CAM High Yield Weekly Insights

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $0.3 billion and year to date flows stand at $45.8 billion. New issuance for the week was $3.6 billion and year to date issuance is at $368.9 billion.

(Bloomberg) High Yield Market Highlights

- A rally in U.S. junk bonds pushed yields near a record low as investors sought riskier assets on bets the Federal Reserve will continue to support the economy with low rates as the prospect of a divided U.S. government looms.

- Yields on the debt were just 10bps off a record low of 4.83% set in June 2014, and closed at about a 6-year low on Thursday

- The index is heading for its biggest weekly gains in five months, with spreads closing at an eight-month low of +436bps

- The rally was across ratings: single B yields were just 14bps off a six- year low of 4.99% and closed at an eight-month low of 5.13%. Spreads closed at +453bps, also an eight-month low

- The CCC index is set to outperform BBs and single Bs this week, with expected gains of 2.23%. Yields are at a new two-year low of 8.95% and spreads are at an eight-month low of +831bps

- Returns across ratings are poised to be the biggest since June

- The broader junk bond index posted gains of 0.6% on Thursday after gaining for four straight sessions. It is set to report returns of 2.13% for the week, the biggest since June 5

- Single B returns were 0.6% on Thursday and are poised for gains of 1.93% for the week. BB returns for the week could be 2.21%

- The junk bond rally may take a pause as stock futures stalled on Friday, unwinding some of the week’s surge as the election count continued

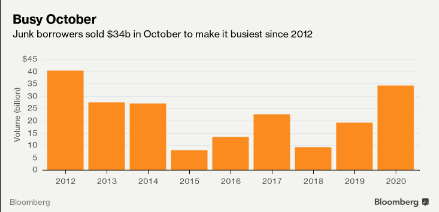

(Bloomberg) Junk Bonds Outperform Stocks in Busiest October Since 2012

- Junk-rated issuers sold more than $34 billion of bonds last month, making it the busiest October since 2012 despite market turmoil from falling stocks and oil.

- While market volatility did pressure junk bonds and resulted in more than $4 billion of outflows in the last two weeks of October, new issues largely drew orders multiple times the deal size and most priced at the tight end of talk

- Outflows from retail funds coupled with tumbling stocks amid fears that the renewed spread of the virus could derail fragile economic growth, forced five borrowers to withdraw their debt offerings.

- The broader junk bond index posted a modest gain of 0.5% in October. CCCs, the riskiest of junk bonds, also reported a small gain of 0.22%

- Equities posted a loss of 2.66%, while the price of WTI crude dropped 11% in the month

- Junk bonds shrugged off equity volatility with yields little changed closing October at 5.78% vs 5.77% in September

- CCC yields actually dropped 5bps to close the month at 10.05% and have been falling for seven consecutive months, the longest declining streak since October 2009