(Bloomberg) High Yield Market Highlights

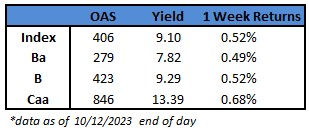

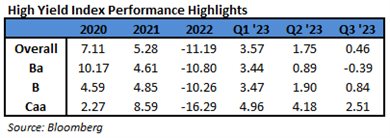

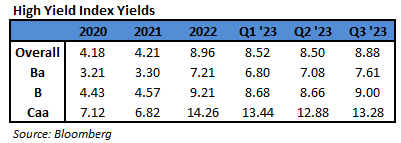

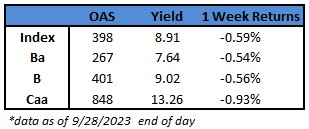

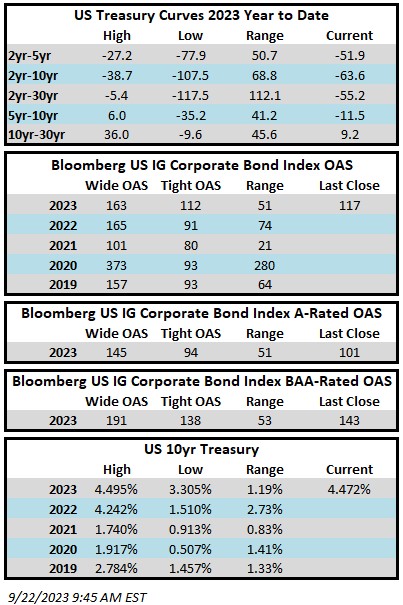

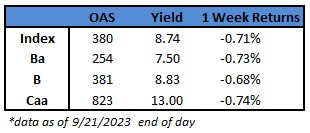

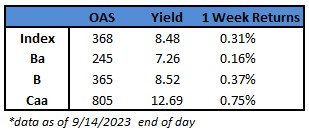

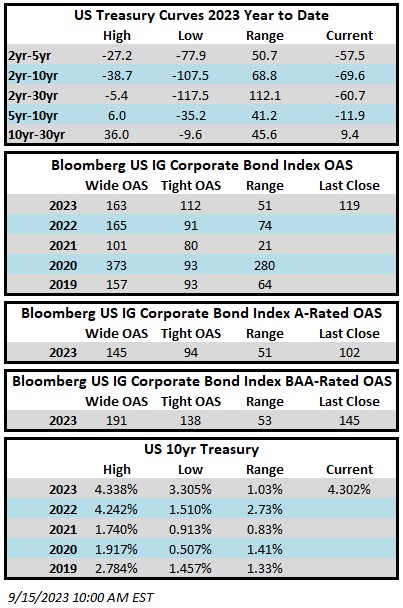

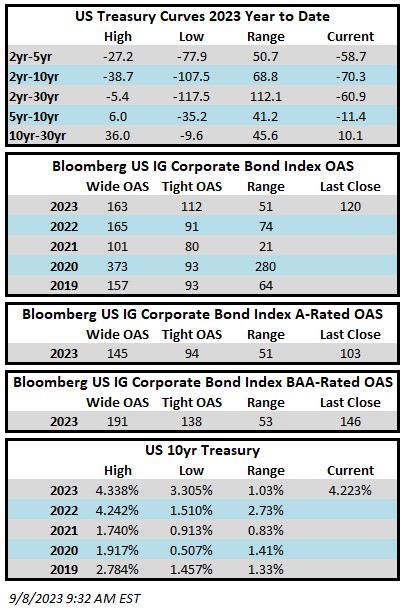

- US junk bonds snapped a five-day winning streak to post the biggest one-day loss in more than a week on Thursday. Yields soared for the second straight session to 9.10% after US consumer prices climbed for a second month, bolstering speculation that the Federal Reserve may keep the doors open for another interest-rate hike this year. After a run-up in US Treasury yields since the last Fed meeting in September, the path for monetary policy seems less clear, causing junk bond yields to spike.

- Losses extended across the high-yield market. CCC- bond yields, the riskiest of junk bonds, rose 15 basis points on Thursday to 13.39%, driving a loss of 0.3%, snapping the four-day gaining streak.

- Climbing yields and steady losses turned cautious investors away from the asset class. US high yield investors pulled $2.45b out of US junk bond funds for week ended Oct. 11, the third consecutive week of outflows.

- Investors withdrew almost $7.5b in just three weeks – week ended Sept. 27, Oct. 4 and Oct. 11.

- The recent rally began after the Fed officials reiterated earlier this week that the US central bank does not need to raise interest rates as the recent surge in yields did the job. Junk bonds may rebound from these losses as the market digests the recent assurance by Fed officials.

- Federal Reserve Bank of Atlanta President Raphael Bostic reiterated earlier this week that the US central bank doesn’t need to keep raising interest rates unless inflation picks up again, or remains around its current pace.

- Federal Reserve Bank of Boston President Susan Collins said the Federal Reserve was taking a more patient approach as rates are at or near their peak. She is the fourth Fed official to ease concerns about a further hike in interest-rates.

- The minutes of the Fed meeting in September also noted that the risks for central bank are two sided, with overtightening and inflation both presenting potential problems.

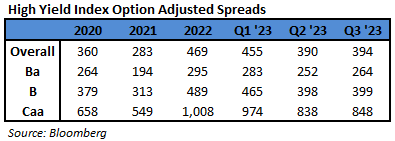

- The recent macro positive data and Federal Reserve signaling patience may keep spreads from widening further, Barclays wrote in a Friday note.

- A 9% yield in the high yield market is an attractive level, and this may prevent spreads from widening materially, Barclays added.

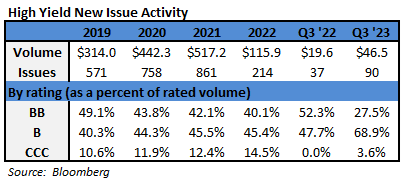

- The broader rebound earlier in the week lured US borrowers back to the market to take advantage of risk-on sentiment.

- The primary market priced about $2b this week, driving the year-to-date supply to $136.4b.

(Bloomberg) Bonds Fall as CPI Boosts Fed-Hike Wagers

- The so-called core consumer price index, which excludes food and energy costs, increased 0.3% last month. From a year ago, it rose 4.1%, the lowest since 2021. Economists favor the core gauge as a better indicator of underlying inflation than the overall CPI. That measure climbed 0.4%, boosted by energy costs. Forecasters had called for a 0.3% monthly advance in both the overall and core measures.

- While swap contracts continue to anticipate a Fed pivot to rate cuts next year, that outcome was assigned somewhat lower odds.

- “Bottom line: the Fed can likely pause in November, though it’s a close call, and it remains too soon to consider cuts,” said Don Rissmiller at Strategas.

- Yet some analysts and traders don’t think the report was surprising enough to move the needle, especially after a raft of Fed officials speaking this week said the rout in bond markets may suspend the need to tighten further for now.

- Fed Governor Christopher Waller noted Wednesday the US central bank can watch and see what happens before taking further action with interest rates as financial markets tighten. Vice Chair Philip Jefferson on Monday said he would “remain cognizant of the tightening in financial conditions through higher bond yields.” And Dallas Fed President Lorie Logan indicated that if risk premiums in the bond market are on the rise, that “could do some of the work of cooling the economy for us, leaving less need for additional monetary policy tightening.”

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.