CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

11/02/2018

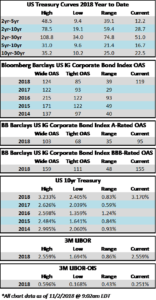

It was another week of volatility in risk assets, but the tone improved throughout, and was cemented by an above-consensus monthly employment report on Friday morning. Credit spreads are at 3-month wides as the Bloomberg Barclays Corporate Index sits at an OAS of 119. As we go to print, positive economic data has sent the 10yr Treasury to its highest level of the week, at 3.17%.

According to Wells Fargo, IG fund flows during the week of October 25-October 31 were a mere $192 million. Per Wells data, this extended MTD outflows to -$7.4bln and marks the first monthly outflow for IG credit funds since January of 2016. Even still, IG fund flows remain firmly positive YTD at +$96.150bln, with short duration funds garnering the lion share of those flows.

According to Bloomberg, new corporate issuance on the week was $17.55bln. YTD corporate issuance has been $989.109bln.

(Bloomberg) General Electric Cut by Moody’s on Weakness in Power Unit

- General Electric’s long-term and senior unsecured rating was cut to Baa1 from A2 by Moody’s as the rating agency cites “the adverse impact on GE’s cash flows from the deteriorating performance of the Power business.”

- Impact from power business will be considerable and could last some time

- Weaker than expected performance of power business also due to co.’s “misjudgment of financial prospects and operational missteps”

- Outlook stable predicated on Moody’s view that co. will be able to contend with the challenges posed by its power business

(Bloomberg) California Utilities to Reach 50% Renewable Power Target in 2020

- Three large utilities in California are ahead of schedule to hit their targets under a law requiring them to source 33 percent of their electricity from renewables by 2020, according to a California Public Utilities Commission report.

- All three investor-owned utilities beat the state-mandated target of 27 percent for 2017

- PG&E: 33%

- Edison: 32%

- Sempra: 44%

- Renewable power contract prices, which peaked at more than $160/MWh in 2007, fell in 2017 to an average of $47/MWh, the report found

- All three investor-owned utilities beat the state-mandated target of 27 percent for 2017

- NOTE: Utilities are required by California law to derive 60 percent of their electricity from renewable sources by 2030

(Bloomberg) Exxon, Chevron Surprise Wall Street as Permian Boosts Results

- Exxon Mobil Corp. and Chevron Corp. delivered their strongest third-quarter results in four years, capping a week in which Big Oil enjoyed profits not seen since the days of $100 crude.

- Exxon shares climbed as the American supermajor appeared to emerge from years of production setbacks after failed bets on Russia and Canada that undercut its previously gold-plated reputation among investors. Chevron’s stock also pushed higher.

- Exxon’s oil and natural gas output surpassed expectations for the first time in 10 quarters, rebounding from a decade-low reached in the second quarter. Earnings climbed 57 percent. At rival Chevron, record production combined with higher crude prices to double profit to $4 billion. Both companies cited growth in the Permian Basin of West Texas and New Mexico as key.