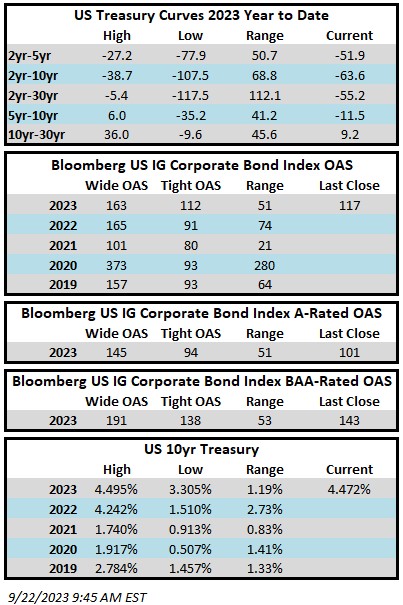

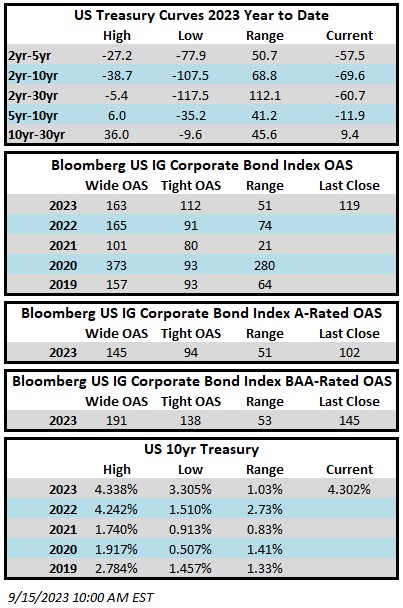

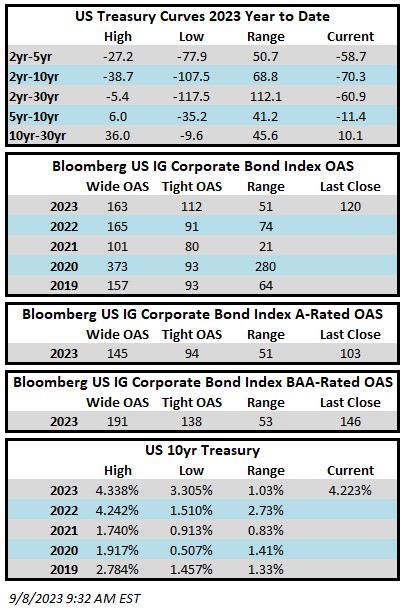

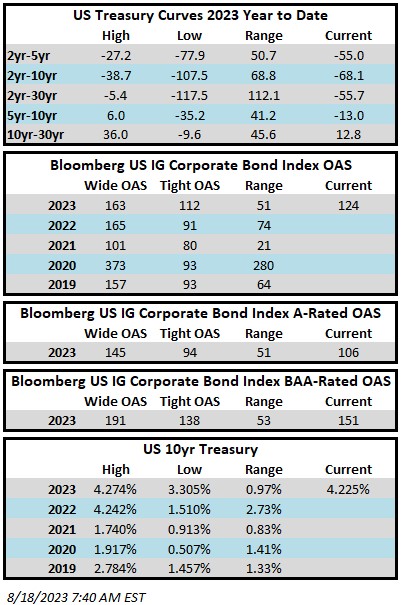

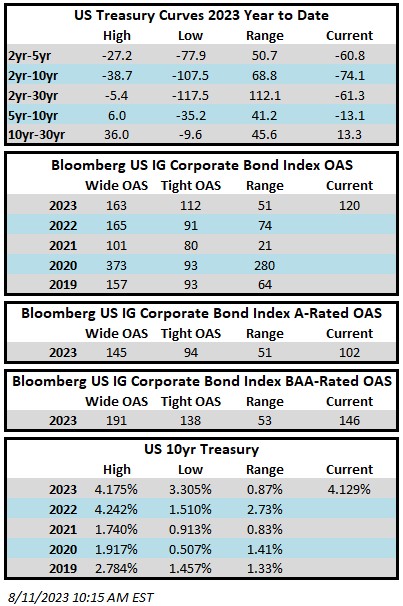

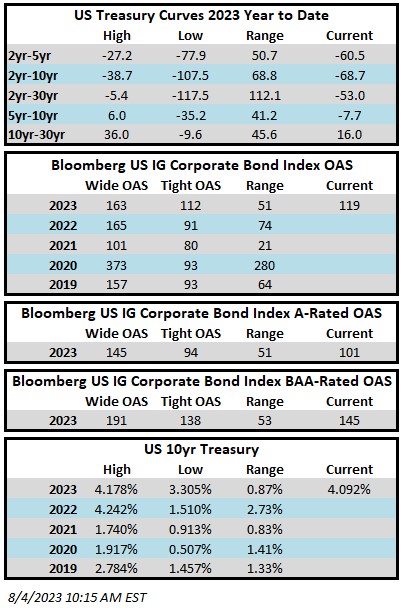

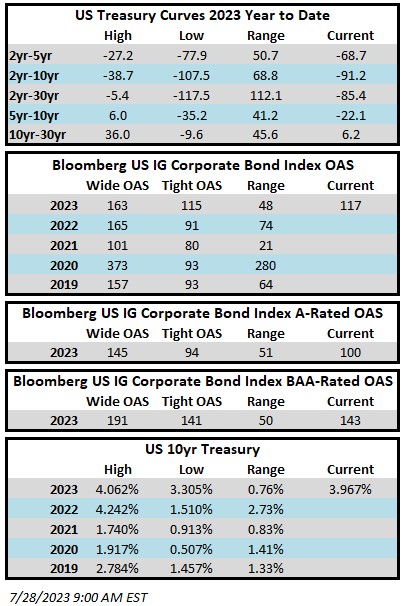

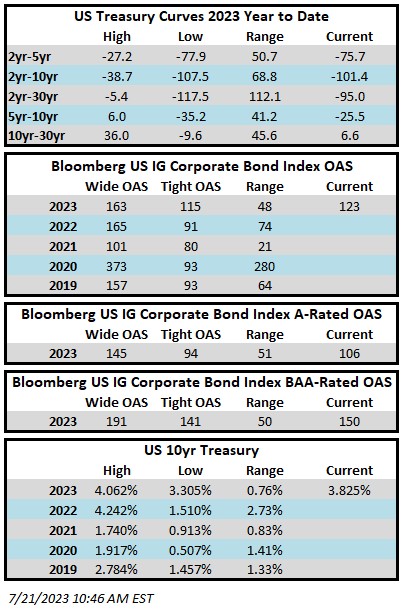

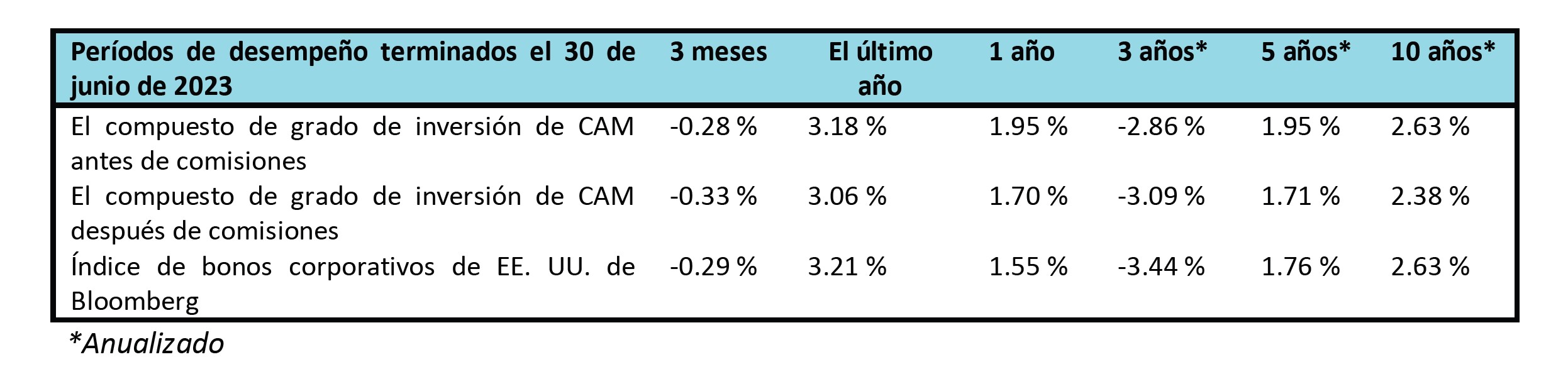

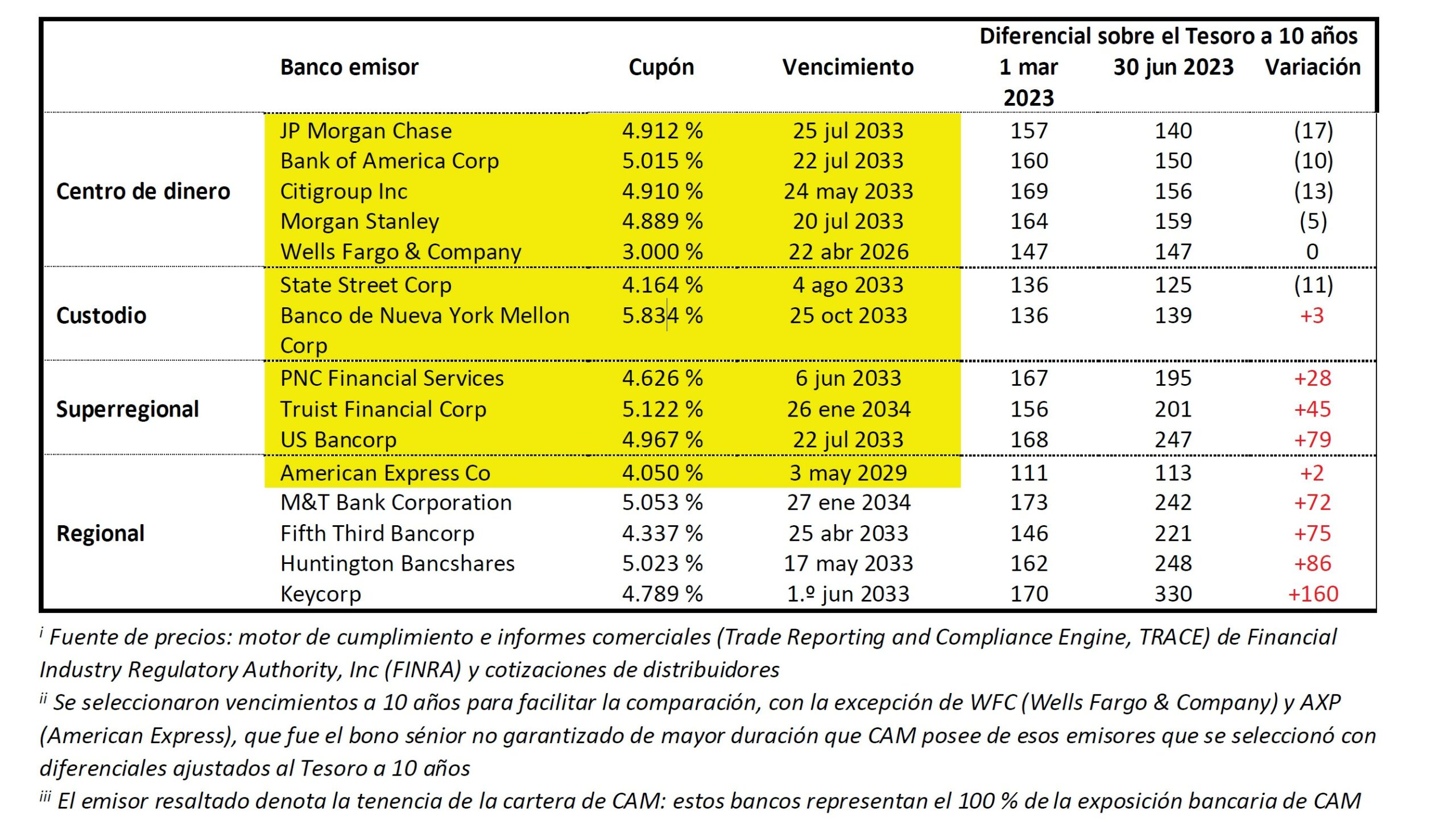

Investment grade credit spreads look likely to finish the week modestly tighter. The Bloomberg US Corporate Bond Index closed at 117 on Thursday September 21 after having closed the week prior at 118. The 10yr is trading a 4.47% as we go to print Friday morning, higher by 14 basis points on the week. Through Thursday, the Corporate Index YTD total return was +0.73%.

Economics

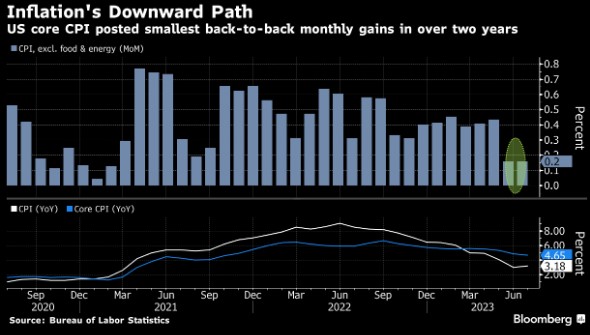

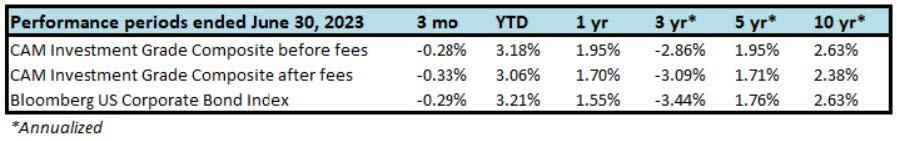

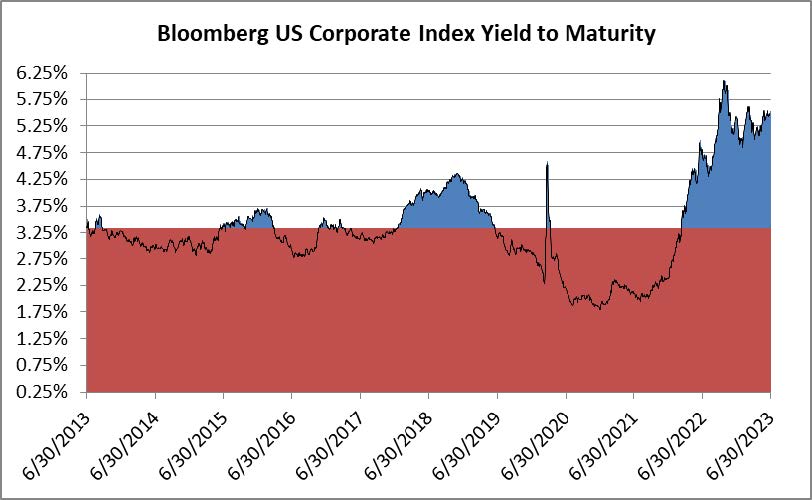

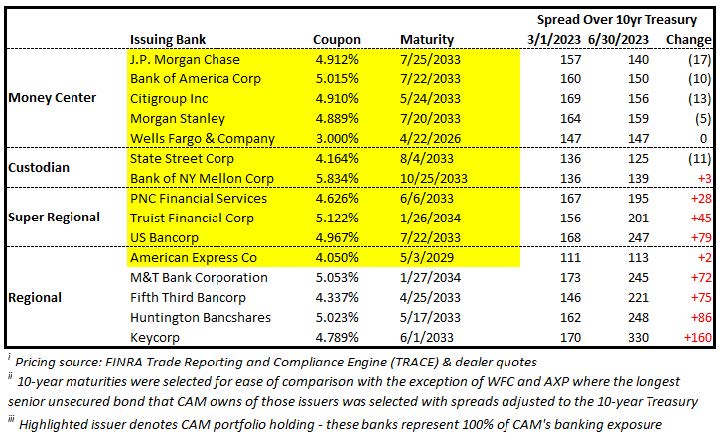

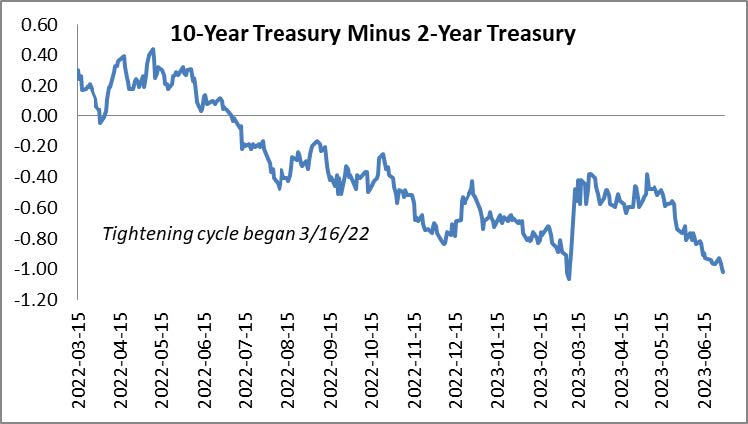

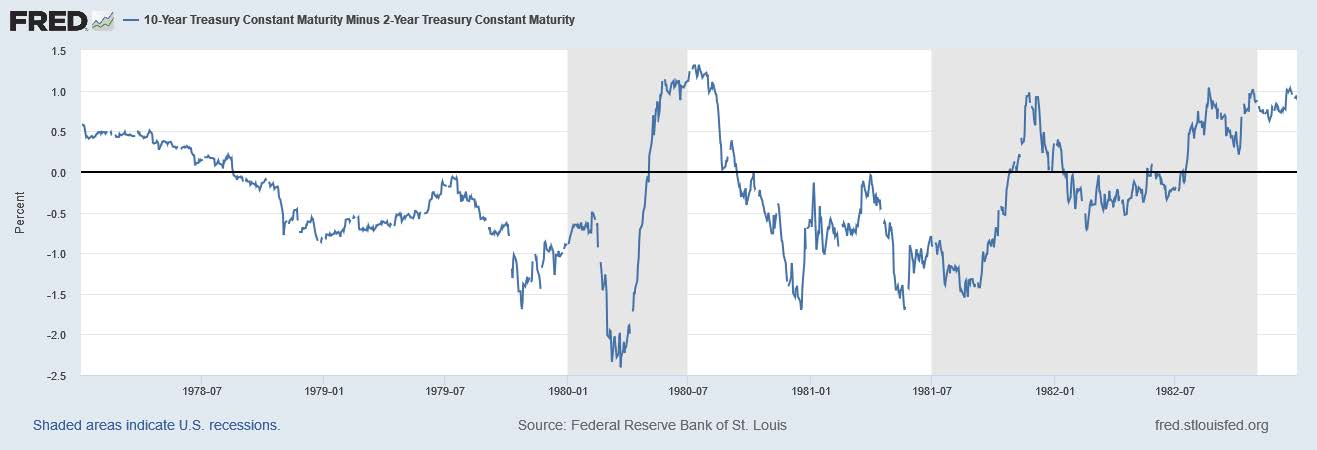

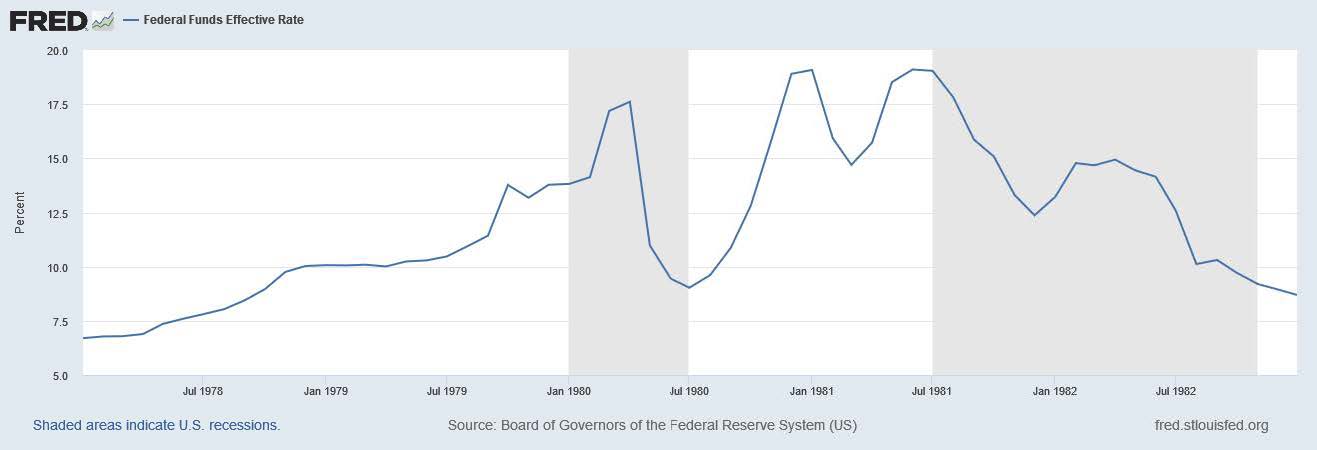

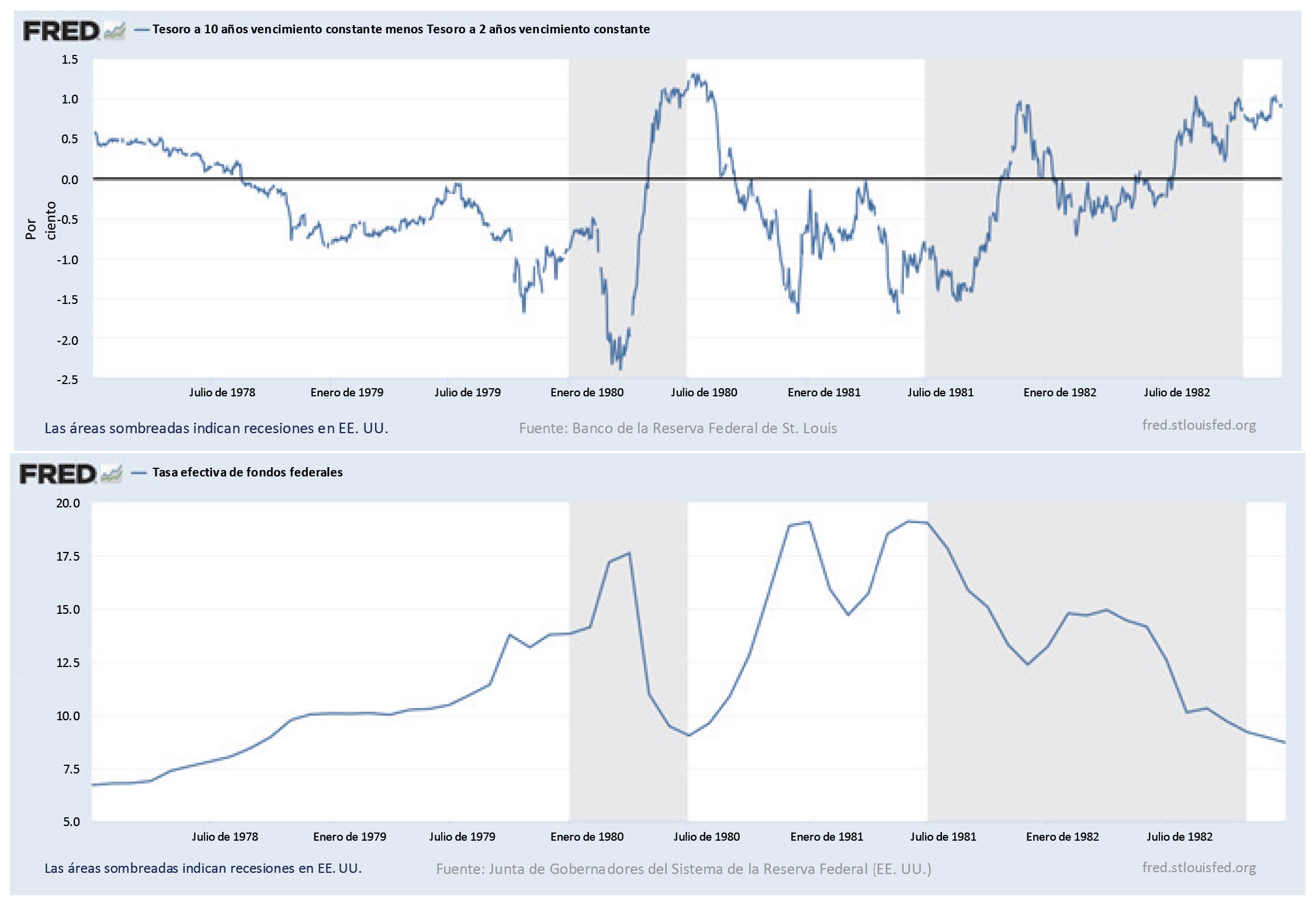

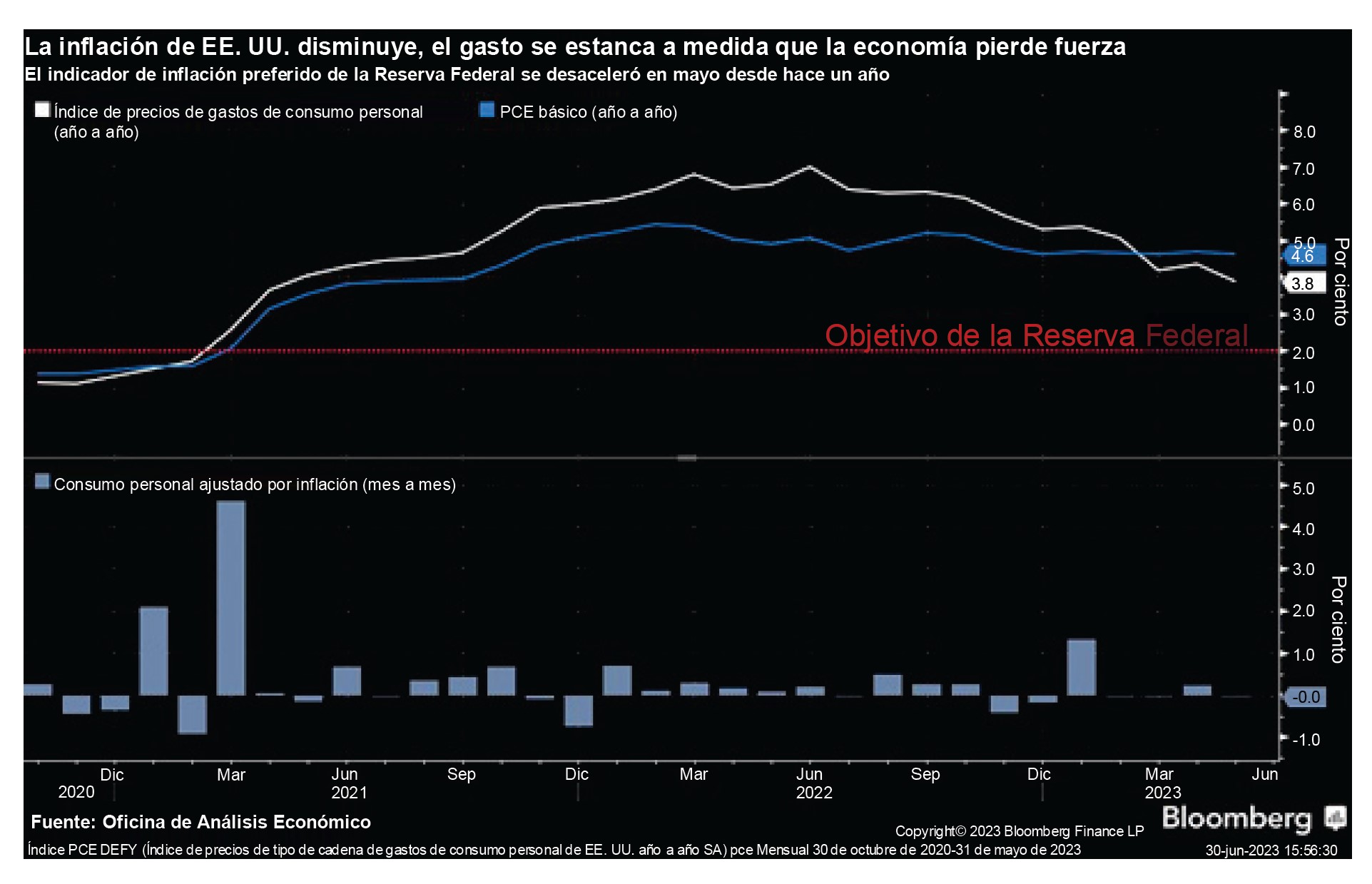

The biggest market moving event on the week was the Federal Reserve rate decision. As expected, The Fed elected not to raise its policy rate, but its hawkish messaging may finally have started to resonate with investors as both stocks and Treasuries sold off after Chair Jerome Powell’s press conference. We believe that a higher for longer rate environment is an opportunity for investment grade credit investors. The Fed could proceed with additional hikes from here but there is wide agreement among investors and the Federal Reserve itself that we are near the end of the current hiking cycle. Even if we make a conservative forecast and assume three additional rate-hikes, the impact simply wouldn’t be that meaningful when the current base rate is 5.5%. The 10yr Treasury closed at its cycle high of 4.49% on Thursday. With a Treasury of nearly 4.5% and a spread on the index of 117 new investors in our Investment Grade program are being compensated with a yield of >5.5% in a portfolio that has an index rating of A3 and a duration of around 7yrs. In other words, an investor is being well compensated without taking a lot of credit risk and without taking a lot of interest rate risk. If rates truly are “higher for longer” and simply trade sideways for a year or two then an investor will be compensated to wait for what comes next. Maybe the next step is a soft landing? In that scenario we could envision interest rates simply trading sideways and credit spreads would likely continue to perform well. Conversely, we could get a hard landing scenario or a scenario where there is a modest recession. In a recession scenario of any severity, the Fed is virtually guaranteed to cut its policy rate so an investor would benefit from lower rates although a recession usually means wider credit spreads –a scenario where total returns can actually be quite good for bonds if rate movement offsets spread movement. The point of these examples is to show that the IG credit investor has a lot of cushion right now in terms of all-in yield. There was a brief opportunity to put money to work in IG last fall with yields >6% and the market traded close to that level again this week. For context, compare that to the average yield to worst on the IG index for the last 10yrs of 3.36%.

Issuance

It was a light week for primary issuance which is not unusual for a Fed-week. Monday saw an active session with 11 companies pricing new debt but then activity fell off a cliff after that trading session. All told, weekly volume finished at $16bln. Next week, forecasts are calling for $15-$20bln of new debt.

Flows

According to Refinitiv Lipper, for the week ended September 20, investment-grade bond funds reported a net inflow of +$2.06bln. This is the largest weekly inflow for IG in since June 22. Flows for the full year are net positive +$25.9bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.