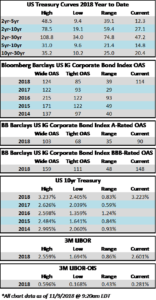

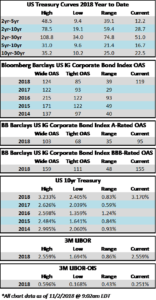

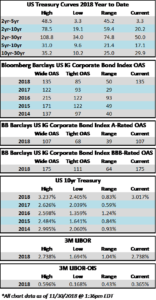

Credit markets are struggling to find footing, as the Bloomberg Barclays Corporate Bond Index opened Friday at an OAS of 135 which is the widest level of 2018. Investment grade credit has drifted wider since November 8, when the index closed at an OAS of 113. The move wider in credit over that timeframe has almost entirely been offset by rates, at least for the intermediate portion of the curve, as the 10yr Treasury has moved from 3.23% to 3.01%. Note that the front end of the yield curve has flattened substantially during the month of November and the spread between the 2yr and 5yr Treasury is down to a mere 3.3 basis points as we go to print. The investment grade corporate bond market currently has little appetite for idiosyncratic risk and we are seeing that reflected in the spreads of bonds for companies under duress, like General Electric, which continues to trade wider, seemingly day after day. BBB credit too has underperformed relative to single-A credit. Since November 8, the Corporate Index is 22 wider, while the BBB-rated portion of the index is 28 wider. The A-rated portion of the index has outperformed over that time period, having moved 17 wider.

According to Wells Fargo, IG fund flows during the week of November 22-November 28 were -$3.2 billion, which was the second largest outflow YTD. Per Wells data, YTD fund flows are +$82.148bln.

The IG primary market was fairly active this week and the primary market remains open to issuers of all stripes even in the face of widening spreads. According to Bloomberg, new corporate issuance on the week was $30.325bln while issuance for the month of November topped $84bln. YTD corporate issuance has been $1.066 trillion.

(WSJ) Bond Indexes Bend Under Weight of Treasury Debt

- The surge in U.S. government borrowing is beginning to warp bond indexes, posing a challenge for investors looking for the best returns when interest rates are rising.

- The problem: Treasurys tend to offer investors lower yields and produce weaker returns than other kinds of bonds, such as high-quality company debt or securities backed by mortgage payments. Yet as the government steps up borrowing to fund last year’s tax cuts, index funds end up holding more Treasurys, squeezing out the securities that pay higher rates of interest.

- The U.S. government is borrowing $129 billion this week, up 28% from the same series of note auctions a year ago. The increased borrowing means Treasurys now amount to almost 40% of the value in the leading bond market investment benchmark—the Bloomberg Barclays U.S. aggregate index—which fund managers use to gauge their success. That is up from around 20% in 2006, before the start of the financial crisis.

- Some analysts said investors should consider the growing weight of Treasurys in indexes before purchasing mutual funds. Actively managed bond funds have performed better than their index-tracking peers recently, a trend some analysts credit to their efforts to pare back Treasury holdings. Rising rates erode the value of outstanding bonds, because newly issued debt offers higher payouts. And Federal Reserve officials have penciled in additional increases into 2020.

- “The value from active management is going to be more important,” said Kathleen Gaffney, director of diversified fixed income at Eaton Vance , who bought dollar-denominated corporate bonds in emerging markets because U.S. corporate yields remain low by historic measures. “You’re not going to want market risk.”

- Through the first six months of this year, active managers topped indexes in five of 14 categories including municipal bonds and short- and intermediate taxable bonds, according to data from S&P Dow Jones Indices. That is coming off a 2017 in which actively managed funds had their best year since 2012, when active managers beat passive funds in nine of 13 categories the firm then measured.

- Should yields continue to rise, advocates of active portfolio management say investors would be better served by a human being shielding them from the parts of the bond market most likely to suffer losses versus an index which includes all bonds, without regard to their potential risks. “Most of the stuff I own’s probably not in the agg,” said Jerry Paul, who has recently purchased preferred stocks for his ICON Flexible Bond Fund, which has returned 0.3% this year, beating the Bloomberg Barclays index.

- Many expect to persist. The Treasury Department projected to run trillion-dollar deficits for the foreseeable future. As issuance increases, funds that use the Bloomberg Barclays aggregate index as a guidepost for portfolio composition will wind up owning increasingly large amounts of Treasury debt. Independent bond analyst David Ader predicts Treasurys will make up half of the U.S. bond market and the indexes that track it by 2028.

- Still, because many individuals invest in bond funds to protect against losses in their stock portfolios, there are advantages to indexes that reflect the constituency of bond market borrowers instead of optimizing returns, said Josh Barrickman, who manages Vanguard Group’s bond index fund. While corporate bonds, for example, offer higher yields than Treasurys, U.S. government debt tends to post high returns during periods when investors shun risk, he said.

- The changing composition of bond market indexes can exert a powerful force over what resides within their bond mutual funds without their becoming aware of it, according to fund managers and analysts. Treasury Department data shows that the category of investors that represents mutual funds bought about one half of the $2 trillion of U.S. government notes and bonds sold at auction last year. That is up from about one-fifth of the $2.2 trillion sold in 2010.

- As the supply of Treasury debt rises, the government will have to spend more to pay interest. Some investors say the rising supply of bonds has also helped push yields higher, which can pressure stocks by offering investors a way to get more yield with less risk.

- “It’s going to reflect itself as a drag on the economy and on potential equity market returns,” said Craig Bishop, a bond strategist with RBC Wealth Management.

- Should slowing growth lead business conditions to worsen, corporations have the option of borrowing less. Not so the U.S. government. Because legally mandated spending on unemployment insurance and other safety net programs tends to rise when growth slows, wider budget deficits and more Treasury debt could ensue. That means many bond investors could face conditions where there is no alternative to holding a rising share of government debt.

(Bloomberg) Salesforce Soars as Management Mutes Market Skepticism

- Salesforce.com Inc. rose as much as 9.5 percent Wednesday, the most since February 2016, after third-quarter sales and a top-line beat report muted some of Wall Street’s concerns about the broader demand environment. Several analysts raised their price target on the stock, including Alliance Bernstein, who believes the report should help lift software stocks. Meanwhile, Raymond James cut their bullish target as Salesforce.com shares “aren’t immune from broader macro trends.”

(Bloomberg) Ford Digs Further Out of Trump’s Doghouse as GM Takes Its Turn

- Ford Motor Co. and General Motors Co. both need to overhaul their U.S. manufacturing base to cope with consumers’ drastic switch to SUVs from sedans. Only one is poised to make that adjustment without ticking off the president.

- In a significant rework of its U.S. production plans, Ford will eliminate shifts at factories in Trump country. But it plans to retain all the 1,150 workers affected by shifting their jobs to Michigan and Kentucky plants making big SUVs or supplying transmissions to pickups. That’s fortunate not only for employees, but for Ford’s relations with a touchy White House.

- GM, on the other hand, is caught with way too much capacity to make out-of-vogue sedans, so it has little choice but to go the more painful route of shuttering factories and firing workers. Inevitable or not, the decision has infuriated Donald Trump. He’s renewed a threat to slap auto imports with 25 percent tariffs and enlisted federal agencies to look for ways to cut the carmaker’s subsidies.

- “Ford has been in Trump’s cross-hairs before, and this should help keep them out,” said Michelle Krebs, a senior analyst with researcher Autotrader. Ford “had their time in the barrel” in 2016, when Trump lambasted its plans to move small-car production to Mexico. The company abandoned that strategy last year and canceled a new car factory it was building there.