CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

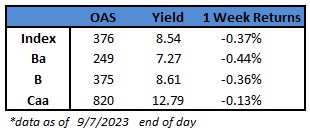

- US junk bonds are headed to the biggest weekly loss since mid-August, snapping a two-week gain, after yields jumped 14 basis points to 8.54% on renewed fears that the Federal Reserve will keep interest rates higher for longer.

- Chicago Fed President, Austan Goolsbee, told the Marketplace radio program on Thursday that “we are very rapidly approaching the time when our argument is not going to be about how high should the rates go.” Instead, “it’s going to be an argument of how long do we need to keep the rates at this position before we’re sure that we’re on the path back to the target.”

- Stronger-than-estimated macro data this week also bolstered some speculation that the Fed may hike interest-rates again in November for one last time. US service sector activity rose to a six-month high in August, suggesting a pick up in new orders and hiring, according to an Institute for Supply Management index. Also, applications for US unemployment benefits fell to the lowest since February, indicating a resilient labor market.

- Meanwhile, the junk-bond primary market is gearing for a rush of new supply as private equity firms look to close on LBO deals before the cost of debt rises further.

- It has sprung back to life after a summer lull pricing more than $800 million in just three sessions.

- Barclays estimates $15b-$20b of new bond supply and $20b-$25b in leveraged loans for September. The pipeline may be concentrated in technology, media and entertainment, Barclays wrote in a note this morning.

- US junk bond yields have risen 14 basis points week-to-date to 8.54% and spreads have widened 10 basis points to 376.

- Losses extended across ratings in the junk-bond market. CCC yields rose 14 basis points this week to 12.79%.

(Bloomberg) Fed Officials Set to Double Growth Forecast Amid Strong Data

- The US economy has been looking so solid lately that Federal Reserve officials will probably need to double their projection for growth in 2023 when they publish an updated outlook later this month.

- Following a string of stronger-than-expected reports on everything from consumer spending to residential investment, economists have been boosting their forecasts for gross domestic product. One widely-followed, unofficial estimate produced by the Atlanta Fed even has it expanding 5.6% on an annualized basis in the third quarter.

- That marks a sharp turnaround from three months ago — the last time policymakers updated their own numbers — when the consensus view was that the economy would stall in the current quarter. And it may be enough to prompt Fed officials to scale back their estimates for interest-rate cuts in 2024.

- “Consumer spending was robust in June and July, so the third quarter is virtually baked in the cake at this point,” said Stephen Stanley, the chief economist at Santander Capital Markets US who is projecting 3.7% growth in the July-to-September period. “5% seems too high, but not impossible.”

- Any read on GDP growth above 3.2% would mark the strongest quarter since 2021, when the US was experiencing a rapid recovery from the initial shock of the pandemic. The acceleration is in stark contrast with the outlook for China, which has been downgraded in recent weeks amid a mounting property crisis.

- When Fed officials last updated their own projections for the US in mid-June, they showed the median policymaker thought GDP would expand just 1% in 2023. At the time, that marked an upgrade over the previous projection round in March, which implied a recession this year.

- That number will probably go up to 1.8% or 2% in the new projections set to be released at the conclusion of the central bank’s Sept. 19-20 policy meeting, and the outlook for the unemployment rate could be revised lower, according to Omair Sharif, president of Inflation Insights LLC.

- The growth upgrade may also lead Fed officials to scale back the easing they had projected for next year, Sharif said.

- The Atlanta Fed tracker — which is separate from policymakers’ quarterly projections — is volatile and will probably be revised down some before the government publishes its first official read on current-quarter growth at the end of October.

- But it underscores the widespread upswing in sentiment over the past few months. Better-than-expected numbers in a monthly Institute for Supply Management report on the US services sector published Wednesday bolstered the theme.

- Despite the rising optimism, the central bank has signaled it will probably leave its benchmark interest rate unchanged at the September meeting.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.