CAM High Yield Weekly Insights

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $2.5 billion and year to date flows stand at $0.8 billion. New issuance for the week was $13.3 billion and year to date issuance is at $57.2 billion.

(Bloomberg) High Yield Market Highlights

- U.S. junk bond yields hit a new all-time low of 4.09%, while funds that buy the risky debt saw their first weekly influx of cash this year. Great Western Petroleum could be the latest energy company to benefit from the wide-open market, looking to clear out near-term maturities and land a higher credit grade with a debt sale that’s due Friday.

- The high-yield market is headed for the biggest gains in a little more than two months, according to data compiled by Bloomberg, and yields may fall further with credit risk lower, and stock futures advancing after the U.S. Senate voted to adopt a budget blueprint for a $1.9 trillion stimulus package

- The market’s also getting a boost from rising oil prices, which climbed close to $60 a barrel

- Investors poured money into high-yield funds for the week. It follows four straight weeks of outflows

- Investors are snapping up debt in the riskiest CCC tier that’s notched up gains of more than 2% already this year. Yields on the debt have plunged to 6.48%, just 6bps off the record low of 6.42%

- “Stressed credits have historically been a good place to look for strong returns,” Barclays Plc credit analysts led by Brad Rogoff wrote in a note Friday

- In the primary market, more than a third of sales this week have been deals with ratings in the CCC bucket.

- Average junk-bonds have gained 0.56% this week, the best in about two months

- BB yields closed at a new all-time low of 3.16%

- CCCs posted gains of 0.2% on Thursday, the best asset in the high yield market. It is set to post gains of 0.67% for the week

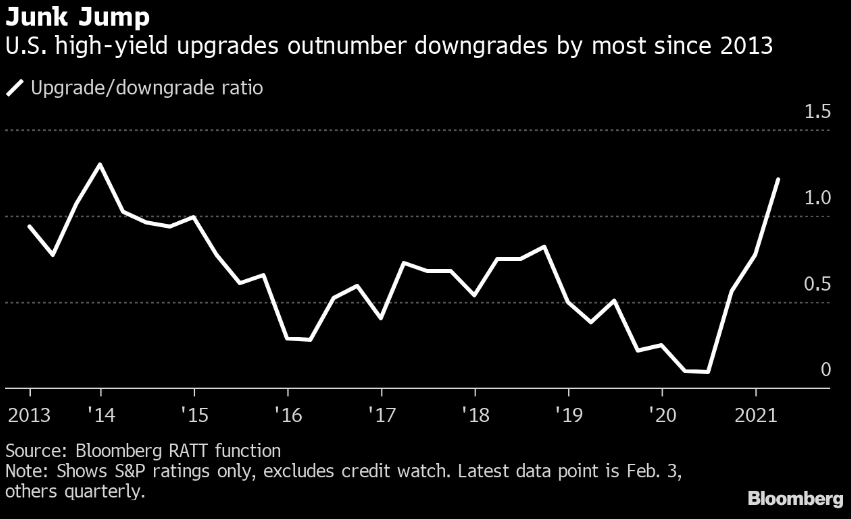

(Bloomberg) Credit Upgrade Cycle Is in Full Swing Amid Signs of Recovery

- As the U.S. economy shows more signs of recovering from the worst of its pandemic doldrums, the credit upgrade cycle is in full force.

- Junk companies are seeing their ratings increased in droves, with upgrades so far this quarter reaching the highest level relative to downgrades since the end of 2013, according to data for the U.S. compiled by Bloomberg. That’s a big about-face from last year, when the pandemic weighed on companies’ profits and triggered a near unprecedented rate of downgrades.

- With governments in the U.S. and Europe providing extensive support to the economy, low interest rates boosting the money supply, and signs of an improving economy, there’s a wave of upgrades happening now, according to Christina Padgett, head of leveraged finance research at Moody’s.

- Companies are refinancing shorter-term loans they got at the height of the pandemic and turning them into longer-term obligations, which is also a positive sign, she said. Boeing Co., which Moody’s rates at Baa2 or the second-lowest investment-grade level, sold $9.825 billion of bonds Tuesday, refinancing some of the $13.8 billion loan it drew down at the beginning of the Covid-19 outbreak.

- “We do see light at the end of the tunnel,” said Padgett in an interview. “The economy both in the U.S. and Europe will grow materially this year.”

- U.S. initial jobless claims fell last week to the lowest level since the end of November, a signal that job cuts are starting to slow as Covid-19 infections ebb, according to a report on Thursday.

- Even with economic improvement, junk-rated companies still face trouble, including the higher debt loads many of them now bear, said Moody’s Padgett. Shedding those obligations could be difficult.

- “If you were very levered going into the downturn, it is going to be much harder to exit with a sustainable capital structure,” she said.

- Ratings firms may have been too quick to downgrade in the first place, Bank of America Corp. credit strategists led by Hans Mikkelsen wrote on Wednesday.

- “Rating agencies overreacted to the Covid-crisis when downgrading investment-grade companies during the first part of 2020, and to compensate there will be an upgrade cycle this year,” Mikkelsen wrote.

- The number of companies facing near-term potential downgrades, among issuers rated AAA to B-, dropped for the fifth consecutive month to 1,178 on Dec. 25, from a historic high of 1,365 in July, S&P Global Ratings said in a report Tuesday. The downgrade risk among non-financial companies, however, remains elevated this year, with airlines as a vulnerable industry.