CAM Investment Grade Weekly Insights

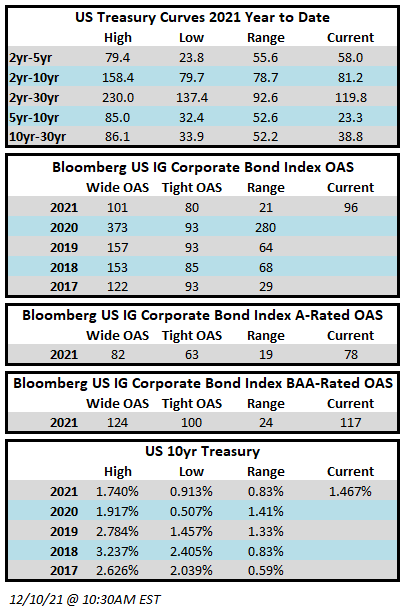

Spreads will finish the week tighter, reclaiming some ground after having experienced headwinds in the week prior which saw the index close two days at 101 –its widest level of 2021. The OAS on the Bloomberg US Corporate Bond Index closed at 96 on Thursday, December 9, after having closed the week prior at 100. Treasury volatility has been a common theme in recent weeks and this week was no exception. The 10yr Treasury is 1.47% on Friday morning after having closed last week at 1.34%. Through Thursday, the Corporate Index had posted a year-to-date total return of -1.26% and an excess return over the same time period of +1.25%. The Federal Reserve is currently within its blackout period as the market patiently awaits the next FOMC decision on Wednesday of next week.

The primary market was active this week with Merck leading all issuers with an outsize $8bln print. In all, over $38bln in new debt was brought to market during the week. This month can be seasonally slow but that has not been the case this year with a record breaking amount of new issuance during the month of December ($61.7bln) which is impressive to be sure given we are not yet half way through the month. According to data compiled by Bloomberg, $1,411bln of new debt has been issued year-to-date. 2021 has firmly secured its place in history as the 2nd busiest year for issuance on record but it still trails 2020’s record breaking volume by almost 20%. Issuance consensus estimates for next week are calling for only $5bln but we are skeptical and would not be surprised if Monday and Tuesday bring some activity. Wednesday is likely to be very quiet with the FOMC on the tape.

Per data compiled by Wells Fargo, flows into investment grade credit for the week of December 2–8 were +$0.885bln which brings the year-to-date total to +$321bln.