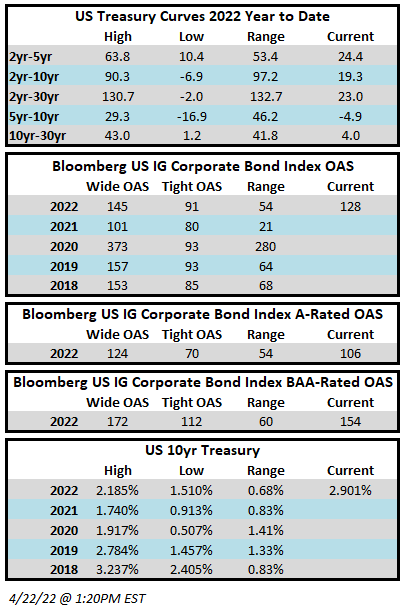

Spreads drifted wider throughout the week and the tape is weak on Friday afternoon for credit and equites as we go to print. The OAS on the Bloomberg US Corporate Bond Index closed at 128 on Thursday, April 21, after having closed the week prior at 121. On Thursday, Federal Reserve Chairman Jerome Powell delivered a hawkish message that sent equities lower and credit spreads wider. Geopolitical tensions and a humanitarian crisis Ukraine also continue to weigh on sentiment. The Investment Grade Corporate Index had a negative YTD total return of -12% through Thursday. The YTD S&P500 Index return was -7.4% and the Nasdaq Composite Index return was -15.6%. The yield to worst for the Corporate Index is now 4.21%, closing in on the high of 4.57% that occurred during the early days of the pandemic in March of 2020.

The primary market was very busy this week with $55 billion in new debt having been brought to market. Financials led the way with $33bln in issuance from money center banks. Year-to-date issuance has now topped $551bln, slightly ahead of 2021’s pace.

Per data compiled by Wells Fargo, flows for investment grade were negative on the week. Outflows for the week of April 14–20 were -$2.8bln which brings the year-to-date total to -$45.1bln.