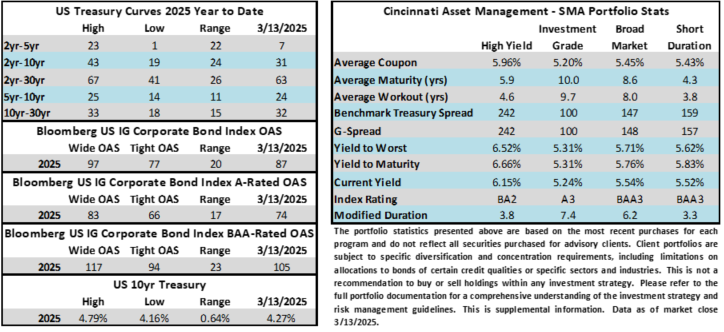

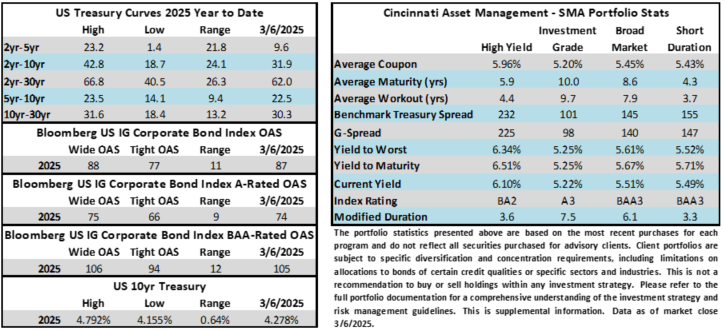

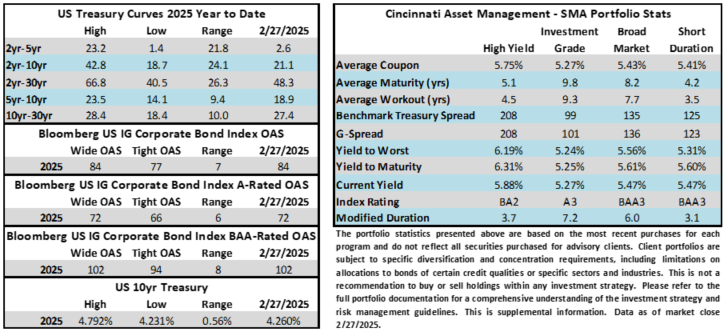

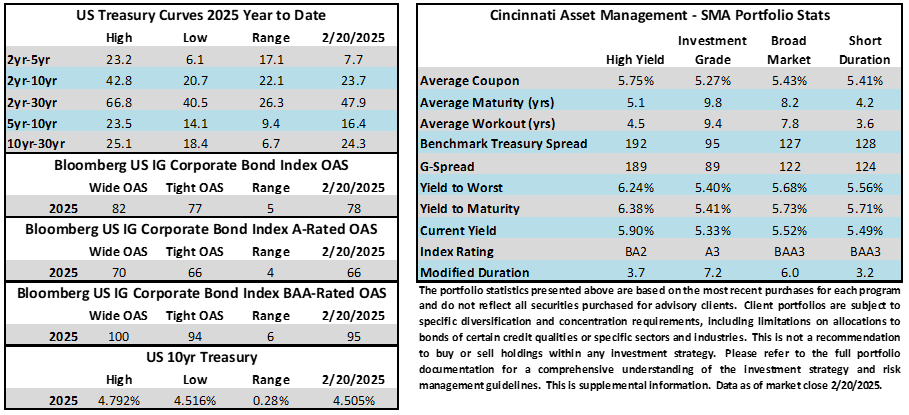

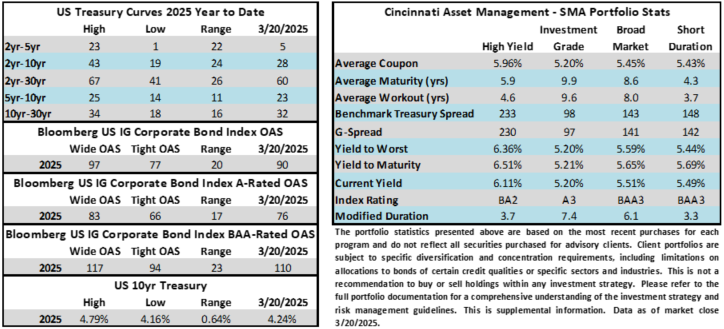

Credit spreads clawed their way back from the wides of last week and are poised to finish the period tighter. The OAS on the Corporate Index was 3 basis points tighter this week through Thursday. The 10yr Treasury yield inched lower throughout the week as investors remained wary of risk assets. The 10yr was 7bps lower through Thursday. Through Thursday, the Corporate Bond Index year-to-date total return was +2.49% while the yield to maturity for the Index closed the day at 5.13%.

Economics

The data this week yielded some mixed messages. Retail sales on Monday were soft as February sales advanced just +0.2% but the bigger news was a revision of January’s data that made it the largest monthly decline since 2021. There were some bright spots for the home construction market on Tuesday as housing starts showed a rebound for the month of February but permitting activity suggested a slowdown in future months. Staying with the housing theme for a moment, Thursday also had a positive release for existing home sales as they surprised to the upside for February, but affordability concerns remain a headwind. Wednesday’s FOMC release was unsurprising as the committee elected to hold rates steady. Commentary from Chairman Powell was viewed by investors as having a dovish tilt, and we agree, but the dot plot was slightly more hawkish than the prior release. The updated dot plot median expectations were unchanged with most members expecting 50ps worth of cuts by the end of 2025. However, examining the details, there were more policymakers expecting zero or just one cut than there were in December. Recall that the Summary of Policy Expectations (dot plot) is released every three months so we will not get our next update until the FOMC release on June 18.

There are now plenty of diverging views among investors and street economists with regard to the Fed’s policy rate. At Thursday’s close, interest rate futures were pricing 2.7 cuts by the end of 2025. There are some strategists predicting no cuts at all and then there are those in the recession/slow down camp that are predicting 3+ cuts. There were some calling for hikes but they seem to have gone into hiding for now. We view this Fed as being data dependent with a dovish bias and believe that 1 or 2 cuts before the end of 2025 as the most likely outcome.

Next week brings plenty to parse with new home sales, consumer confidence, durable goods, GDP, personal consumption, and finally on Friday we get the Fed’s preferred inflation gauge with the release of Core PCE.

Issuance

The new issue market for corporate bonds was in line with expectations this week as borrowers priced $33bln of new debt relative to the $35bln estimate. Concessions were narrower this week amid a more positive backdrop for credit than what we saw for most of the prior two weeks. YTD activity has been brisk thus far with $490bln of new issue, just -2% off 2024’s pace. Next week, syndicate desks are looking for around $30bln of new supply.

Flows

According to LSEG Lipper, for the week ended March 19, investment-grade bond funds reported a net inflow of +$336mm. Total year-to-date flows into investment grade funds were +$20.07bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.