Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $1.4 billion and year to date flows stand at $11.1 billion. New issuance for the week was $4.6 billion and year to date HY is at $42.7 billion, which is -12% over the same period last year.

(Bloomberg) High Yield Market Highlights

- S. junk bonds extended this week’s rally, as dedicated funds received fresh cash inflows.

- Yields held firm as oil rallied to close at a 4-month high after rising for 4 straight sessions

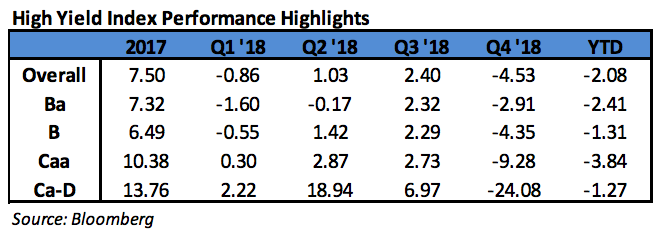

- Returns were at new YTD highs across ratings, with high-yield index at 6.52%

- Triple Cs were best performers yesterday, held top rank YTD, with 6.83% gain

- BBs returned 6.35%, single-Bs 6.45%

- Loans lagged high yield bonds, with YTD return of 4.2%

- S. junk operating against backdrop of strong technicals as reflected in slow issuance activity, net inflows into retail funds, low default rate, steady corporate earnings

(Fierce Wireless) New details cause FCC to pause T-Mobile/Sprint merger for third time

- The FCC has stopped the clock on a proposed merger between wireless carriers Sprint and T-Mobile. The agency said it has received “significant new information” regarding the deal and has opened up a three-week period ending March 28 for public comment. The pause comes on day 122 of the 180-day review period the FCC holds for mergers.

- Opposition to the merger gained momentum when the Wireless Internet Service Providers Association (WISPA) joined a coalition of rural wireless providers that oppose the merger. The 4Competition Coalition is comprised of 25 organizations, including WISPA, Dish, C Spire and the Rural Wireless Association (RWA). The coalition has argued that the merger, which would reduce the number of nationwide wireless carriers to from four to three if successful, would hamper rural consumers’ access to wireless service. “The combined company would have significant new incentive and ability to raise prices and preemptively stamp out competition from newcomers. And the merger would result in the loss of tens of thousands of jobs in the process,” the coalition claims on its website.

- Earlier this week, T-Mobile filed new plans for the combined company to provide residential broadband service. T-Mobile CEO John Legere seemed to respond to the opposition in a blog post this week, which claimed that the combined company will pose a competitive challenge to cable broadband providers.

- “We’ll give millions of Americans—especially those in underserved rural areas—more choices and options for connecting to the internet and participating in the digital economy,” Legere wrote. “With the New T-Mobile and our unique 5G capabilities, we’ll be able to offer a fast and reliable alternative for in-home broadband.”

(Company Filing and CAM) AMC Entertainment notes downgraded to CCC+ by S&P

- AMC launched a potential refinancing of their existing credit facilities. They intend to use a portion of the net proceeds of such refinancing to redeem all of the outstanding 5.875% Senior Subordinated Notes due 2022 and 6.00% Senior Secured Notes due 2023 pursuant to the provisions of the indentures pursuant to which such notes were issued. There can be no assurance as to whether and when such refinancing and redemption will occur and on what terms such refinancing will occur, if at all.

- While the refinancing is for the most part leverage neutral, S&P lowered the ratings on the existing senior subordinated notes due to the added secured debt placed above the notes in the capital structure.