Resumen y perspectivas del segundo trimestre

de julio de 2025

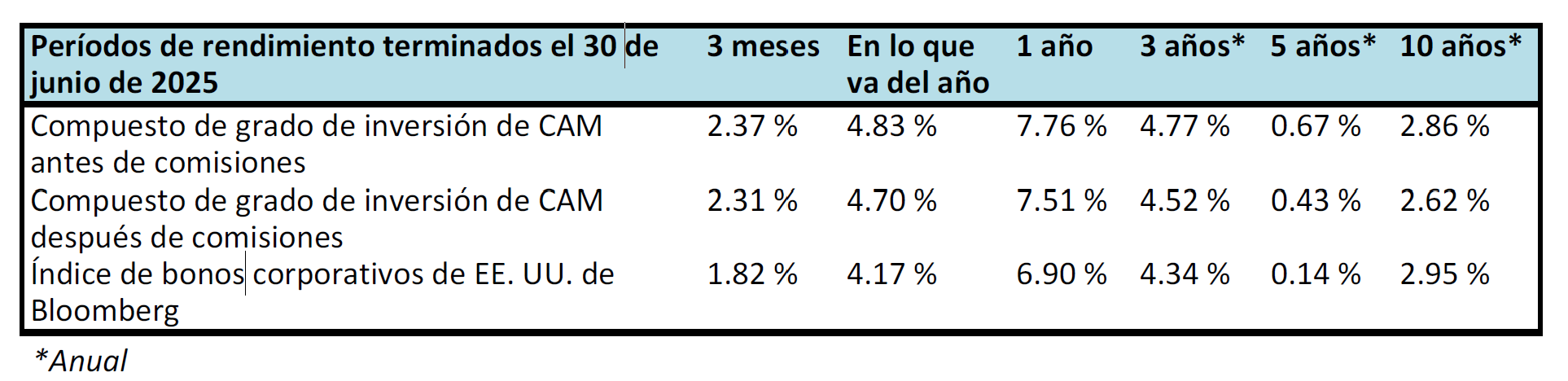

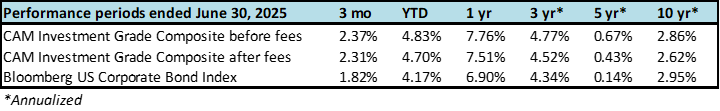

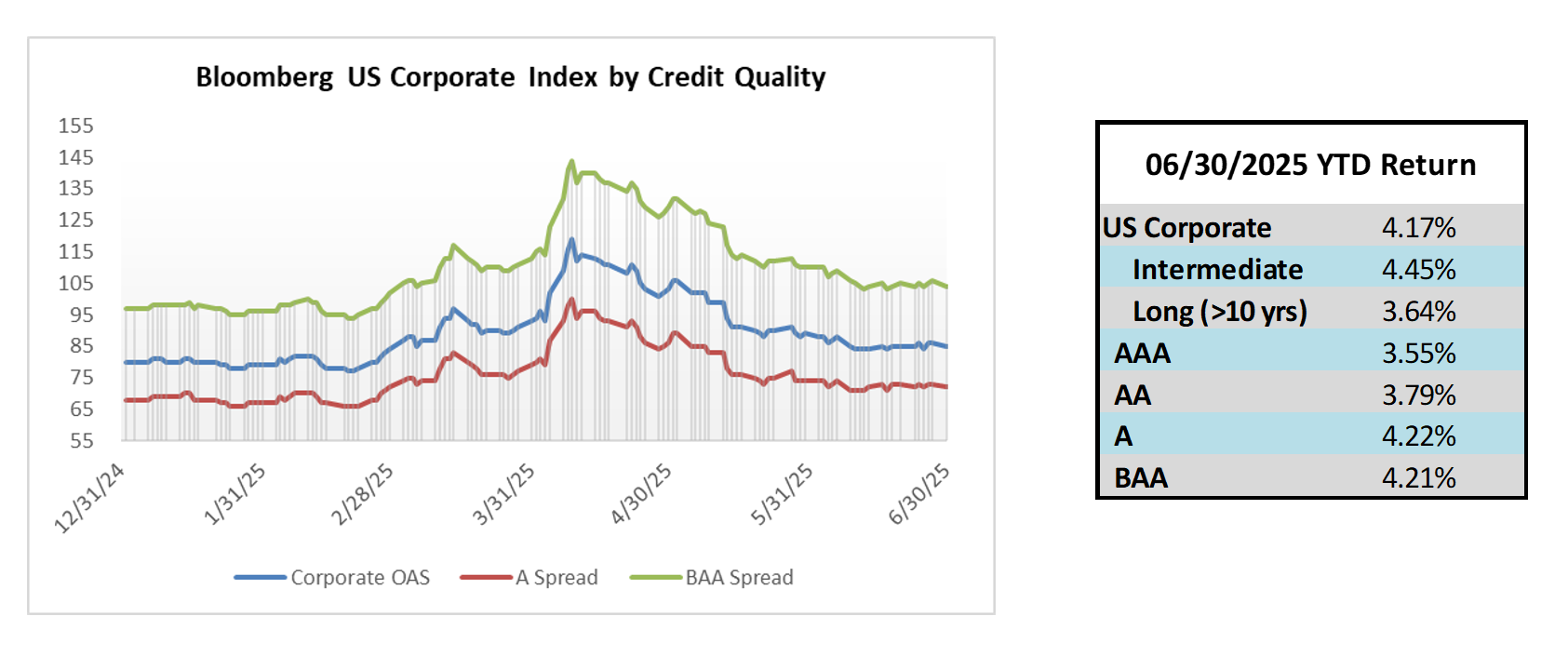

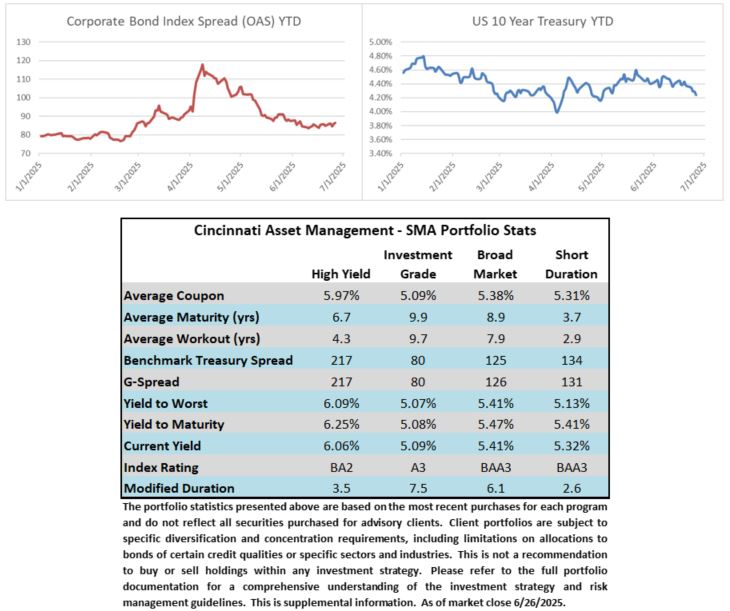

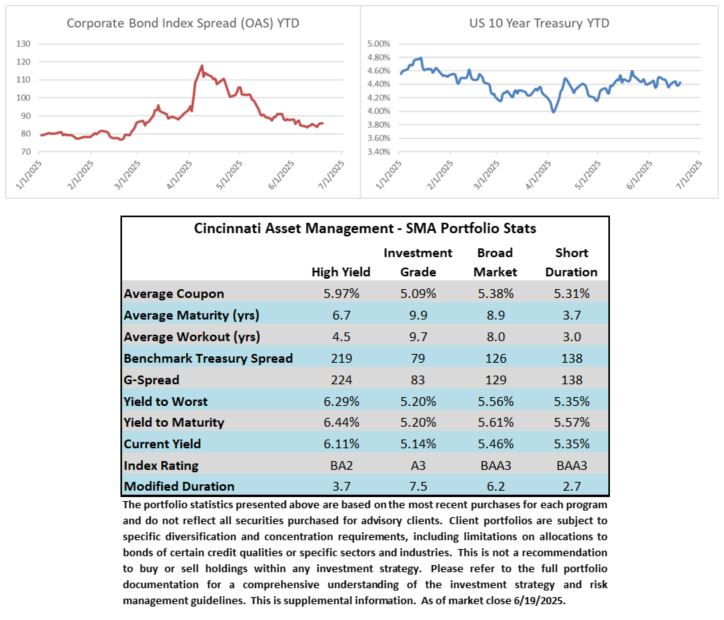

El crédito con grado de inversión tuvo otro sólido trimestre de rendimiento durante el segundo período. Los diferenciales de crédito fueron volátiles durante abril antes de ajustarse aún más en mayo y durante todo junio.

Resumen del segundo trimestre

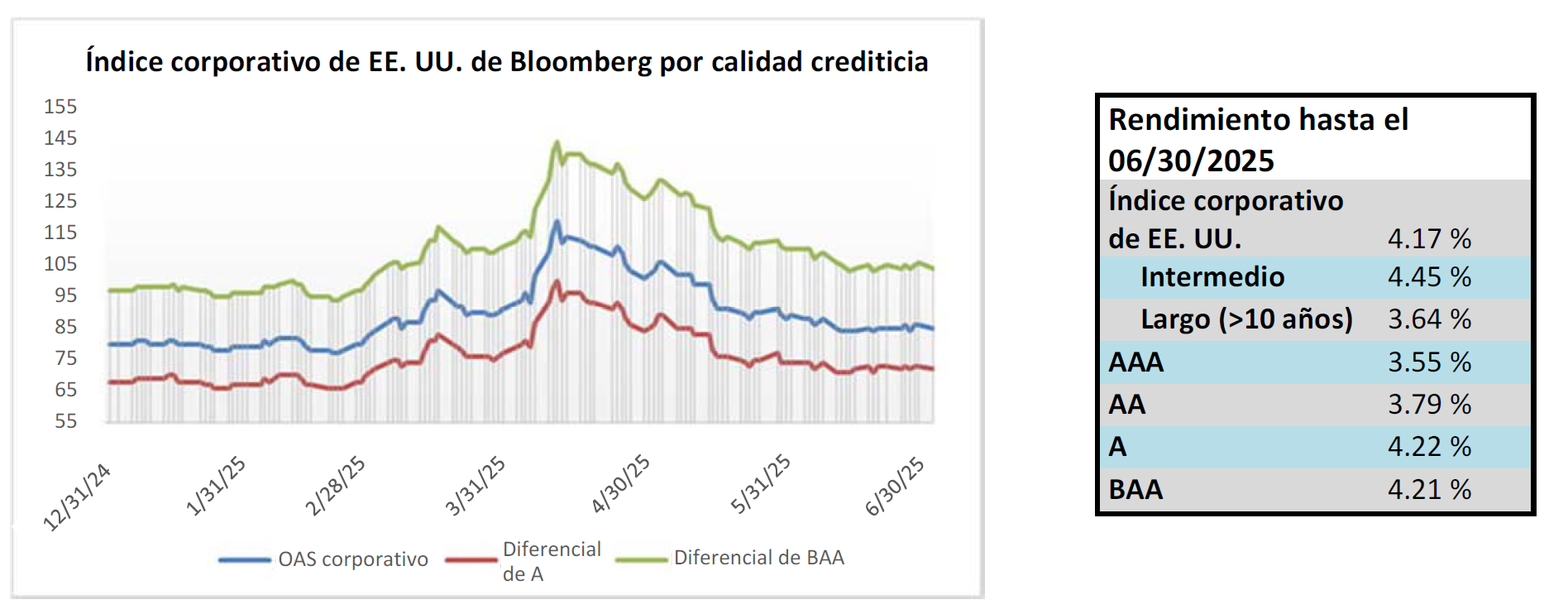

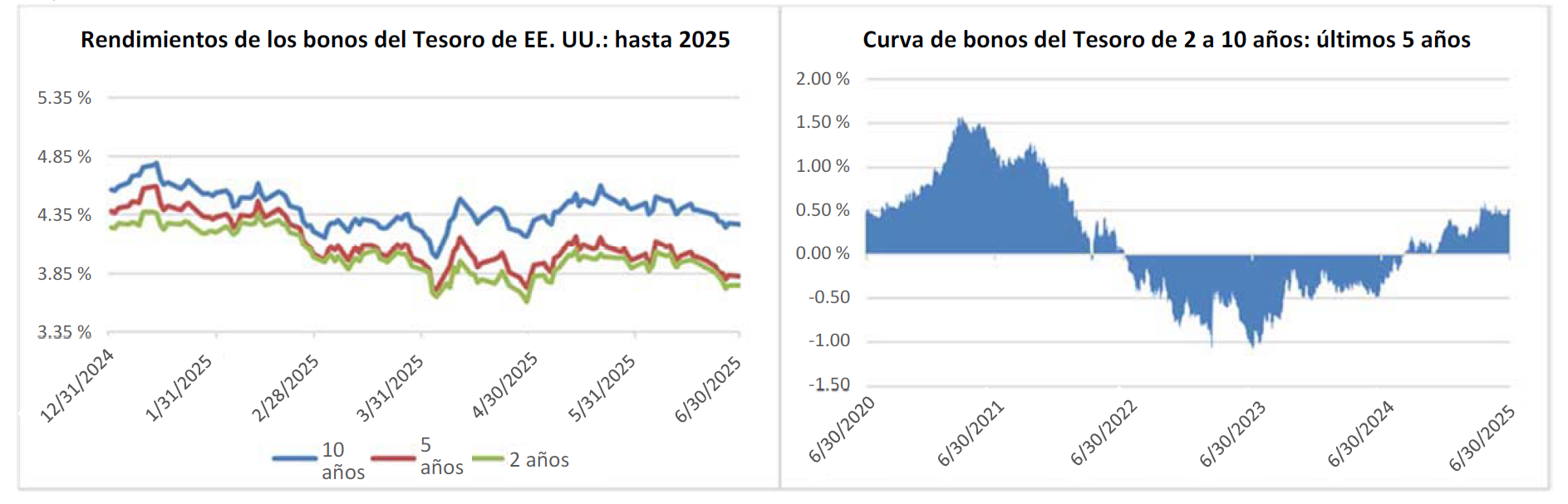

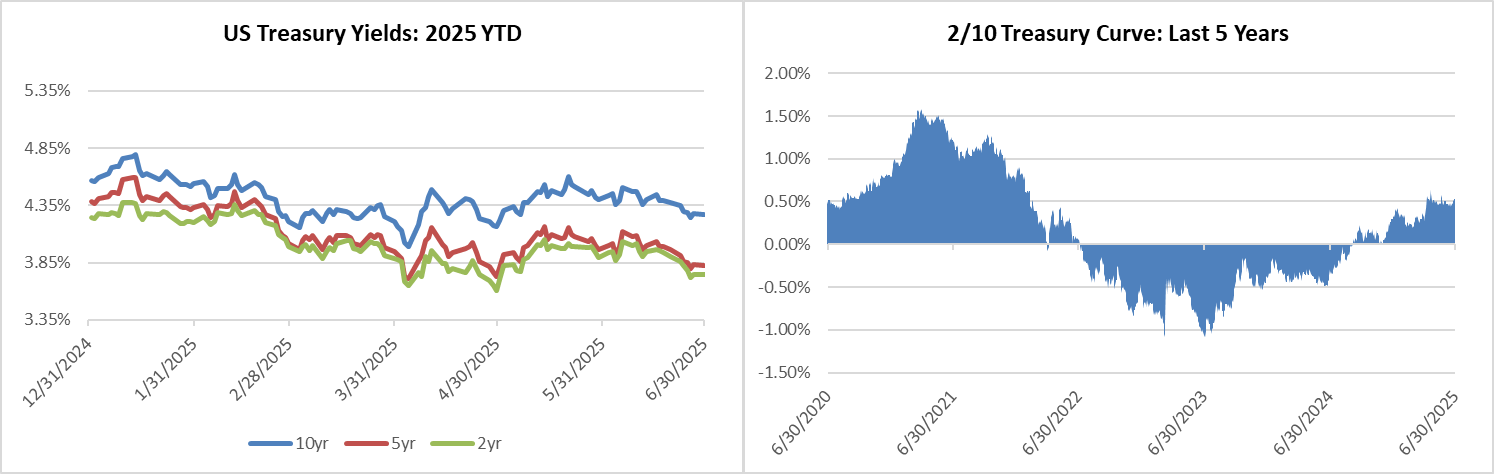

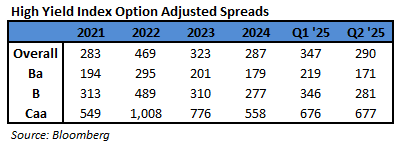

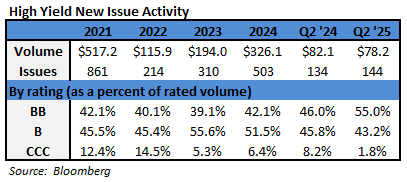

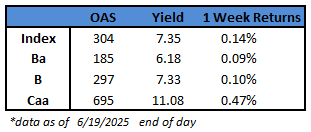

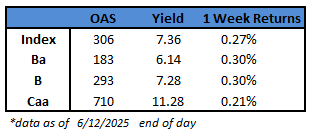

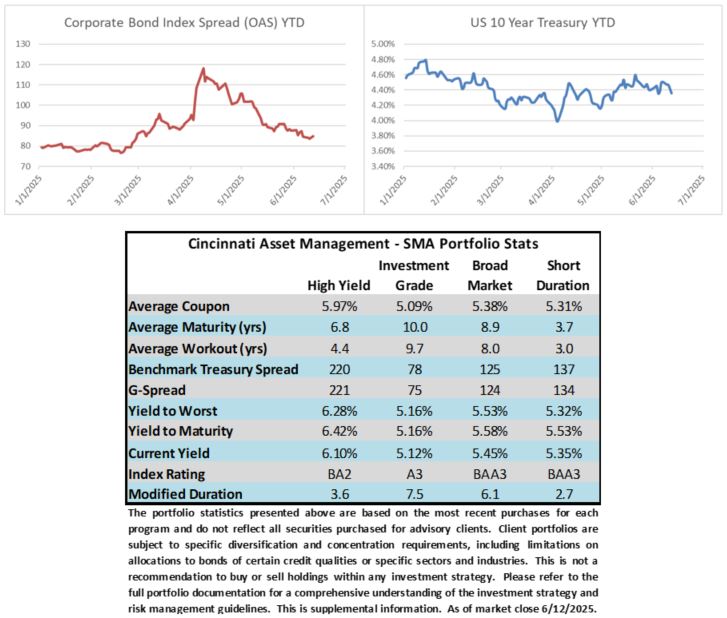

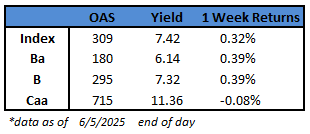

El segundo trimestre fue agitado para los activos de riesgo, ya que el anuncio arancelario del “Día de la Liberación” tuvo lugar al comienzo del período, el 2 de abril. El paquete arancelario entró en vigor solo unos días después, antes de que se anunciara una pausa de 90 días el 9 de abril, con una excepción para China. Las acciones globales se desplomaron y los diferenciales de crédito se ampliaron antes de que ambos se recuperaran gradualmente hacia el final del trimestre. Durante el segundo trimestre, el diferencial ajustado por opciones (OAS) del índice de bonos corporativos de EE. UU. de Bloomberg se redujo en 11 puntos básicos, situándose en 83 después de comenzar el trimestre con un diferencial de 94. El diferencial del índice llegó a ampliarse hasta 119 a principios de abril, pero el crédito con grado de inversión (IG) mostró un comportamiento mucho más estable que la mayoría de las demás clases de activos en términos de volatilidad. Sorprendentemente, incluso con el estancamiento económico derivado de la política comercial de EE. UU., los bonos con calificación BAA superaron levemente el rendimiento de los bonos de mayor calidad con calificación AAA y AA durante los primeros seis meses del año. Los vencimientos intermedios superaron significativamente a los vencimientos de mayor duración en dicho período. Los rendimientos de los bonos del Tesoro a corto plazo disminuyeron a lo largo del año, pero el rendimiento del bono a 30 años se mantuvo elevado.

En lo que va del año hasta el cierre del trimestre, los rendimientos de los bonos del Tesoro a 2, 5 y 10 años habían disminuido en 52, 58 y 34 puntos básicos, respectivamente. Mientras tanto, el rendimiento del bono a 30 años superó el 5 % en varias ocasiones a fines de mayo, antes de retroceder en junio y cerrar el mes en 4.77 %. Hasta el final del segundo trimestre, el rendimiento del bono a 30 años se encontraba a menos de un punto básico de donde comenzó en 2025. Una posible explicación de por qué los rendimientos intermedios han disminuido mientras que el de 30 años se mantuvo estancado es que el mercado de bonos del Tesoro a largo plazo está influenciado en mayor medida por las perspectivas de política fiscal y monetaria, así como por las expectativas de inflación.

Con los diferenciales de crédito dentro de los promedios históricos, los ingresos por cupones siguieron siendo un impulsor importante de los rendimientos de los inversores durante los primeros seis meses del año. Hasta el 30 de junio, el ingreso por cupones representó un 2.32 % del rendimiento total del índice corporativo en lo que va del año, mientras que la apreciación de precios representó un 1.81 % y otros factores contribuyeron con un 0.04 %.

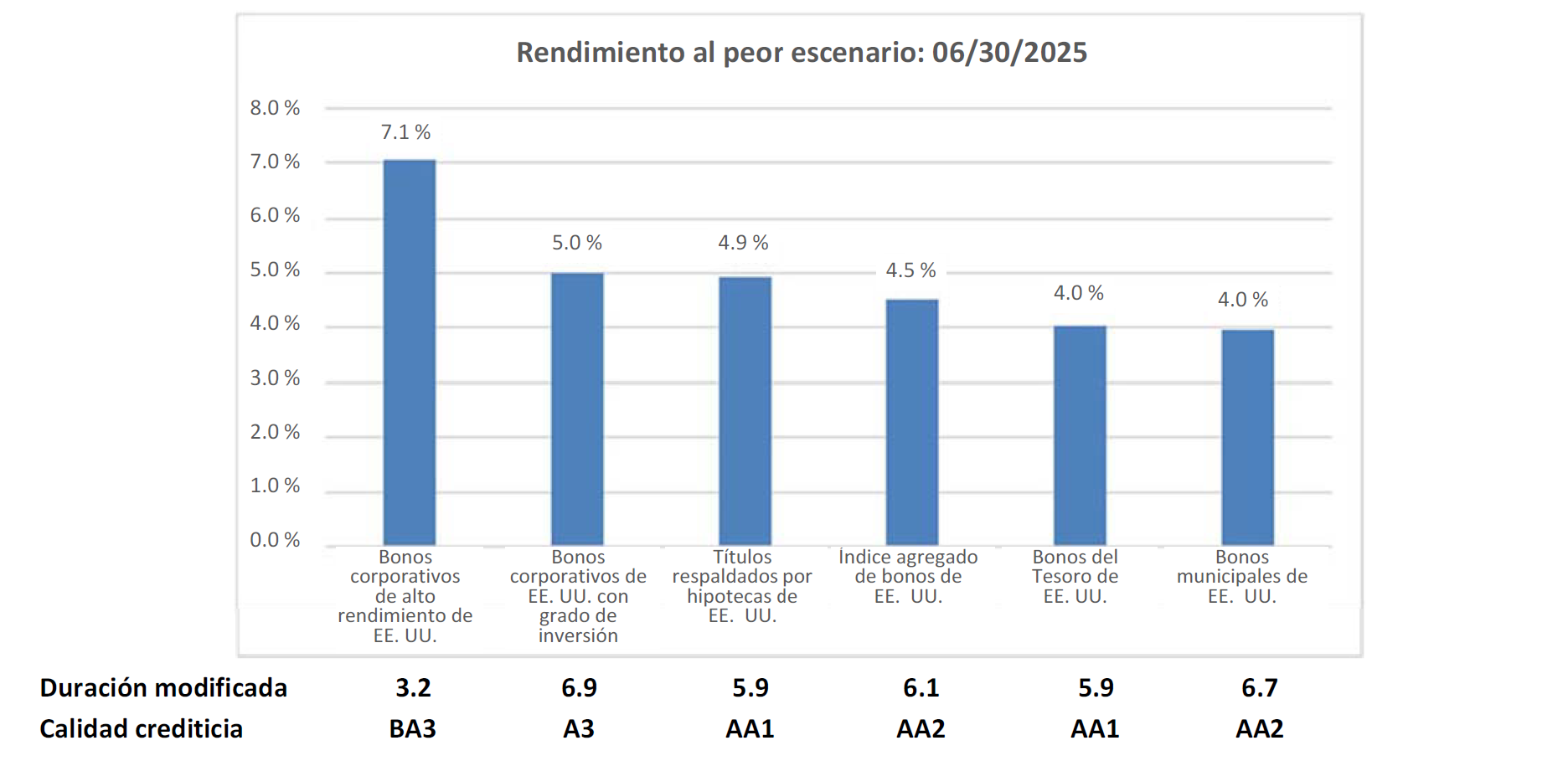

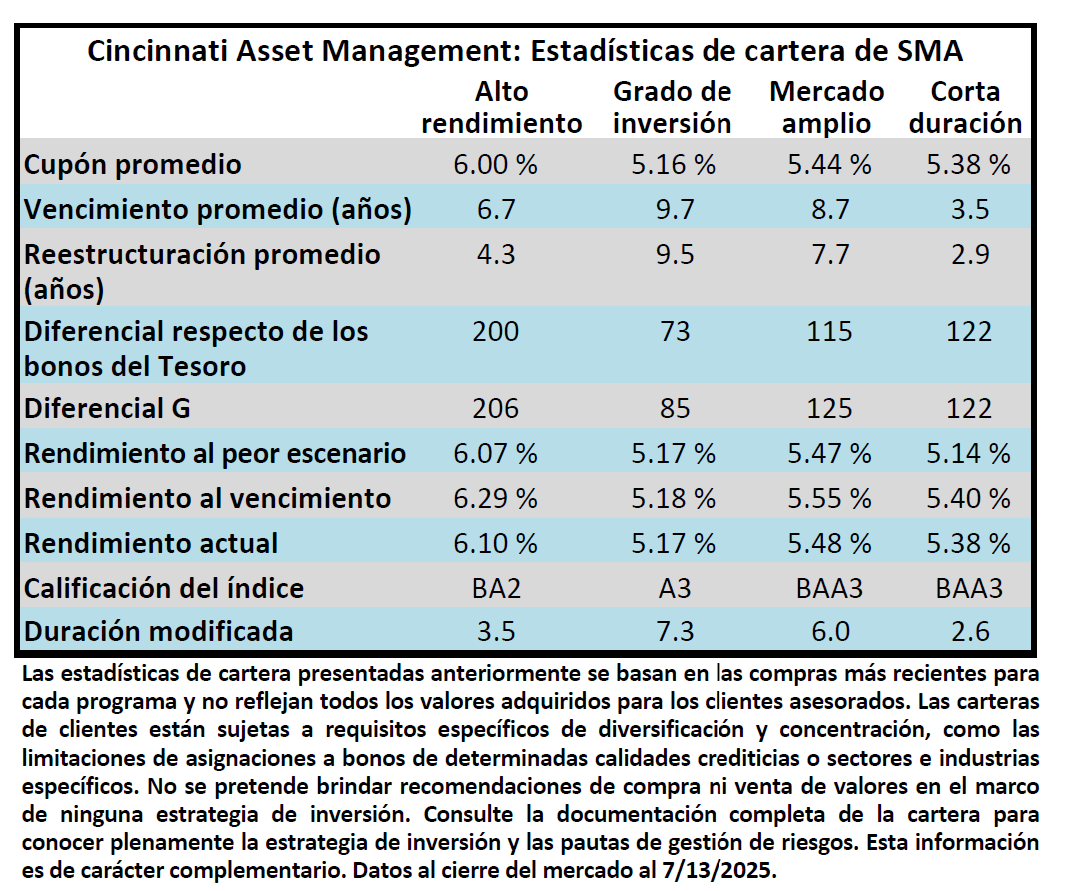

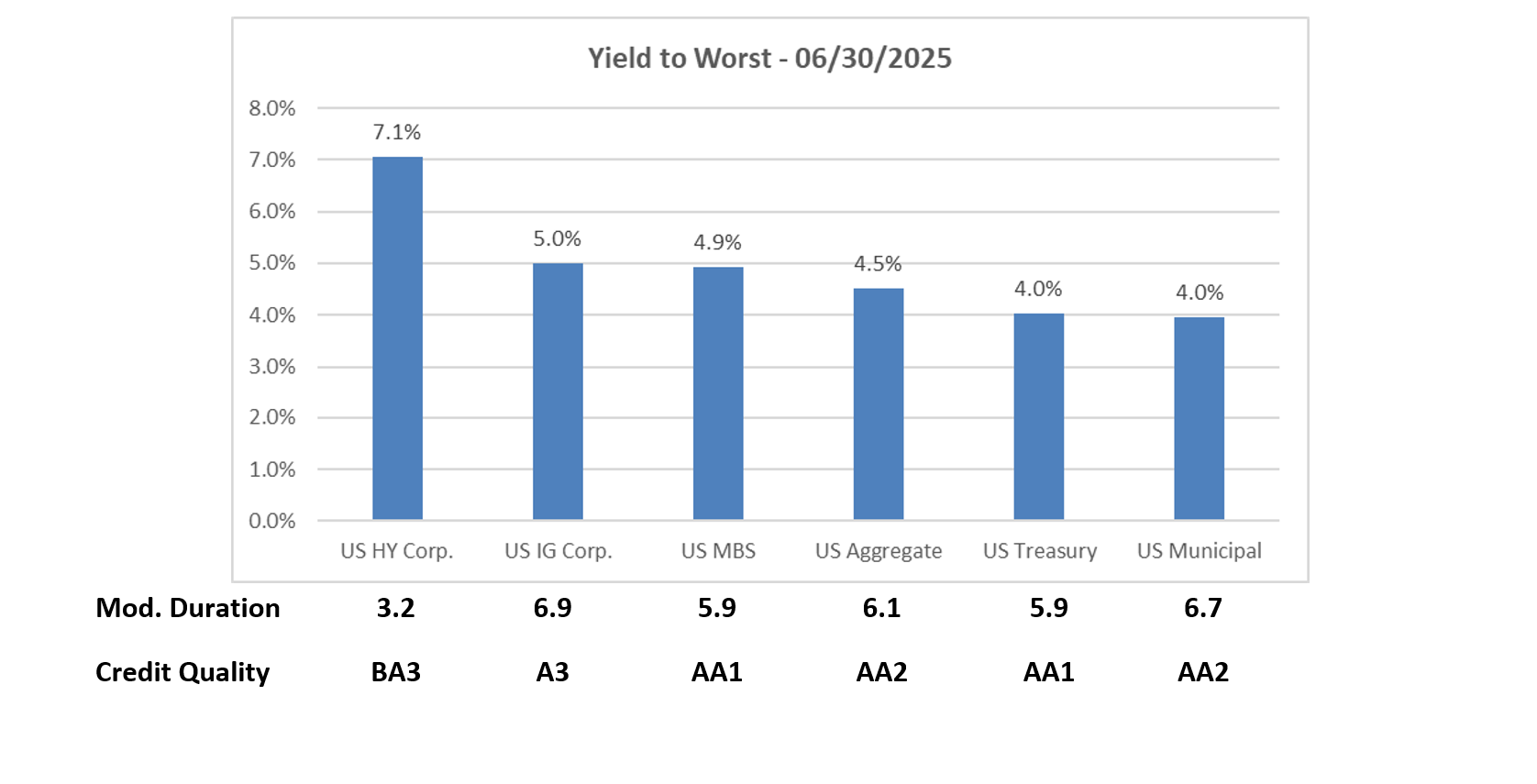

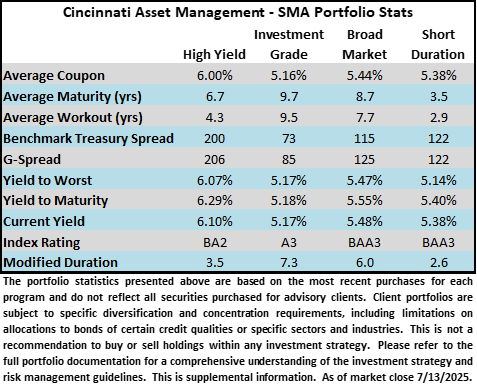

Considerando conjuntamente los diferenciales de crédito y los rendimientos del Tesoro, el rendimiento hasta el peor escenario del índice corporativo cerró el trimestre en un 5 %, frente a un promedio de 3.78 % en los últimos 10 años. Los diferenciales de crédito cerraron el trimestre con un diferencial del índice de 83, comparado con el promedio de 119 de los últimos 10 años. Si bien los diferenciales de crédito parecen algo ajustados, consideramos que este es un entorno clásico de “comprar por el rendimiento, no por el diferencial” para los inversionistas, y seguimos creyendo que el crédito con grado de inversión ofrece una atractiva relación riesgo‐recompensa en función de su calidad crediticia y duración.

El poder de la diversificación

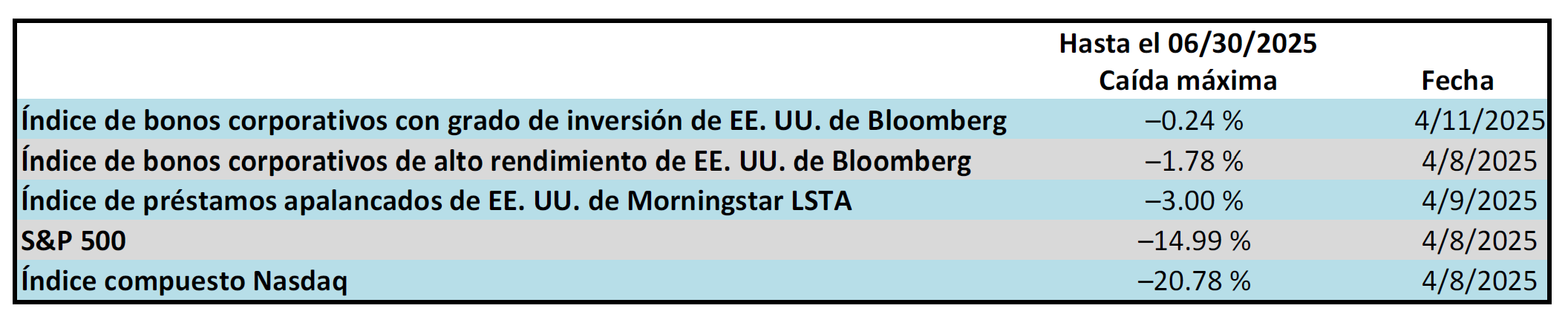

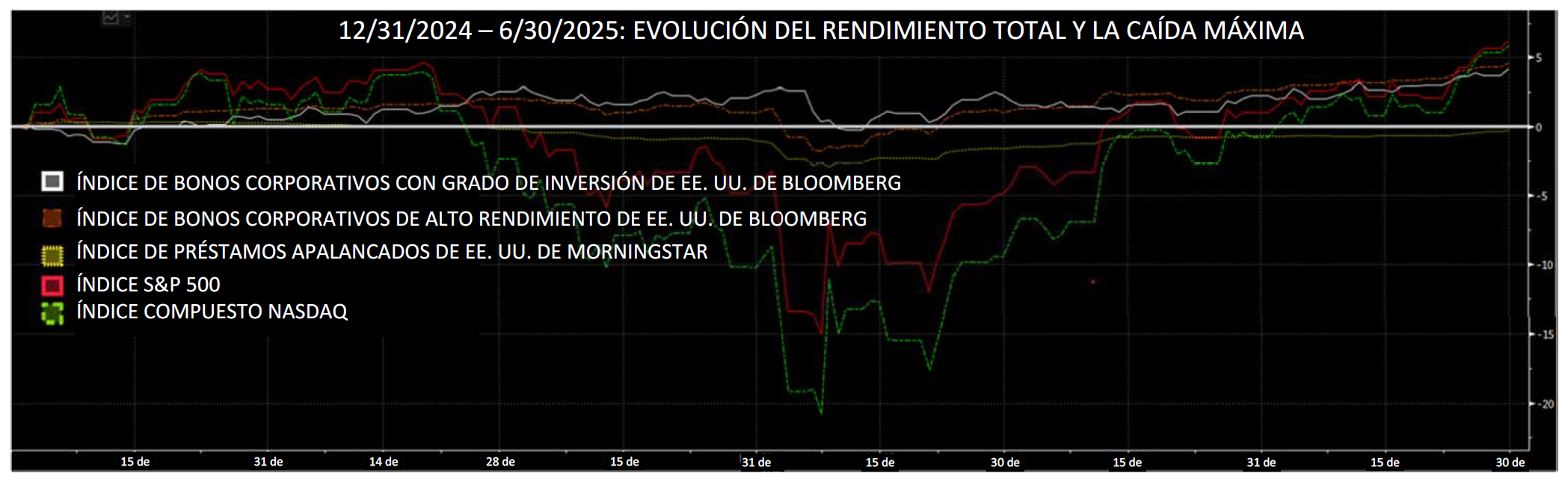

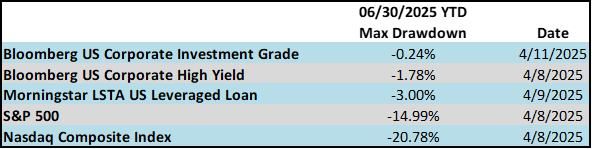

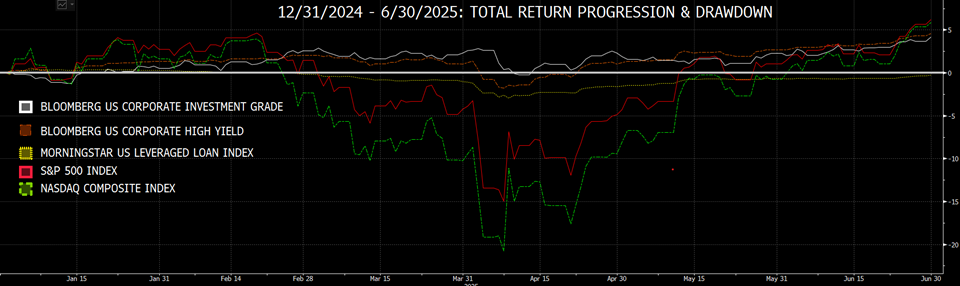

La volatilidad del segundo trimestre ofreció un excelente ejemplo de la utilidad del crédito con grado de inversión como elemento diversificador en la asignación de activos. La diversificación no se trata necesariamente de aumentar los rendimientos, sino más bien de reducir el riesgo y maximizar el potencial de crecimiento a lo largo de un horizonte temporal más amplio. Una medida de protección a la baja es la “caída máxima”, que se define como el rendimiento calculado según el porcentaje de disminución en el valor desde un pico anterior hasta el siguiente mínimo. Analizamos los rendimientos diarios acumulados en lo que va del año para diversas clases de activos durante los primeros seis meses de 2025.

Ha habido un retroceso en todas las clases de activos mencionadas anteriormente, pero cuando el ciclo de noticias alcanzó su punto más crítico y los temores de los inversores estaban en su punto máximo, el impacto sobre el crédito con grado de inversión fue relativamente limitado en comparación con los activos de mayor riesgo. Aún está por verse si este retroceso ha sido excesivo, ya que es posible que el impacto de la política comercial de EE. UU. en la economía global aún no se haya manifestado por completo. Históricamente, los bonos corporativos con grado de inversión han generado rendimientos con caídas máximas limitadas, al tiempo que ofrecen una rentabilidad ajustada por riesgo favorable en períodos de incertidumbre.

El FOMC se mantiene estable (por ahora)

El Comité Federal de Mercado Abierto (FOMC) se reunió dos veces durante el segundo trimestre, en mayo y junio, y en ambas ocasiones decidió mantener sin cambios la tasa de interés de política monetaria, continuando con la misma postura adoptada en las cuatro reuniones celebradas en lo que va de 2025. Aún quedan cuatro reuniones programadas para este año: el 30 de julio, el 17 de septiembre, el 29 de octubre y el 10 de diciembre. Aunque el consenso entre los inversores es que no habrá un recorte de tasas en la reunión de julio, el presidente Powell evitó descartar por completo esa posibilidad durante una reunión de bancos centrales celebrada en Portugal el 1 de julio. El 3 de julio, los datos de empleo no agrícola de junio superaron ampliamente las expectativas y la tasa de desempleo se redujo, lo que probablemente cerró la puerta a un posible recorte en julio. En cambio, los inversores comenzaron a alinearse con la expectativa de que el primer recorte del año ocurra en la reunión de septiembre, con los contratos de futuros sobre los fondos federales estimando una probabilidad del 92.3 % de un recorte al cierre del trimestre. Sin embargo, dicha probabilidad cayó al 68.1 % el 3 de julio tras la publicación del informe de empleo.

Al cierre del segundo trimestre, los futuros reflejaban un total acumulado de –67 puntos básicos en recortes para lo que resta de 2025. Por su parte, el FOMC adoptó una postura ligeramente más restrictiva en la publicación más reciente del Resumen de Proyecciones Económicas (gráfico de puntos) del 18 de junio. Según dicho gráfico, el miembro promedio del FOMC proyecta recortes por un total de –50 puntos básicos en 2025, con un recorte adicional de –25 puntos básicos en 2026. Sin embargo, los inversores se mostraban notablemente más inclinados hacia una postura expansiva y proyectaban recortes por –135 puntos básicos hasta finales de 2026. Esto equivale a 5.4 recortes de 25 puntos básicos, frente a los 3 recortes de 25 puntos básicos previstos en la mediana de las proyecciones del FOMC.

Seguimos esperando entre 1 y 2 recortes de tasas en 2025. El mercado laboral ha mostrado una desaceleración gradual desde hace algún tiempo, pero aún no presenta señales de deterioro severo. Si eso ocurriera, sería probable que el FOMC actuara con rapidez y aplicara múltiples recortes para estabilizar la economía.

El sentimiento puede cambiar rápidamente

Con posibles recortes de tasas en el horizonte, la oportunidad de invertir con rendimientos elevados podría ser efímera. Al observar lo ocurrido en abril, fue sorprendente la rapidez con la que los mercados bursátiles cambiaron de rumbo. La volatilidad podría volver a aumentar en ausencia de una serie de acuerdos comerciales. Los conflictos geopolíticos continúan ocupando un lugar central, especialmente en Europa y Medio Oriente. Seguiremos posicionando el portafolio de manera conservadora, con preferencia por activos crediticios estables que puedan generar flujo de efectivo en tiempos económicos inciertos. Gracias por la confianza que ha depositado en nosotros.

Esta información solo tiene el propósito de dar a conocer las estrategias de inversión identificadas por Cincinnati Asset Management. Las opiniones y estimaciones ofrecidas están basadas en nuestro criterio y están sujetas a cambios sin previo aviso, al igual que las declaraciones sobre las tendencias del mercado financiero, que dependen de las condiciones actuales del mercado. Este material no tiene como objetivo ser una oferta ni una solicitud para comprar, mantener ni vender instrumentos financieros. El rendimiento pasado no es garantía de resultados futuros. El rendimiento bruto de la tarifa de asesoramiento no refleja la deducción de las tarifas de asesoramiento de inversión. Nuestras tarifas de asesoramiento se comunican en el Formulario ADV Parte 2A. En general, las cuentas administradas mediante programas de firmas de corretaje incluyen tarifas adicionales. Los retornos se calculan mensualmente en dólares estadounidenses e incluyen la reinversión de dividendos e intereses. El Índice no está administrado y no considera las tarifas de la cuenta, los gastos y los costos de transacción. Los rendimientos de los índices y los datos relacionados, como los rendimientos y los diferenciales, se presentan con fines comparativos y se basan en información generalmente disponible al público, proveniente de fuentes que se consideran confiables. No se hace ninguna afirmación sobre su precisión o integridad.

La información suministrada en este informe no debe considerarse una recomendación para comprar o vender ningún valor en particular. Los distintos tipos de inversiones implican distintos grados de riesgo y no puede garantizarse que cualquier inversión específica sea adecuada o rentable para la cartera de un cliente. Las inversiones de renta fija tienen distintos grados de riesgo crediticio, riesgo de tasa de interés, riesgo de incumplimiento y riesgo de prepago y extensión. En general, los precios de los bonos suben cuando las tasas de interés bajan y viceversa. Este efecto suele ser más pronunciado en el caso de los valores a largo plazo. No hay garantía de que los valores que se tratan en este documento hayan permanecido o permanecerán en la cartera de una cuenta en el momento en que reciba este informe o que los valores vendidos no se hayan vuelto a comprar. Los valores analizados no representan la cartera completa de una cuenta y, en conjunto, pueden representar solo un pequeño porcentaje de las tenencias de cartera de una cuenta. No debe suponerse que las transacciones de valores o participaciones analizadas fueron rentables o demostrarán serlo, o que las decisiones de inversión que tomemos en el futuro serán rentables o igualarán el rendimiento de la inversión de los valores examinados en este documento. Si se lo solicita, Cincinnati Asset Management proporcionará una lista de todas las recomendaciones de valores realizadas durante el último año.

En nuestro sitio web se encuentran disponibles las divulgaciones adicionales sobre los riesgos materiales y los posibles beneficios de invertir en bonos corporativos: https://www.cambonds.com/disclosure‐statements/.