CAM Investment Grade Weekly Insights

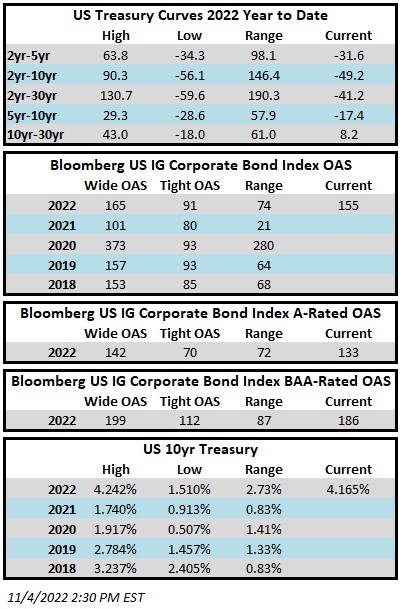

Investment grade credit spreads look as though they will finish the week slightly tighter. The Bloomberg US Corporate Bond Index closed at 155 on Thursday November 3 after having closed the week prior at 158. Treasury yields moved higher during the week. The 10yr Treasury closed last Friday evening at 4.01% and it is trading at 4.17% as we go to print this Friday afternoon. Through Thursday the Corporate Index had a YTD total return of -19.7% while the YTD S&P500 Index return was -20.9% and the Nasdaq Composite Index return was -33.5%.

It was an active week for central bankers and there was plenty of economic data to parse. The FOMC raised the policy rate by 75bps for the fourth consecutive meeting, moving the benchmark to a target range of 3.75% to 4%. This move was largely expected by markets but some investors may not have been sufficiently prepared for Powell’s comments which were perceived as hawkish in nature. In our view this should not have come as a surprise as Fed officials have been consistently hawkish in recent weeks. Powell did indicate that the committee may look to slow the pace of Fed Funds rate increases but that they are committed to seeing this through to the end in order to tame inflation. We think that this level of commitment increases the probability that the economy will start to slow significantly in the months ahead. Not to be outdone by the FOMC, the Bank of England was on the tape Thursday with a 75bps hike but its rhetoric was much more dovish than the U.S. central bank. The BOE warned investors that market expectations for its terminal rate have overshot, and that while additional rate hikes may be required, the bank will be careful to limit the associated impact on economic growth. The BOE expects that GDP for the UK will contract for eight consecutive quarters until mid-2024. The final major piece of data came on Friday morning when the October jobs report showed that the U.S. labor market was still quite healthy. Although the unemployment rate did tick higher from 3.5% to 3.7%, it is clear that the labor market was still too tight relative to FOMC expectations. Futures contracts are pricing in a 50-basis point hike at the Fed’s December 14 meeting, but if the data over the next month does not paint a picture of slowing inflation then 75bps could be on the table once again.

Primary market activity in corporate credit was muted during the week. Borrowers brought just over $12bln in new debt to market relative to expectations that were looking for $15bln on the low-end. 2022 has seen over $1,080bln in new issue volume which trails 2021’s pace by ~12%.

Investment grade funds reported a modest outflow for the week. Per data compiled by Wells Fargo, inflows for the week of October 27–November 2 were -$0.4bln which brings the year-to-date total to -$147bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.