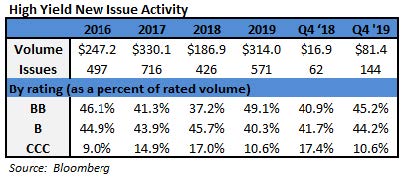

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $0.1 billion and year to date flows stand at $1.2 billion. New issuance for the week was $12.5 billion and year to date issuance is at $48.2 billion.

(Bloomberg) High Yield Market Highlights

- New issues have been well-received

- Yet it’s looking like a risk-off day as stock futures slide on renewed fears of the spread of the coronavirus

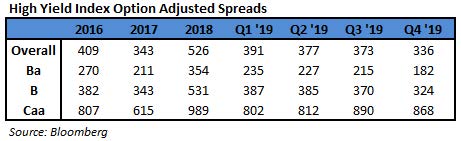

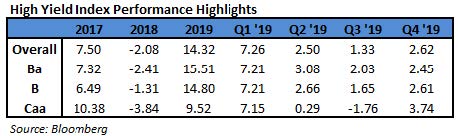

- Junk- bond yields have fallen 24bps in the past week. At 5.28%, they’re just 30bps off the 5.5-year low hit on Jan. 21

- Spreads have tightened 34bps over the same period to 356bps over Treasuries

- Even riskier debt has rallied with yields on CAAs falling below 10% for the first time in two weeks to 9.95%

- Junk- bond investors are pouring money back into exchange-traded funds again

- HYG and JNK, the two biggest high-yield ETFs, reported a combined inflow of $325m yesterday after $630m the previous day

(New York Times) Some Takeaways From Trump’s State of the Union Address

- President Trump framed his third year in office as an unmistakable success and his fourth as more of the same.

- A partisan atmosphere loomed over the House floor from the very start of Mr. Trump’s speech, when Republican lawmakers chanted “four more years” after the president stepped up to the rostrum. The hostility carried through to the end, when House Speaker Nancy Pelosi ripped up a copy of the address after he finished delivering it.

- He proclaimed that the economy was setting records, that American enemies were on the defense, and that the American spirit had been renewed.

- “In just three short years, we have shattered the mentality of American decline and we have rejected the downsizing of America’s destiny,” he said. “We are moving forward at a pace that was unimaginable just a short time ago and we are never going back.”

- Trump dived into the state of the economy at the top of the speech, making broad declarations about tax cuts, deregulation and the renegotiation of the North American Free Trade Agreement, the new version of which he signed into law last week.

- Trump addressed two pieces of potential health care legislation that remain a top priority for both parties in the coming months: surprise billing and prescription drugs.

- After signing an initial trade deal with China last month, Mr. Trump pointed on Tuesday to the tariffs he has imposed on the country in order to take on its “massive theft of America’s jobs.” He said that “our strategy has worked.”

- Trump’s attention on foreign policy later swung to the Middle East, when he highlighted two people his administration killed in recent months: Abu Bakr al-Baghdadi, the leader of the Islamic State, and Maj. Gen. Qassim Suleimani, the powerful Iranian commander.

(Wall Street Journal) Ford’s Operating Income Plunges

- Ford Motor Co. said fourth-quarter operating income sank by two-thirds, and it issued a lower-than-expected profit outlook for 2020, the latest signs of trouble for Chief Executive Jim Hackett’s turnaround plan.

- Ford said operating income for the October-to-December period was $485 million, down from $1.5 billion a year earlier. Earnings per share adjusted for one-time items were 12 cents, well short of analysts’ estimate of 17 cents.

- The company’s financial standing has continued to weaken under Mr. Hackett, who was brought in nearly three years ago to revive the auto maker’s profit growth and give it a stronger vision for the future.

- Revenue for the full year dropped 3% to $155.9 billion.

- “Financially, it wasn’t OK,” finance chief Tim Stone said of the 2019 results during a discussion with reporters at Ford’s headquarters. “Strategically. . .I think we made strong progress.”

- Ford pinned the shortfall in part on lower production volumes in North America stemming from problems with launches of key models, including the redesigned Explorer and Escape sport-utility vehicles and its Super Duty pickup truck. It also cited higher warranty costs and a bonus payout to United Auto Workers that totaled about $600 million.

- The auto maker forecast operating profit this year of $5.6 billion to $6.6 billion, compared with $6.38 billion last year. That equals an earnings-per-share range of 94 cents to $1.20, which is lower than the average analysts’ estimate of $1.30, according to S&P Global Market Intelligence.

- Hackett’s strategy to revitalize Ford — which includes a multiyear, multibillion-dollar restructuring — hasn’t returned the company to earnings growth or restored profitability overseas, where Ford is closing plants and shedding thousands of workers to cut costs.

- “Financially, the company’s 2019 performance was short of our original expectations, mostly because our operational execution — which we usually do very well — wasn’t nearly good enough,” Mr. Hackett said. “We recognize, take accountability for and have made changes because of this.”

- In a bright spot for the year, Ford trimmed its losses in overseas markets. It halved its China loss, to $771 million from $1.55 billion, which it attributed to cost cutting. In Europe, the company had a $47 million loss for the year, down from a $398 million loss a year earlier.