CAM Investment Grade Weekly Insights

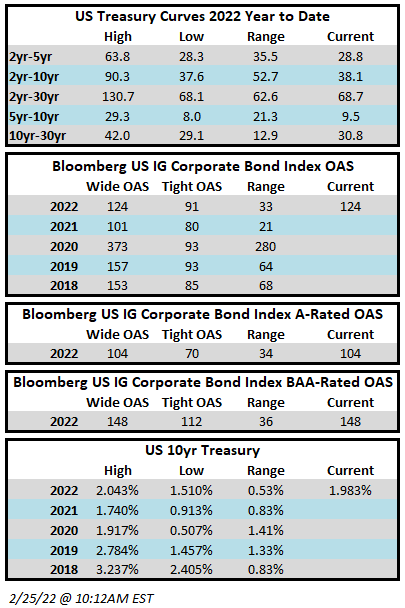

Spreads finished Thursday of this week at their widest levels of the year but there has been a significant retracement through Friday morning. The first half of the trading day on Thursday was extraordinarily weak with poor performance for risk assets as investors digested the news out of Europe before equities and credit staged a stunning reversal that afternoon. The OAS on the Bloomberg US Corporate Bond Index closed at 124 on Thursday, February 25, after having closed the week prior at 118. Investment grade has posted its worst start to a year ever with the Corporate Index down -6.5% total returns through Thursday. The YTD S&P500 Index return was -9.77% and the Nasdaq Composite Index return was -13.69%.

The primary market was less active than expected this week with the backdrop of geopolitical tensions but investment grade companies still managed to issue $18bln of new debt. Next week’s consensus forecast is calling for more than $25bln in new issue and some sell side prognosticators are predicting an extremely busy calendar for March with as much as $175bln+. There are some jumbo deals waiting in the wings that could print next month which could balloon that figure even further.

Per data compiled by Wells Fargo, flows into investment grade were modestly positive on the week. Flows for the week of February 17–23 were +$0.4bln which brings the year-to-date total to -$12.7bln.