CAM Investment Grade Weekly Insights

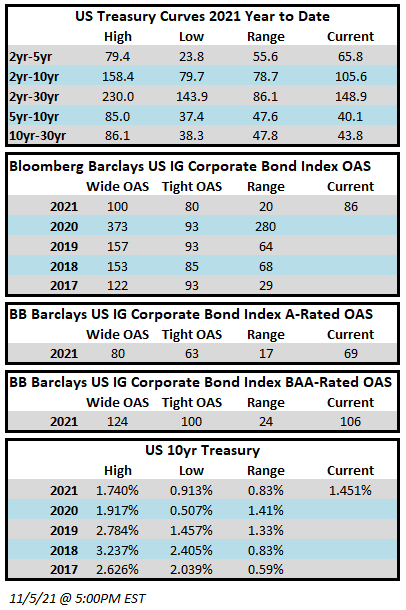

Spreads inched tighter throughout the week. The OAS on the Blomberg Barclays Corporate Index closed at 86 on Friday, November 5, after having closed the week prior at 88. On Wednesday, in a move that was widely anticipated, the Federal Reserve proceeded with the implementation of its plan to gradually taper the pace of asset purchases. Treasury yields moved lower after the FOMC meeting with the yield on the 10yr Treasury finishing the week at 1.45%, 10 basis points lower from its close the week prior. Even a solid payrolls report with an upward revision to prior data was not enough to stem the rally in rates. Through Friday, the Corporate Index had posted a year-to-date total return of -0.14% and an excess return over the same time period of +2.06%.

The primary market saw another somewhat active week with $20bln in new debt having been brought to market. According to data compiled by Bloomberg, $1,258bln of new debt has been issued year-to-date.

Per data compiled by Wells Fargo, outflows from investment grade credit for the week of October 28–November 3 were -$0.280bln which brings the year-to-date total to +$313bln. This marked the first outflow since March and only the second recorded outflow in the past calendar year.