Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were +$2.9 billion and year to date flows stand at $2.8 billion. New issuance for the week was $8.1 billion and year to date issuance is at $113.8 billion.

(Bloomberg) High Yield Market Highlights

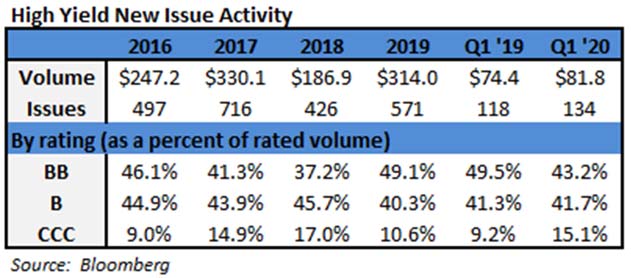

- Barclays credit strategists led by Brad Rogoff have increased their forecast for full-year supply to $290b to $310b, driven by an increase in refinancings and general corporate purpose funding. The previous estimate was $240b to $260b

- “The midpoint of this estimate would represent the largest supply year since 2014. Several tailwinds should result in additional supply, including the need to fund negative free cash flow, as well as loan issuers’ turning to the bond market given a more supportive demand technical,” they wrote in a note Friday

- Investors continue to pour cash into the asset class with an inflow of $2.9b into U.S. high yield funds for the week

- This is the sixth straight week of inflows

- Junk bonds returned 0.22% yesterday, the third straight session of gains

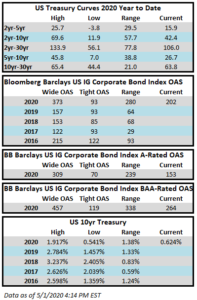

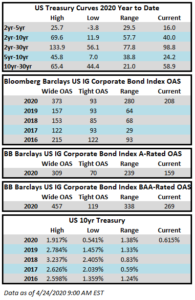

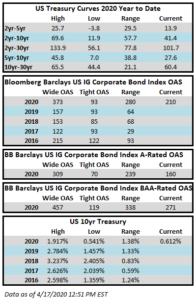

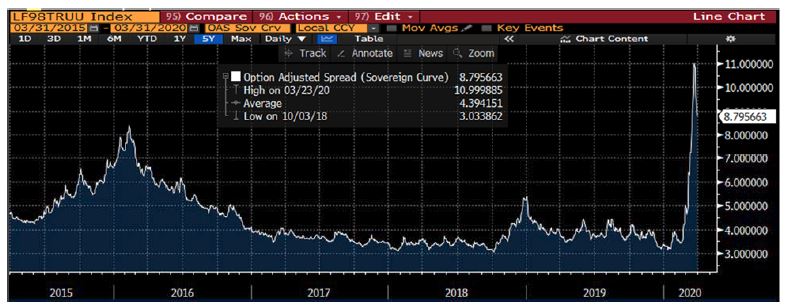

- Heavy issuance hasn’t weighed on spreads which edged tighter again to +735bps, and are 10bp lower since last Friday. Yields fell 6bps to 7.93%

(Bloomberg) New York Fed Says It Will Begin Buying ETFs in ‘Early May’

- The Federal Reserve is close to starting up two corporate lending programs that could buy up to $750 billion in debt and exchange-traded funds under its emergency coronavirus actions.

- The New York Fed announced on its website Monday that it expects to begin purchasing shares of eligible ETFs in early May through its Secondary Market Corporate Credit Facility. Lending through the Fed’s Primary- and secondary-market corporate credit facilities via purchases of corporate bonds will begin soon thereafter, it said. ETFs are included in the secondary facility and the program’s announcement in March had a major impact on that market.

- “Additional details on timing will be made available as those dates approach,” the New York Fed said.

- The corporate facilities are among nine emergency lending programs announced by the Fed to help shelter the U.S. economy from the pandemic and keep credit flowing. The move was a dramatic escalation of the central bank’s intervention, stepping into the corporate debt markets for the first time since the 1950s and including some sub-investment grade debt in the ETF purchases.

- The corporate programs are backed by the more than $2 trillion economic relief package passed by Congress. Businesses across the nation have shuttered to limit contagion and more than 30 million people have claimed unemployment benefits in the last six weeks. So far, only four programs are up and running.

- “Many companies that would’ve had to come to the Fed have now been able to finance themselves privately since we announced the initial term sheet on these facilities,” Fed Chair Jerome Powell said during an April 29 press conference. “The ultimate demand for the facilities is quite difficult to predict because there is this ‘announcement effect’ that really gets the market functioning again. Of course, we have to follow through, though. And we will follow through to validate that announcement effect.”

(Reuters) U.S. airlines burn through $10 billion a month as traffic plummets

- S. airlines are collectively burning more than $10 billion in cash a month and averaging fewer than two dozen passengers per domestic flight because of the coronavirus pandemic, industry trade group Airlines for America said in prepared testimony seen by Reuters ahead of a U.S. Senate hearing on Wednesday.

- Even after grounding more than 3,000 aircraft, or nearly 50% of the active U.S. fleet, the group said its member carriers, which include the four largest U.S. airlines, were averaging just 17 passengers per domestic flight and 29 passengers per international flight.

- “The U.S. airline industry will emerge from this crisis a mere shadow of what it was just three short months ago,” the group’s chief executive, Nicholas Calio, will say, according to his prepared testimony.

- Net booked passengers have fallen by nearly 100% year-on-year, according to the testimony before the Senate Commerce Committee. The group warned that if air carriers were to refund all tickets, including those purchased as nonrefundable or those canceled by a passenger instead of the carrier, “this will result in negative cash balances that will lead to bankruptcy.”

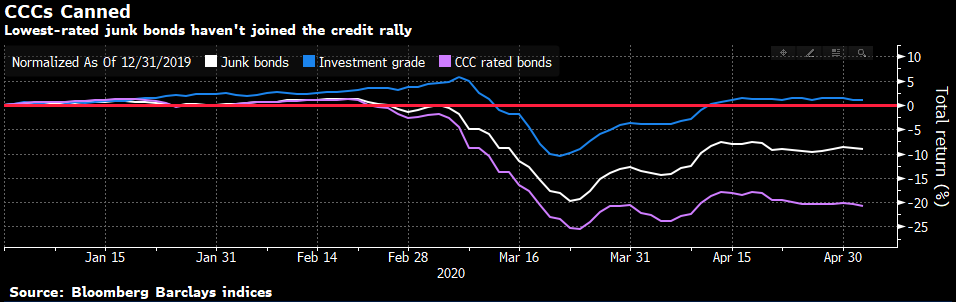

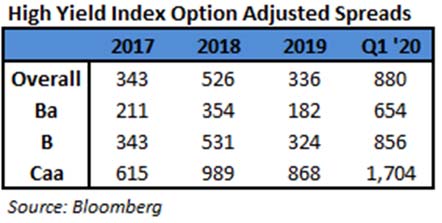

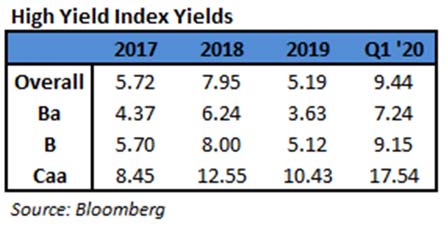

(Bloomberg) Junkiest Junk Decays in Basement of Credit Rally

- Investment-grade credit has recouped March losses and junk bonds are halfway back despite foul fundamentals and a deluge of new issuance. CCC debt didn’t rise with the tide and looks set to plumb new depths as the distressed cycle grips.