CAM High Yield Weekly Insights

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$1.3 billion and year to date flows stand at -$27.4 billion. New issuance for the week was $0.5 billion and year to date issuance is at $35.4 billion.

(Bloomberg) High Yield Market Highlights

- U.S. junk bonds are headed toward the biggest weekly loss in 17 months as yields jump to a fresh 20-month high after inflation accelerated and the war on Ukraine intensified.

- Continuing volatility drove investors to pull cash from retail junk-bond funds for the ninth straight week, the longest losing streak since 2007

- U.S. high yield funds reported an outflow of $1.3b for the week

- The escalating war has increased the economic pressure on Russia, with the U.S. now calling for the end of normal trade relations, clearing the way for increased tariffs on Russian imports

- The sanctions are expected to spur inflation even higher and slow economic growth

- Bloomberg economist Anna Wong forecast that U.S. inflation could hit 9% as early as March or April with oil at $120 a barrel, and may end the year close to 7%

- Bloomberg economists have lowered 2022 U.S. GDP growth forecast to 2.5% from 3.6%

- The benchmark U.S. high yield index posts a loss of 1.29% week-to-date after reporting negative returns in three of the last four sessions

- The losses were across the board in the high yield market. BBs were leading the pack with week-to-date losses of 1.34%

- BB yields, the most rate-sensitive in the high yield market, also climbed to a 20- month high of 5.08% amid widespread fears of inflation disrupting growth

- CCCs are poised to post the least losses, with 1.20% week-to-date, while yields rose to a 16-month high of 8.82%

- The junk bond primary market has been quiet as borrowers have stayed away, waiting for some clarity on macro risks

- The primary market has slowed to a crawl

- The issuance volume was about $36b year-to-date, the slowest first quarter since 2009

- As of Friday morning, the markets may recover as U.S. equity futures edged higher amid reports that some progress is being made in talks between Russia and Ukraine

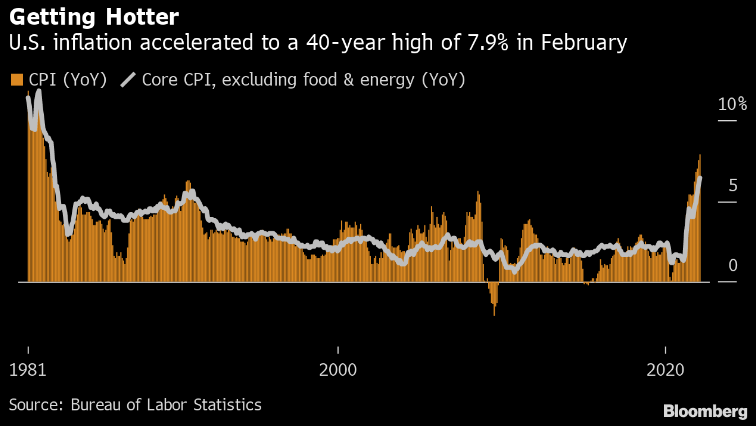

(Bloomberg) U.S. Inflation Hit Fresh 40-Year High of 7.9% Before Oil Spike

- U.S. consumer price gains accelerated in February to a fresh 40-year high, consistent with rapid inflation that’s become even more pronounced following Russia’s invasion of Ukraine.

- The consumer price index jumped 7.9% from a year earlier following a 7.5% annual gain in January, Labor Department data showed Thursday. The widely followed inflation gauge rose 0.8% in February from a month earlier, reflecting higher gasoline, food and shelter costs. Both readings matched the median projections of economists in a Bloomberg survey.

- Excluding volatile food and energy components, so-called core prices increased 0.5% from a month earlier and 6.4% from a year ago.

- The data illustrate the extent to which inflation was tightening its grip on the economy before Russia’s war brought about a spike in commodities, including the highest retail gasoline price on record. Most economists had expected February would be the peak for annual inflation, but the conflict likely means even higher inflation prints in the coming months.

- To combat building price pressures, the Federal Reserve is set to raise interest rates next week for the first time since 2018. At the same time, the geopolitical situation adds uncertainty to the central bank’s rate hiking cycle over the coming year.

- Fed officials could take a more hawkish stance if energy price shocks lead to higher and more persistent inflation, but they also may take a more cautious approach if sinking consumer sentiment and declining real wages begin to weigh on growth as the war drags on.

- The February report showed that gasoline prices rose 6.6% from the prior month and accounted for almost a third of the monthly increase in the CPI. Some of that may reflect energy price spikes resulting from the first days of Russia’s invasion during the last week of the month. The impact will be more fully captured in the March CPI report.

- So far this month, the retail price of a regular-grade gasoline has increased 19.3% to $4.32 a gallon, according to American Automobile Association data.

Food prices climbed 1% from the prior month, the largest advance since April 2020, the CPI report showed. Compared with February last year, the 7.9% jump was the biggest since 1981.