus on credit research and identify bonds of corporations that can withstand economic headwinds and also enjoy improved credit metrics in a stable to improving economy. As always, we will continue our search for value and adjust positions as we uncover compelling situations. Finally, we are very grateful for the trust placed in our team to manage your capital through such a historic time.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

i Bloomberg January 4, 2021: Economic Forecasts (ECFC)

ii JP Morgan January 4, 2021: “Default Monitor”

iii Wells Fargo January 4, 2021: “Credit Flows”

iv Barclays January 4, 2021: “US High Yield Corporate Update”