(Bloomberg) High Yield Market Highlights

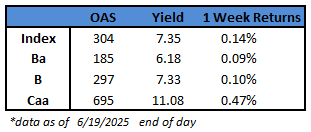

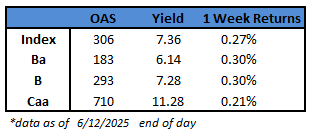

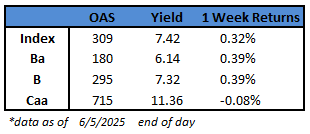

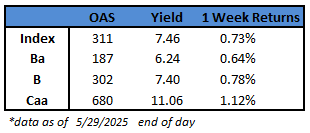

- US junk bonds are headed for their third weekly gain with each ratings cohort participating

- US high yield funds attracted $2.5b of inflows for week ended Wednesday, the most since July, wrote JPMorgan citing LSEG data.

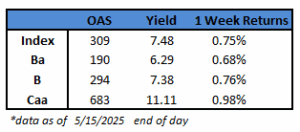

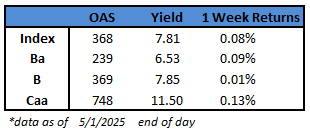

- US junk bond yields moved 1basis point higher to 7.81% this week with the spread moving 7 basis points wider to 368

- CCCs, the riskiest tier of the junk bond market, was the best performer, gaining 0.13%. CCCs are set to post gains for the third consecutive week

- BB spreads widened 7 basis points to 239 and yields moving 2 basis points higher to 6.53%. The segment is also on track to record positive returns for the third week in a row.

- April was the slowest month for supply since July. However, there was a broad rally across risk assets on Thursday that revived the primary market seeing a combined $2b in new bonds price to kick off the new month

(Bloomberg) US Payroll Gain of 177,000 Shows Uncertainty Yet to Dent Hiring

- US job growth was robust in April and the unemployment rate held steady, suggesting uncertainty over President Donald Trump’s trade policy has yet to have a material impact on hiring plans.

- Nonfarm payrolls increased 177,000 last month after the prior two months’ advances were revised lower, according to Bureau of Labor Statistics data out Friday. The unemployment rate was unchanged at 4.2%.

- The report suggests the labor market continues to cool gradually, a sign that businesses facing heightened uncertainty around tariffs and turmoil in financial markets didn’t significantly alter their hiring plans. Most economists anticipate the brunt of the impact from punishing levies will be seen in coming months.

- “This is a good jobs report all around. The ‘R’ word that the labor market is demonstrating in this report is resilience, certainly not recession,” Olu Sonola, head of US economic research at Fitch Ratings, said in a note. “For now, we should curb our enthusiasm going forward given the backdrop of trade policies that will likely be a drag on the economy.”

- Fed officials have indicated they’re in no rush to cut rates until they get further clarity on the impact the administration’s policies will have on the economy, and are widely expected to leave their benchmark unchanged when they next meet May 6-7 despite a report Wednesday showing inflation decelerated in March.

- Payroll gains were broad based, led by an advance in health care. Transportation and warehousing employment rose by the most since December, suggesting a surge in imports and activity boosted demand for labor as businesses rushed to get ahead of tariffs. Manufacturing, meanwhile, shed jobs as the sector saw the steepest contraction in output last month since 2020.

- The federal government cut jobs for a third month — the longest such streak since 2022 — reflecting efforts by the Elon Musk-led Department of Government Efficiency to downsize the federal workforce and reduce government spending.

- The government leads all US industries in terms of layoffs announced so far in 2025, with the vast majority of the about 282,000 cuts being attributed to DOGE actions, outplacement firm Challenger, Gray & Christmas said in a report Thursday. Economists contend at least half a million US jobs could be on the line as federal spending cuts spread to contractors, universities and others who rely on government funding.

- The participation rate — the share of the population that is working or looking for work — ticked up to 62.6% in April. The rate for those between the ages of 25 and 54, known as prime-age workers, rose to the highest level in seven months

- Economists are also paying close attention to how labor supply and demand dynamics are impacting wage gains — especially with inflation risks heating up again. The report showed average hourly earnings rose 0.2% last month, marking a deceleration from March. From a year earlier, they rose 3.8%.

- Other data are pointing to a more marked deterioration in labor-market conditions. Job openings fell in March to the lowest level since September, and a report on private hiring showed employers added the fewest payrolls in nine months in April.

- Economists largely expect layoffs to pick up in the coming months as economic uncertainty puts a halt on expansion plans.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.

US junk bonds shrugged off a jump in jobless claims and recurring benefits to

US junk bonds shrugged off a jump in jobless claims and recurring benefits to