CAM Investment Grade Weekly

11/09/2018

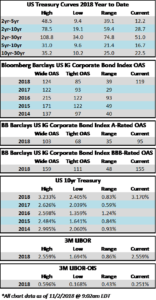

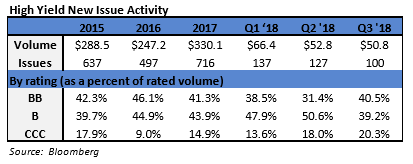

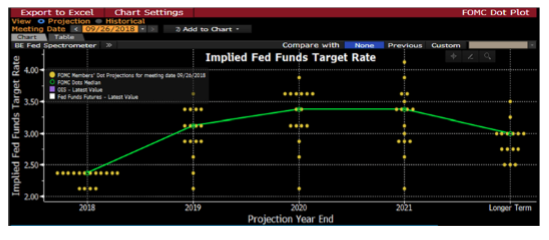

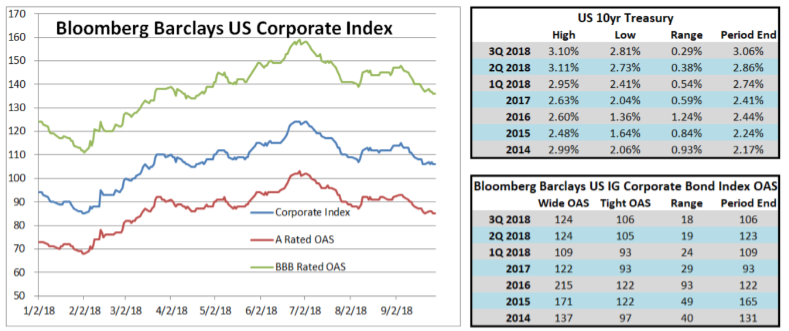

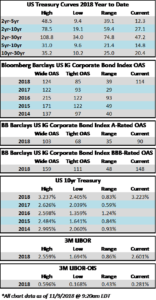

Credit spreads look to finish the week tighter, as the Bloomberg Barclays Corporate Bond Index opened Friday at an OAS of 114 after starting the week at 117. As we go to print, the 10yr Treasury sits at 3.223%, which is 1 basis point higher relative to its close a week prior.

According to Wells Fargo, IG fund flows during the week of November 1-November 7 were +$2.7 billion with short duration funds posting a record +$3.6 billion inflow. Per Wells data, YTD fund flows are +$98.796bln.

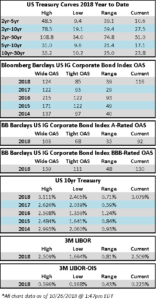

According to Bloomberg, new corporate issuance on the week was $22bln. YTD corporate issuance has been $1.011 trillion.

(Bloomberg) Oil Teeters Near Record Losing Streak After Entering Bear Market

- Oil extended a run of declines after falling into a bear market, heading for its longest losing streak on record.

- Futures in New York fell for a 10th day, extending a dramatic plunge that’s dragged prices down more than 20 percent from a four-year high reached in early October. In London, Brent sank to a seven-month low below $70 a barrel. The drop comes days before the Organization of Petroleum Exporting Countries meets with partners in Abu Dhabi, having signaled it may cut output next year.

- Oil’s decline has been exacerbated by a U.S. decision to allow eight countries to continue importing from Iran, which it slapped with sanctions earlier this week. That decision, as well as pledges by Saudi Arabia and other producers to pump more and gains in American supply and stockpiles, have turned fears of a supply crunch into talk of an oversupply.

(Bloomberg) California Wildfire Quadruples in Size, and PG&E Falls

- A wildfire in Northern California’s Sierra Nevada foothills quadrupled in size late Thursday as winds threaten to make it spread faster. The state’s largest utility, PG&E Corp., fell 10 percent in early trading.

- The blaze near Chico has left more than 23,000 homes and businesses without power, according to PG&E’s website. Residents in several towns were evacuated. The National Weather Service warns flames will spread rapidly as high pressure across the region has parched the air and fueled gusts of up to 65 miles per hour.

- As of 8 p.m. Thursday, the foothills fire had grown to 20,000 acres up from 5,000 earlier in the day. Two fires have broken out in Ventura County, just north of Los Angeles, consuming about 12,000 acres, and causing residents there to flee the flames.

- PG&E is struggling to cope with losses from deadly fires last year that could cost the utility as much as $17.32 billion in liabilities, according to a JPMorgan Chase & Co. estimate. Investors are still waiting on the state’s investigation into the Tubbs fire, the deadliest of last year’s wine country fires.

(Bloomberg) Lithium Giant Staying Nimble in Fickle Car-Battery Market

- The world’s largest lithium producer is planning to expand production in Australia, chasing the market for a form of the metal increasingly being used by the makers of electric car batteries.

- Albemarle Corp. will halt plans to expand its lithium carbonate production in Chile, the company said on Thursday. Instead, it will plow funding into a Western Australia project that produces lithium hydroxide, a rarer form of the metal that’s growing in use and currently sells for higher prices than the carbonate form.

- Lithium hydroxide works better with cathodes containing higher levels of nickel, helping cars go further on a single charge. Global demand for lithium overall is expected to almost triple by 2025, according to Bloomberg NEF, as carmakers such as Tesla Inc. look to boost sales of battered-powered vehicles.

- Lithium miners, meanwhile, have struggled to meet demand, and prices for the metal have tripled in just four years.

- “The challenge at this point in the cycle is that lithium companies must ramp their capital spending amidst a backdrop of some uncertainty around lithium pricing,” Chris Berry, a New York-based analyst and founder of research firm House Mountain Partners LLC, said by phone on Thursday. “For Albemarle to maintain its market share with such robust lithium demand growth, the company needs to execute their capacity expansion plans perfectly.”

- Albemarle is planning to boost its overall production of lithium across its operations in Chile, China and Australia to 225,000 tons per year in 2025 from 65,000 tons in 2017, the company said in its earnings report. In just four years, lithium has gone from being Albemarle’s least important product to representing 44.5 percent of the company’s revenue in 2017.

- On Thursday, the Charlotte, North Carolina-based company posted mixed third quarter results that sent shares down 2 percent at 4:15 p.m. to $105.57 in New York trading. Capital expenditures were up, reaching record levels, but Albemarle missed estimates for sales.