CAM Investment Grade Weekly Insights

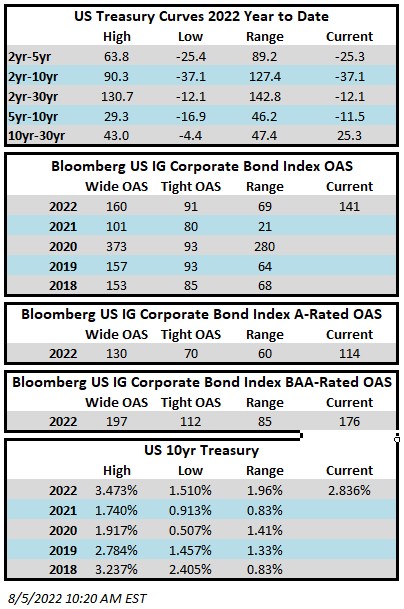

Investment grade credit performance was mixed again this week. It looked like spreads would finish the week better bid but then the monthly payroll report hit on Friday morning. Things are volatile as we go to print so it is merely a guess but we could finish the week somewhere in the neighborhood of unchanged to modestly wider amid a risk off tone on the back of payrolls. The Bloomberg US Corporate Bond Index closed at 141 on Thursday August 4 after having closed the week prior at 144. The 10yr Treasury has been all over the map this week. The 10yr closed last week at 2.65%, closed Monday of this week at 2.57% and is now up at 2.84% mid-Friday morning. Fed speakers spent much of this week reinforcing their hawkish views and commitment to tame inflation and then a strong jobs report fueled a 14 basis point sell-off in 10s this morning. Front-end rates are getting hit even harder with the 2-year Treasury up nearly 18 basis points as we go to print. The short and intermediate portions of the Treasury curve are now more inverted than they have been at any point in this cycle. Through Thursday the Corporate Index had a negative YTD total return of -11.35% while the YTD S&P500 Index return was -12.11% and the Nasdaq Composite Index return was -18.88%.

Primary issuance was big this week with $56bln in new debt brought to market which exceeded even the highest of expectations. There was issuance from high quality household names such as Apple and Intel and Meta Platforms (fka Facebook) printed its inaugural bond deal of $10bln. Street estimates are looking for $20-25bln in issuance next week. There has been $859bln of new issuance YTD which trails 2021’s pace by 5% according to data compiled by Bloomberg.

Investment grade credit saw its highest weekly inflow in almost a year. Per data compiled by Wells Fargo, inflows for the week of July 28–August 3 were +$6.5bln which brings the year-to-date total to -$119.9bln.