Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $0.5 billion and year to date flows stand at -$28.0 billion. New issuance for the week was $6.0 billion and year to date issuance is at $49.1 billion.

(Bloomberg) High Yield Market Highlights

- The U.S. junk bond market is set to close the week with losses after declining for three straight sessions and yields rose 25 basis points to a three-week high of 6.32%, rising 25bps week-to-date amid broader market volatility.

- “Risk assets sold off this week in light of increased hawkishness from the Federal Reserve,” Brad Rogoff, Barclays’ head of fixed income research, wrote on Friday.

- The primary market priced $6b this week to make it the busiest for new issuance in two months after the slowest first quarter since 2016, with just $43b

- Junk bond investors pulled cash from high yield funds in 11 of the 13 weeks in the first quarter, but are showing signs of demand again

- U.S. high yield funds report a modest inflow of $0.5b for the week, the second consecutive week of inflows

(Bloomberg) Markets Bet on Sharpest Pace of Fed Tightening Since 1994

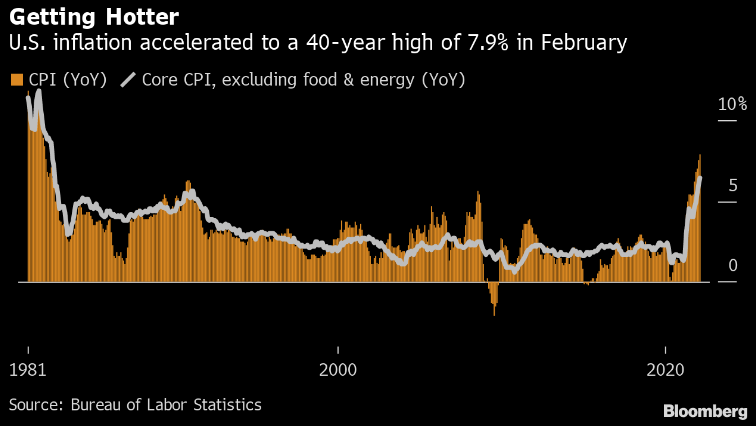

- Money-market traders are betting the Federal Reserve is heading for its most aggressive monetary-policy tightening in almost three decades as it fights a commodity-driven inflation spike.

- They are pricing in a further 225 basis points of interest-rate hikes by the end of the year on top of the 25 basis points delivered in March.

- Minutes of the Fed’s March meeting released Wednesday showed that “many” officials would have preferred to raise rates by a half percentage point but were deterred by Russia’s invasion of Ukraine. Only St. Louis Fed President James Bullard dissented in favor of a half-point hike. The Fed also signaled it will reduce its massive bond holdings at a maximum pace of $95 billion a month, further tightening credit to cool inflation.

- The Fed hasn’t done that much tightening — 250 basis points — in one year since 1994, a famously brutal year for bond investors that even included a 75 basis-point hike. The last year there was more tightening was in the early 1980s, when Paul Volcker was in charge of the central bank. Treasuries have already lost 6.7% this year, heading for the worst annual return since Bloomberg started compiling the data in 1973.

- With U.S. inflation heading for 8%, a rate not seen in 40 years, Fed officials have adopted a decidedly more hawkish tone. The latest move in market bets began Tuesday after Governor Lael Brainard said the central bank will continue tightening monetary policy methodically.

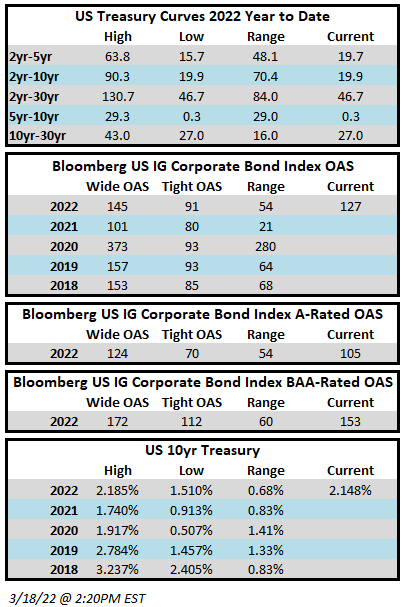

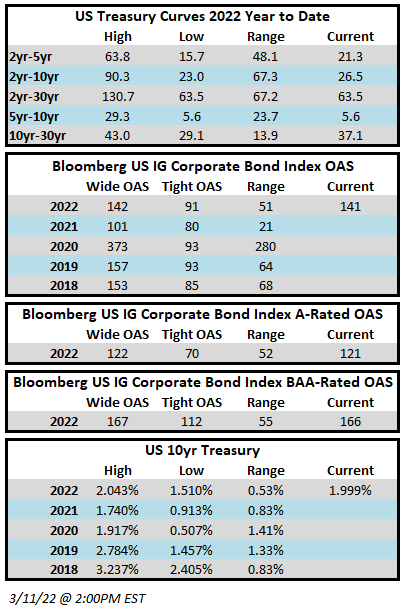

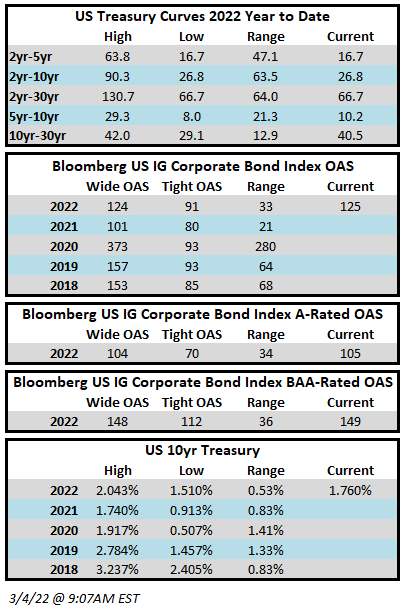

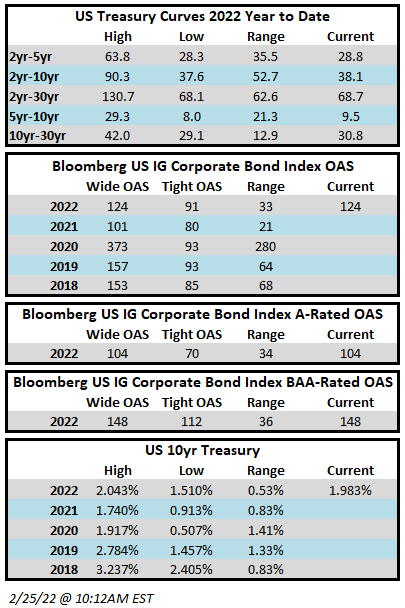

- In a reversal of a recent trend, the yield curve has steepened since Brainard commented Tuesday that the Fed will shrink its balance sheet “considerably more rapidly than in the previous recovery.” The 10-year yields traded 8 basis points higher than two-year notes, after dipping below the shorter-maturity rate last week for the first time since 2019. The curve inversion last week stirred concern that the Fed’s tightening may raise the risk of a recession over time.

- “The implication here is that over time, the balance-sheet reduction will lead to an increase in the term premium, which in turn will put upward pressure on the long end of the curve,” Tim Duy, chief U.S. economist at SGH Macro Advisors, wrote in a note to clients.

- The minutes showed participates agreed that the maximum monthly reduction of its bond holdings, composed of $60 billion in Treasuries and $35 billion in mortgage-backed securities, would “likely be appropriate.”