Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $0.6 billion and year to date flows stand at -$34.3 billion. New issuance for the week was $6.5 billion and year to date HY is at $121.0 billion, which is -24% over the same period last year.

(Bloomberg) High Yield Market Highlights

- The U.S. junk bond issuance onslaught continued yesterday, with five more deals for $4.6 billion priced and strong oversubscription. This week was, the second busiest year-to-date, and most active since March.

- Global risk appetite took a hit this morning on Turkey contagion worries

- Demand for high-yield bonds in the primary market was most evident in the pricing of BMC Software, a CCC- credit funding an LBO by KKR

- Orders exceeded $4.5b for the $1.475b issue which priced at 9.75%, the wide end of talk after tightening from initial whispers of 10%

- HCA Inc drove-by with a $2b 2-tranche offering on orders of about $7.5b, more than 3.5x the size of the offering; priced at tight end of talk

- Marriott Vacations had orders of ~$3.8b, 5x the size of the offering, priced through talk

- Earlier in the week, Springleaf Finance and Wellcare Health were oversubscribed multiple times

- Junk bond yields are under some pressure as new supply hit, oil dropped for the second straight session and stocks retreated amid continuing trade tensions with China

- CCCs stay on top as they beat BBs and single-Bs, with YTD return of 4.64%

- IG bonds are down 2.36% YTD

- Goldman expects big boost to junk bond issuance from a rebound in acquisition activity by high yield-rated buyers

(CAM Note) Moody’s upgrades debt of Penske Automotive Group

- The Moody’s upgrade was based on Penske’s continually improving credit profile. Additionally, Moody’s appreciates the diversity of Penske which helps insulate the Company from headwinds.

(CAM Note) S&P downgrades debt of AMC Entertainment

- The S&P downgrade was based on their assessment that discretionary cash flow could turn negative for 2018. Therefore, leverage is likely to remain elevated. However, S&P did note that AMC has adequate sources of liquidity to fund operations.

(Los Angeles Times) Tribune Media terminates sale to Sinclair Broadcast Group, seeks $1 billion in damages

- Sinclair Broadcast Group’s proposed $3.9-billion deal to acquire Tribune Media is dead.

- Tribune announced Thursday that it is terminating the merger agreement first announced in May 2017. The companies had the option to kill the sale if it had not closed by Aug. 8.

- Tribune also said it filed a breach-of-contract lawsuit against Sinclair in Delaware Chancery Court, alleging it failed to make its best effort at getting regulatory approval of the sale. Tribune is seeking $1 billion in damages.

- “In light of the FCC’s unanimous decision … our merger cannot be completed within an acceptable timeframe, if ever,” Tribune Media Chief Executive Peter Kern said in a statement. “This uncertainty and delay would be detrimental to our company and our shareholders. Accordingly, we have exercised our right to terminate the merger agreement, and, by way of our lawsuit, intend to hold Sinclair accountable.”

- The merger has been on hold since the Federal Communications Commission voted July 19 to have the proposal reviewed by an administrative court, a process that has a history of killing such deals.

- Sinclair’s plan to buy Tribune’s 42 TV had been expected to benefit from President Trump’s appointment of FCC Chairman Ajit Pai, who is considered a strong proponent of deregulation of the broadcast industry.

- But Pai raised concerns about how Sinclair planned to divest some Tribune stations in order to meet the national cap on TV-station ownership. Under Sinclair’s plan, Tribune stations in Chicago, Dallas and Houston would have been sold to entities that had business ties to Sinclair for prices under market value. Sinclair also would have retained control of the stations even after the divestiture.

(Bloomberg) Private-Prison REITs Expand Empires Thanks to Tax Advantages

- A big part of the success stems from Trump’s plan to spend nearly $2.8 billion next year expanding immigrant detention capacity by 30 percent from 2017. More than 70 percent of undocumented immigrants were held in private prisons last year, according to nonprofit group In the Public Interest.

- Use of the tax code plays a role, too. CoreCivic and GEO, the biggest U.S. prison companies, are classified as real estate investment trusts. That means almost all their profits from property-related operations are tax free as long as they’re distributed to shareholders through dividends.

- The tax rules incentivize CoreCivic and GEO to build and lease detention facilities rather than only manage them. They’re doing just that.

- Boca Raton, Florida-based GEO owned or leased 102 prisons in the U.S. last year, up from 65 in 2013, when it became a REIT.

- CoreCivic, based in Nashville, Tennessee, reduced managed-only contracts to seven last year from 16 in 2013, the year it also became a REIT. Facilities it owns and manages or leases grew to 82 from 53.

- “For the past five years, we’ve been very thoughtful about rebidding on CoreCivic Safety’s managed-only contracts when they are up for expiration,” CoreCivic spokeswoman Amanda Gilchrist said in an email. “The margins in the managed-only business are very low, and we are dependent on the government partner to maintain the real estate asset, including maintaining all critical security and life safety systems.”

- Both companies also have business lines whose revenue is taxable.

(CAM Note) Both GEO and CoreCivic reported 2nd quarter results that exceeded analysts’ estimates and raised guidance for the year.

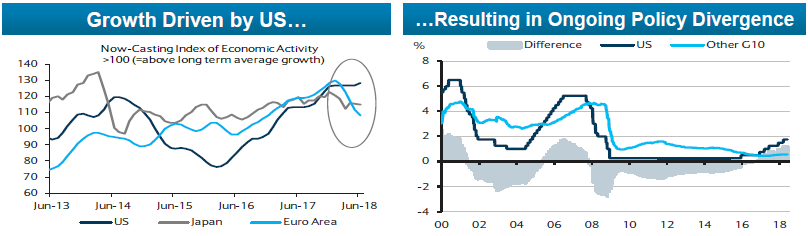

The Federal Reserve held two meetings during Q2 2018. The Federal Funds Target Rate was raised at the June 13

The Federal Reserve held two meetings during Q2 2018. The Federal Funds Target Rate was raised at the June 13

While the Fed continues a less accommodative posture, other Central Banks aren’t necessarily following suit. The Bank of Japan is still buying an annualized JPY45 trillion of Japanese Government Bonds (“JGB’s”) and targeting a JGB yield of 0%.

While the Fed continues a less accommodative posture, other Central Banks aren’t necessarily following suit. The Bank of Japan is still buying an annualized JPY45 trillion of Japanese Government Bonds (“JGB’s”) and targeting a JGB yield of 0%.

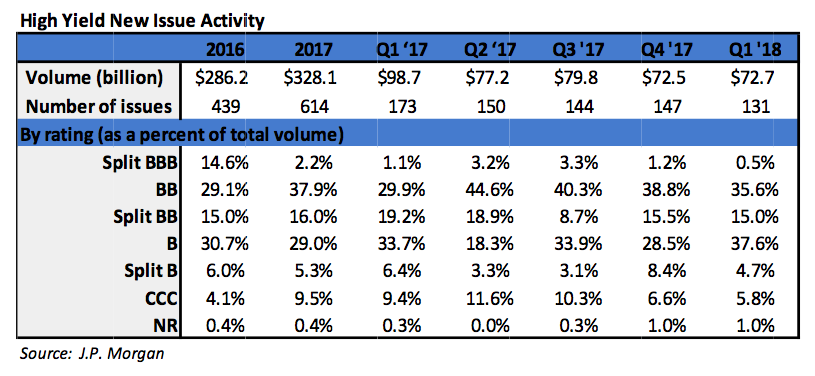

During the first quarter, the high yield primary market posted $72.7 billion in issuance. Importantly, almost three‐quarters of the issuance was used for refinancing activity. That was the highest level of refinancing since 2009. Issuance within Energy comprised just over a quarter of the total issuance. The 2018 first quarter level of issuance was relative to the $98.7 billion posted during the first quarter of 2017. The full year issuance for 2017 was $328.1 billion, making 2017 the strongest year of issuance since the $355.7 posted in 2014.

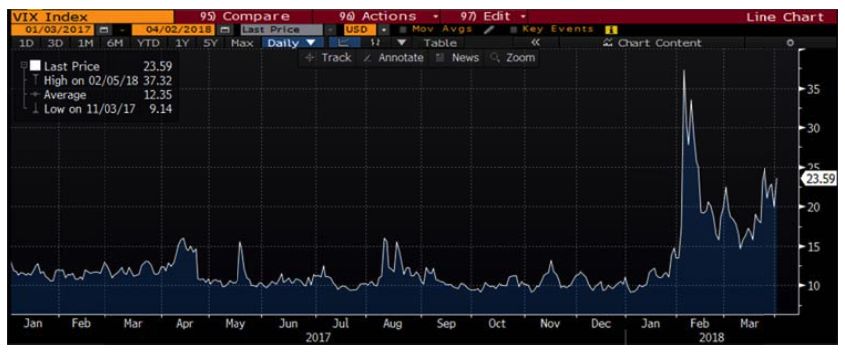

During the first quarter, the high yield primary market posted $72.7 billion in issuance. Importantly, almost three‐quarters of the issuance was used for refinancing activity. That was the highest level of refinancing since 2009. Issuance within Energy comprised just over a quarter of the total issuance. The 2018 first quarter level of issuance was relative to the $98.7 billion posted during the first quarter of 2017. The full year issuance for 2017 was $328.1 billion, making 2017 the strongest year of issuance since the $355.7 posted in 2014. The chart to the left is sourced from Bloomberg and is the Chicago Board Options Exchange Volatility Index (“VIX”). The VIX is a market estimate of future volatility in the S&P 500 equity index. It is quite clear that the market has entered a period of higher volatility. In fact, the equity market through the first quarter of 2018 is already much more volatile than all of 2017 as measured by the number of positive and negative 1% days.iv In addition to the volatility witnessed throughout the markets during the first quarter, there have been a few transitions in high profile government posts as well. Jerome Powell began a four‐year term as Chair of the Federal Reserve following the end of Janet Yellen’s single term in that role; economist Larry Kudlow succeeded to director of the National Economic Council after Gary Cohn’s resignation; and Mike Pompeo and John Bolten were nominated as Secretary of State and National Security Adviser, respectively, after Rex Tillerson and HR McMaster were dismissed from the roles.

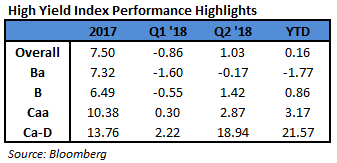

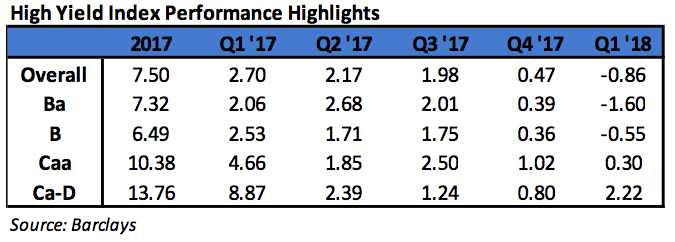

The chart to the left is sourced from Bloomberg and is the Chicago Board Options Exchange Volatility Index (“VIX”). The VIX is a market estimate of future volatility in the S&P 500 equity index. It is quite clear that the market has entered a period of higher volatility. In fact, the equity market through the first quarter of 2018 is already much more volatile than all of 2017 as measured by the number of positive and negative 1% days.iv In addition to the volatility witnessed throughout the markets during the first quarter, there have been a few transitions in high profile government posts as well. Jerome Powell began a four‐year term as Chair of the Federal Reserve following the end of Janet Yellen’s single term in that role; economist Larry Kudlow succeeded to director of the National Economic Council after Gary Cohn’s resignation; and Mike Pompeo and John Bolten were nominated as Secretary of State and National Security Adviser, respectively, after Rex Tillerson and HR McMaster were dismissed from the roles. Being a more conservative asset manager, Cincinnati Asset Management remains significantly underweight CCC and lower rated securities. For the first quarter, that focus on higher quality credits was a detriment as our High Yield Composite gross total return underperformed the return of the Bloomberg Barclays US Corporate High Yield Index (‐1.83% versus ‐0.86%). The higher quality credits that were a focus tended to react more negatively to the interest rate increases. This was an additional consequence also contributing to the underperformance. Our credit selections in the food & beverage and home construction industries were an additional drag on our performance. However, our credit selections in the cable & satellite and leisure industries were a bright spot in the midst of the negative first quarter return.

Being a more conservative asset manager, Cincinnati Asset Management remains significantly underweight CCC and lower rated securities. For the first quarter, that focus on higher quality credits was a detriment as our High Yield Composite gross total return underperformed the return of the Bloomberg Barclays US Corporate High Yield Index (‐1.83% versus ‐0.86%). The higher quality credits that were a focus tended to react more negatively to the interest rate increases. This was an additional consequence also contributing to the underperformance. Our credit selections in the food & beverage and home construction industries were an additional drag on our performance. However, our credit selections in the cable & satellite and leisure industries were a bright spot in the midst of the negative first quarter return.