CAM Investment Grade Weekly Insights

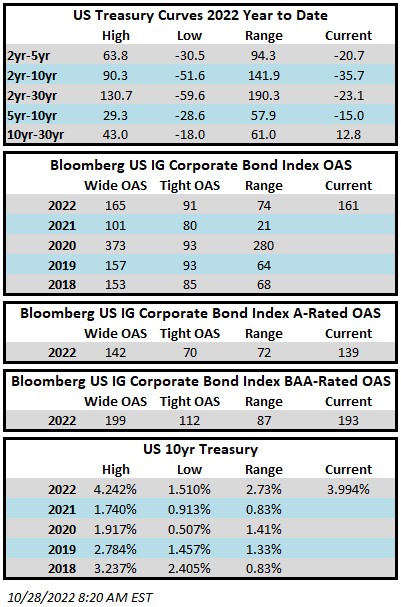

Investment grade credit spreads will likely finish the week tighter. The Bloomberg US Corporate Bond Index closed at 161 on Thursday October 27 after having closed the week prior at 164. Treasury yields drifted lower throughout the week. The 10yr Treasury closed last Friday evening at 4.22% and it is trading at 3.99% as we go to print this morning. Through Thursday the Corporate Index had a negative YTD total return of -19.1% while the YTD S&P500 Index return was -19.1% and the Nasdaq Composite Index return was -30.4%.

It was an extremely active week for economic data and rate decisions by global central banks. We cannot cover it all in this brief note but we will do our best to hit the highlights. Early in the week, data releases showed housing prices that slowed more than expected and a consumer confidence number that was underwhelming relative to expectations. US 30-year mortgage rates topped 7% for the first time since 2001 and mortgage applications continued to slow. On the bright side, new home sales were a slight beat relative to expectations and the third quarter US GDP report showed that growth rebounded into positive territory after two consecutive quarters of contraction. On the central bank front, The Bank of Canada surprised investors with a half-percentage point increase in its policy rate from 3.25% to 3.75%. Investors were expecting the BOC to increase by 75 basis points. The BOC also made comments that indicate that, while it is not done with rate increases, it is getting closer to the end of its hiking cycle. Lastly, the European Central Bank raised its policy rate by 75 basis points to 1.5%, its highest level in more than a decade. ECB President Lagarde said further rate hikes are on the horizon but her tone was cautious given the deteriorating outlook for the Eurozone economy as the region barrels toward a recession. Overall, the news flow continues to paint a mixed picture and there were pieces of data that both hawks and doves could cling to.

It was an active week in the primary market as 13 borrowers priced more than $34bln in new debt through Thursday. There is one deal pending on Friday morning that will push that total further as Honeywell is looking to tap the market for up to $2bln spread across several tranches. Next week will likely bring more muted issuance volumes with the FOMC meeting on Wednesday –market prognosticators are calling for $15-$20bln of issuance weighted toward the front end of the week. 2022 has seen over $1,066bln in new issue volume which trails 2021’s pace by about 13%.

Investment grade funds reported their first inflow in 9 weeks. Per data compiled by Wells Fargo, inflows for the week of October 20–26 were +$1.6bln which brings the year-to-date total to -$146.6bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.