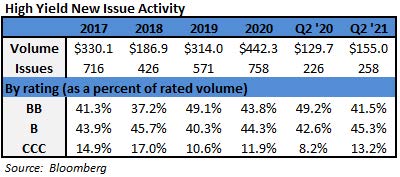

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $0.7 billion and year to date flows stand at -$2.0 billion. New issuance for the week was $12.7 billion and year to date issuance is at $363.5 billion.

(Bloomberg) High Yield Market Highlights

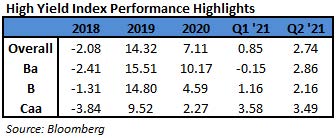

- The riskiest segment of the market, CCCs, is poised to end the week as the best performing asset class, with gains of 0.33%, fueled by rising oil prices.

- The broader junk bond index is also set to post gains for fourth consecutive week, with returns of 0.16%

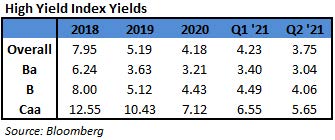

- Junk bond yields are still hovering well below 4%, closing at 3.76% on Thursday, just 23bps away from the all-time low of 3.53%

- It felt like the calm after a storm in the primary market with no new issues pricing or launching a roadshow on Thursday, after almost $13b priced, including the debut note sale of cryptocurrency trading platform Coinbase Global

- The junk bond calendar is steadily building up as investors make room for Medline Industries, the biggest leveraged buyout since the global financial crisis

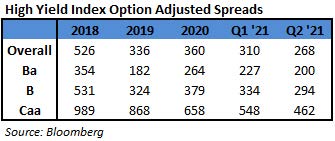

- More borrowers are expected to tap the market as yields continue to drop and spreads tighten in the high yield market

- BB yields closed at 2.88%, just 2bps above the record low of 2.86%

- Spreads were at a 19-month low of +190bps

- Single B yields closed at 4.19%, down 1bp, and spreads tightened 4bps to +314bps

- U.S. equity futures slid and European stocks reversed gains as investors evaluated the resilience of the global economic recovery amid concerns from the Delta strain and risks from China. Traders are waiting for August retail sales numbers, after China’s disappointing data yesterday, for cues on Federal Reserve’s taper plans. Meanwhile, oil is headed for a fourth weekly gain supported by signs of a tighter market and wider rally in energy prices.

(Bloomberg) Gensler Turns Spotlight on Bond Prices

- After U.S. Securities and Exchange Commission Chairman Gary Gensler signaled he may overhaul bond market regulations, industry experts zeroed in on just how opaque trading can be.

- Gensler, who testified Sept. 14 before the Senate Banking Committee, said in prepared remarks released beforehand that he wants to “bring greater efficiency and transparency” to the trading of corporate bonds, municipal bonds and mortgage-backed securities. He offered little detail on what new rules might look like.

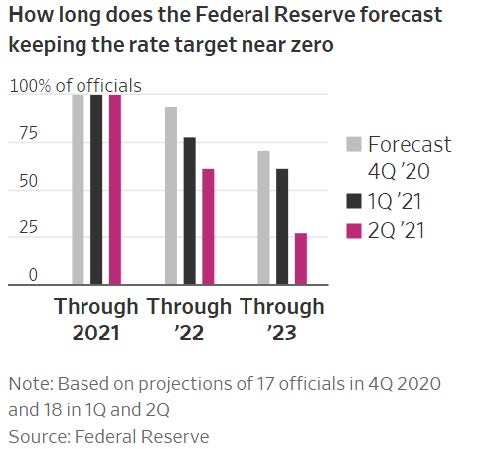

- Market watchers have suggestions, a year after a liquidity breakdown early in the pandemic forced the Federal Reserve to backstop the bond market. A big source of angst: especially when compared with other key financial assets like stocks, it can take a lot more effort to figure out the price of a bond.

- “Pre-trade transparency is a focus,” said Kumar Venkataraman, a finance professor at Southern Methodist University and former member of the SEC’s Fixed Income Market Structure Advisory Committee. “If you’re a large, sophisticated investor, you receive quotes from many dealers and see the best price. If you’re less sophisticated, you might get a less competitive bid.”

- Currently, corporate bond trades must be reported to the Financial Industry Regulatory Authority’s Trace system no more than 15 minutes after they’re executed — a deadline that feels like an eternity in the era when stock and futures traders fret about microseconds.

- And before trades are placed, there are no publicly available price quotes. To get those can require making phone calls or sending electronic requests for quotes to a bunch of banks and brokers.

- A potential solution would require bond brokers to report their offered prices to a centralized system, which is how it’s worked in the U.S. stock market since the 1970s. That could make the business more efficient by stitching together all the different markets where bonds trade. In stocks, for instance, all orders are supposed to be automatically routed to the market with the best price.

- Sell-side banks have little incentive to provide greater transparency, since it could cut into their profits. And reporting quotes could be a costly and time-consuming process that banks currently have little interest in participating in, Venkataraman said.

- Don’t expect corporate bonds to begin trading in a centralized system like equities anytime soon, says Kevin McPartland, head of research for market structure at Coalition Greenwich.

- “The bond market is still very different from the equity market in terms of how it trades and in terms of the market participants,” he said. “Bond markets are by and large institutional markets. So we have a very informed consumer if you will.”

- The bond-market crisis of March and April 2020 is fresh in regulators’ minds. Government officials appear to view the unprecedented steps taken by the Fed in March 2020 as a mandate to address long-standing concerns that bond liquidity disappears in bad times.

- Gensler has targeted market transparency before. The opacity of the swaps market was one of the reasons why the 2008 financial crisis was so severe, since it was extremely difficult to untangle the connections between Wall Street banks who held the derivatives. Gensler, as chairman of the U.S. Commodity Futures Trading Commission, oversaw a push to get more of that business done on public markets.