CAM Investment Grade Weekly

08/03/2018

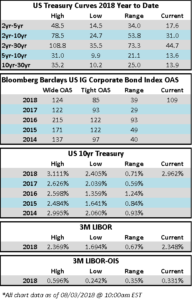

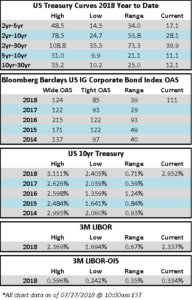

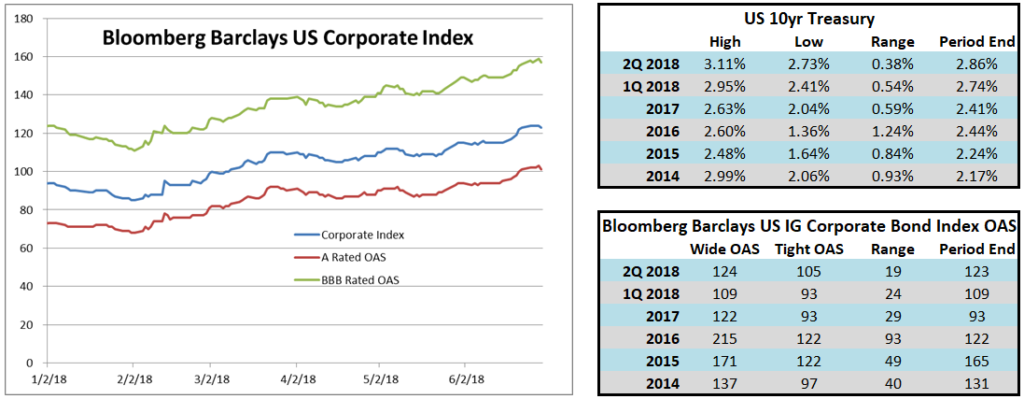

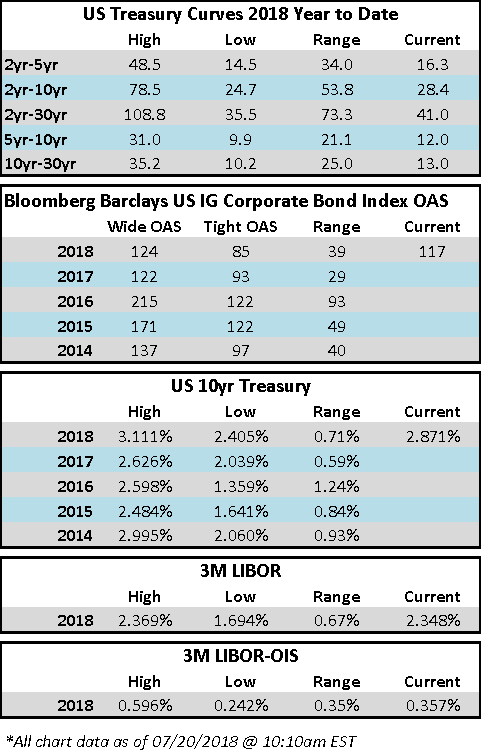

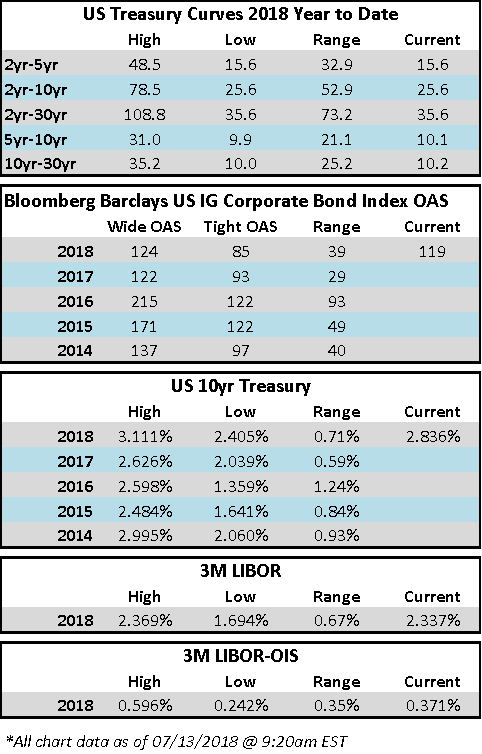

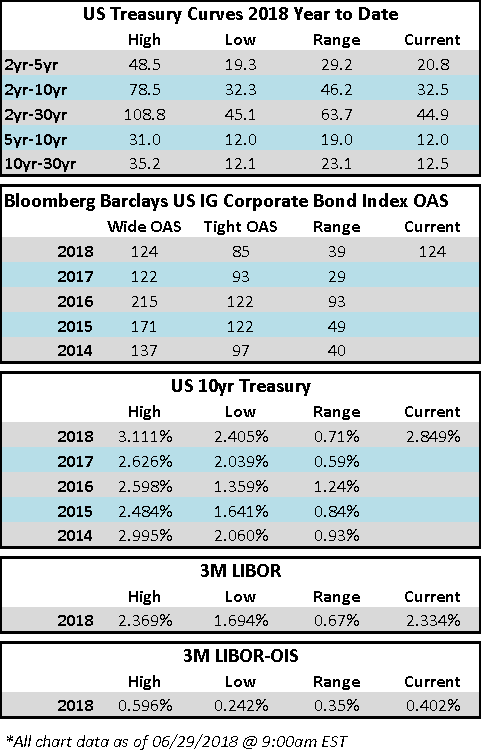

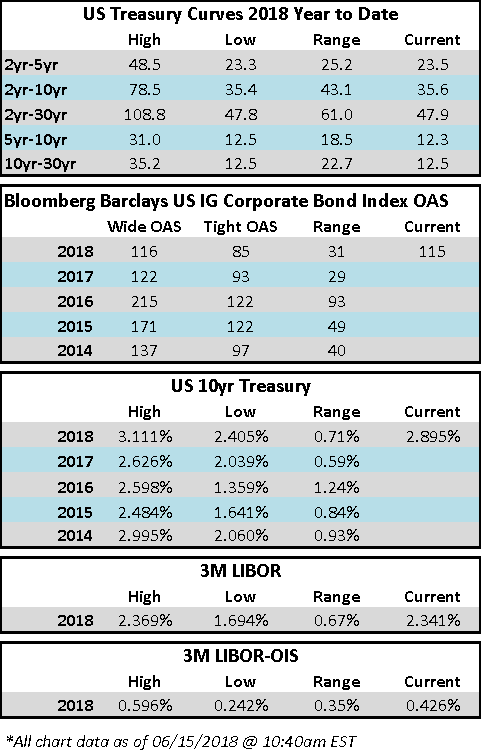

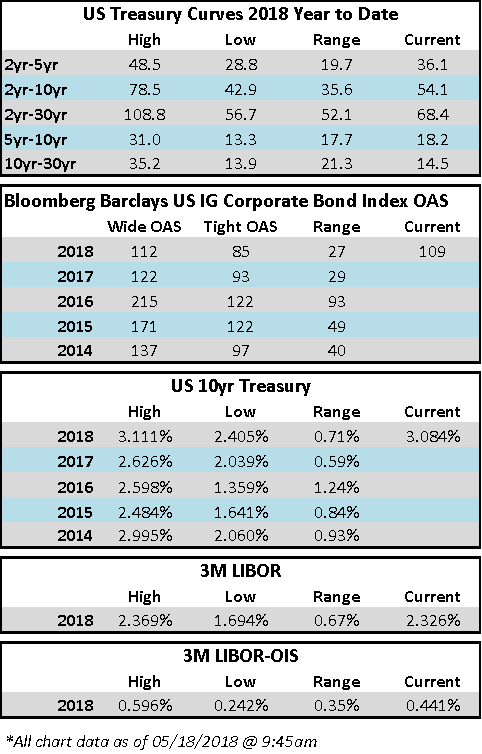

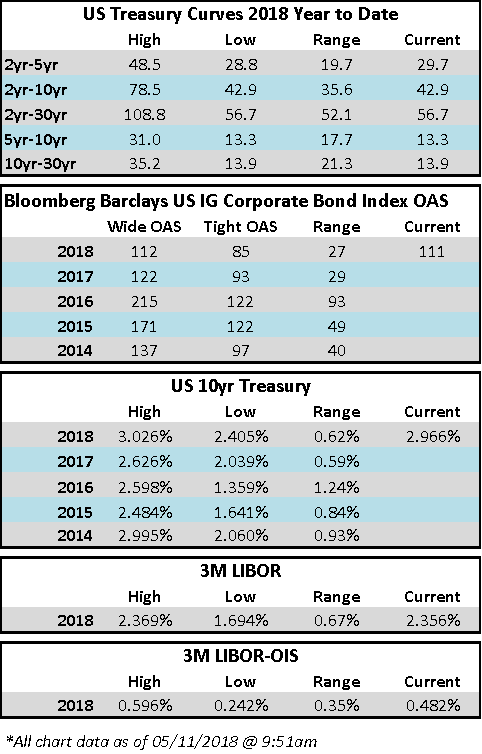

Corporate spreads remained firm this week. The OAS of the corporate index is 1 basis point tighter on the week as we go to print Friday morning.

According to Wells Fargo, IG fund flows for the week of July 26-August 1 were +$2.5 billion. IG flows are now +$79.8 billion YTD.

Per Bloomberg, $7.8 billion of new issuance printed during the week with no deals pending on Friday morning. Bloomberg’s tally of YTD total issuance stands at $699.784bn.

The 10yr Treasury closed above 3% on Wednesday but then retraced several basis points on Thursday. As of Friday morning, 10yrs are unchanged relative to the prior weeks close.

(Bloomberg) Internet Killed the Video Star. Charter Finds the Silver Lining.

- Charter Communications Inc. offered up more evidence Tuesday that cable companies may yet be able to weather the fallout from the dreaded cord-cutter.

- Charter reported second-quarter growth in internet subscribers and sales that beat analysts’ expectations. While the U.S.’s second-largest cable company lost 73,000 video subscribers, it was less than expected and the addition of 218,000 new internet customers helped soften the blow. That sent shares up as much as 7.1 percent Tuesday.

- As cable-TV subscribers disappear in droves, Charter and bigger rival Comcast Corp. are increasingly focusing on growing their internet businesses, selling faster speeds as well as wireless service. Last week, Comcast said it added 260,000 broadband subscribers — its best second quarter in a decade.

- For cable companies, selling TV service comes with several costs built in, including payouts to channel owners for the rights to carry their networks in a package. Selling high-speed internet, on the other hand, has less overhead after the costs associated with building the network.

- In the quarter, Charter’s video losses came entirely from basic-cable customers, who bring in less revenue than fatter bundles with more channels.

(Bloomberg) High-Grade Landscape Improves as July Volume Falls to 5-Year Low

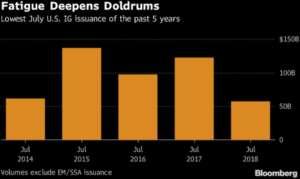

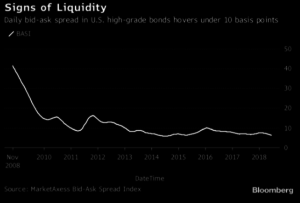

- The slowest July by primary volume in the last half-decade helped buoy a high-grade credit market that was sorely in need of a pick-me-up. While volume was a a statistical blip, the broader impact on the market was wide reaching.

- A combination of new issue fatigue, issuers entering self-imposed earnings blackout periods and cyclical summer slowdown translated into disappointing July volume for non-EM, non-SSA, IG totaling just $57.48b vs $122.48b in 2017, a decrease of 53% YoY

-

- However, stronger technicals, shrinking dealer balance sheets and positive earnings announcements re-established a robust investment-grade credit market

- For issuers who proceeded with funding plans, primary metrics illustrate the strengthening backdrop

- Borrowers paid a meager 2.3bps to bring new deals this month vs the ~5bps new issue concession observed this year

- Spread compression from IPT to pricing averaged 15.7bps vs 14bps YTD.

- Orderbook oversubscription rates came in at 2.9 times deal size in-line with the 2.8 YTD average

- Execution metrics were even stronger during the last two weeks of July

- Average NICs were flat, orderbooks 3.9 times covered and deal spreads tightened 18bps across execution

- In the end, funding conditions in July improved to levels not seen since early February when credit spreads, at the tightest level in over a decade, coincided with an ultra-low Treasury yield environment. The reanimation was a lifeline to a struggling credit market that had started the month with spreads widening to YTD highs and issuance costs rising to double-digit concessions on a deluge of supply in late June

(Bloomberg) Credit-Card Backlash Mounts as Kroger Weighs Expanding Visa Ban

- Kroger Co. is considering expanding a ban on Visa Inc. credit cards imposed by one of its subsidiaries, in the latest signal that retailers are preparing a fresh battle over the $90 billion they pay in swipe fees every year.

- Shares of payment companies including Visa, American Express Co. andMastercard Inc. dropped on Monday. Merchants have long looked for ways to cut such charges, including by lobbying lawmakers for lower rates and through technology upgrades that avoid traditional card payments entirely.

- The largest U.S. supermarket chain, Kroger said its Foods Co. Supermarkets unit in California will stop accepting Visa cards at 21 stores and five fuel centers next month. Kroger spokesman Chris Hjelm said in an interview that the parent company might follow the lead.

- “It’s pretty clear we need to move down this path, and if we have to expand that beyond Foods Co., we’re prepared to take that step,” Hjelm said. When the amount retailers pay in card fees “gets out of alignment, as we believe it is now, we don’t believe we have a choice but to use whatever mechanism possible to get it back in alignment.”

- Kroger’s announcement followed Walmart Inc.’s decision last week to abandon Synchrony Financial after the two couldn’t agree to economic terms. And Amazon.com Inc.’s foray into financial services has also been seen as a way the retailer could save $250 million.