CAM High Yield Weekly Insights

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $0.9 billion and year to date flows stand at -$44.8 billion. New issuance for the week was $3.5 billion and year to date issuance is at $74.7 billion.

(Bloomberg) High Yield Market Highlights

- U.S. junk bonds are headed toward the sixth straight week of gains after steadily climbing in three of the last four sessions as yields plunge to a new two-month low of 7.44%. The six-week gain would be the longest winning streak in more than 18 months. Yields are also on track to drop for the sixth consecutive week, the longest declining stretch in two years.

- The rally gained legs after strong jobs data last Friday and lower-than-expected consumer price index earlier this week eased fears of an imminent recession amid expectations that the Federal Reserve will slow down the rate-hike campaign from the aggressive 75bps hike in the last meeting.

- The market appears to be discounting negative news and focusing on the positives, Brad Rogoff and Dominique Toublan at Barclays Capital wrote on Friday.

- The gains extended across the high-yield market, with CCCs, the riskiest part of the junk bond market, poised to gain for the fourth successive week, the longest gaining streak in more than eight months. The week-to-date gains were at 1.59%, the best performing asset in the high-yield market.

- The total returns for BBs week-to-date were 0.49% and single Bs were at 1.08%.

- BB yields dropped below 6% to 5.99% and single B yields fell to a 10-week low of 7.64%.

- The rally was also partly due to technical factor, with inflows into junk bond funds looking to put money to work and a lack of supply.

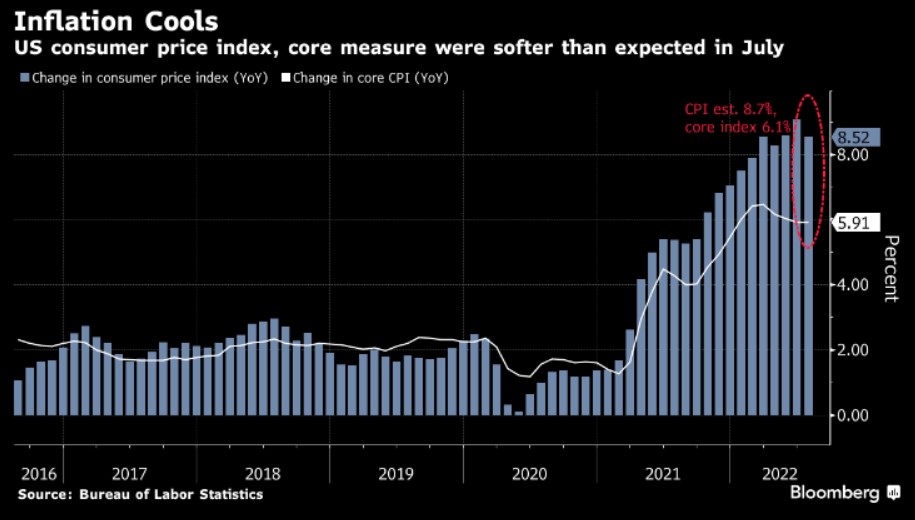

(Bloomberg) US Inflation Runs Cooler Than Forecast, Easing Pressure on Fed

- U.S. inflation decelerated in July by more than expected, reflecting lower energy prices, which may take some pressure off the Federal Reserve to continue aggressively hiking interest rates.

- The consumer price index increased 8.5% from a year earlier, cooling from the 9.1% June advance that was the largest in four decades, Labor Department data showed Wednesday. Prices were unchanged from the prior month. A decline in gasoline offset increases in food and shelter costs.

- So-called core CPI, which strips out the more volatile food and energy components, rose 0.3% from June and 5.9% from a year ago. The core and overall measures came in below forecast.

- The data may give the Fed some breathing room, and the cooling in gas prices, as well as used cars, offers respite to consumers. But annual inflation remains high at more than 8% and food costs continue to rise, providing little relief for President Joe Biden and the Democrats ahead of midterm elections.

- While a drop in gasoline prices is good news for Americans, their cost of living is still painfully high, forcing many to load up on credit cards and drain savings. After data last week showed still-robust labor demand and firmer wage growth, a further deceleration in inflation could take some of the urgency off the Fed to extend outsize interest-rate hikes.

- Fed officials have said they want to see months of evidence that prices are cooling, especially in the core gauge. They’ll have another round of monthly CPI and jobs reports before their next policy meeting on Sept. 20-21.

- Gasoline prices fell 7.7% in July, the most since April 2020, after rising 11.2% a month earlier. Utility prices fell 3.6% from June, the most since May 2009.

- Food costs, however, climbed 10.9% from a year ago, the most since 1979. Used car prices decreased.

Shelter costs — which are the biggest services’ component and make up about a third of the overall CPI index — rose 0.5% from June and 5.7% from last year, the most since 1991. That reflected a 0.7% jump in rent of primary of residence.