CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

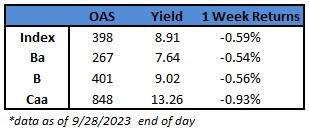

- US junk-bond issuers inundated the primary market this month, driving the supply of new securities to almost $23 billion, the most since January 2022. Seven of the 19 sessions month-to-date priced more than $2 billion, resulting in some of the busiest days since June. The flurry of new issuance partly caused yields to rise closer to 9% and spreads to near 400 basis points.

- US companies rushed to the debt markets to push off maturity payments, moving now in case the Federal Reserve’s plan to keep monetary policy tight pushes rates higher.

- Amid the flood of new supply and worries the economy could slide into a recession due to the Fed’s moves, investors pulled $2.4b from US high-yield funds during the week ended Sept 27, the most since Feb. 22.

- Yields rose and spreads widened across ratings this week.

- Oil prices have been surging, fanning fresh inflation concerns. Moreover, US consumer confidence slumped to a four-month low, a report said on Tuesday, reflecting renewed worries about a recession. Federal Reserve Chair Jerome Powell signaled last week that borrowing costs will likely stay higher for longer after one more hike this year.

- However, the primary market remained busy as companies capitalized on access to debt markets before investors get more cautious and discerning.

- While total returns have been challenging across asset classes, higher yields should support the demand backdrop for credit, Brad Rogoff and Dominique Toublan of Barclays wrote in a note to clients.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.