CAM Investment Grade Weekly Insights

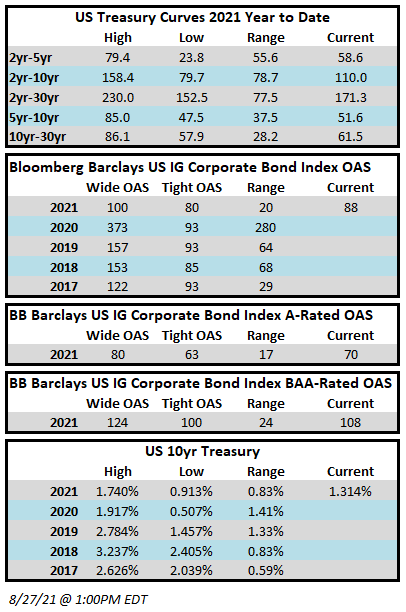

Spreads are set to finish the week tighter, reclaiming the move wider that occurred the week prior. The OAS on the Blomberg Barclays Corporate Index closed Thursday August 26 at a spread of 88 after having closed last week at 91 –spreads are relatively unchanged as we go to print on Friday afternoon. The yield on the 10yr Treasury moved higher throughout the week and is trading at 1.31% at the moment, 6 basis points higher than it closed the previous week. Through Thursday, the Corporate Index had posted a year-to-date total return of -0.55% and an excess return over the same time period of +1.46%.

It was a very slow week for corporate issuance with just $3bln in volume. This is quite typical for this time of year and we expect more of the same next week before the spigot gets turned back on after the Labor Day holiday. According to data compiled by Bloomberg, $962bln of new debt has been issued year-to-date.

Per data compiled by Wells Fargo, inflows into investment grade credit for the week of August 19–25 were +$5.9bln which brings the year-to-date total to +$270bln.