(Bloomberg) High Yield Market Highlights

- US junk bonds are headed toward the biggest weekly loss since mid-January on renewed concerns about the Federal Reserve delaying rate cuts and holdings interest rates higher for longer on robust economic data. The drop was also driven by rising commodity prices, led by oil and copper, fueling more inflation concerns, with the commodity index climbing for six consecutive sessions to close at a four-month high. Data during the week showed expansion in US manufacturing activity, a resilient labor market, and a relatively strong services sector.

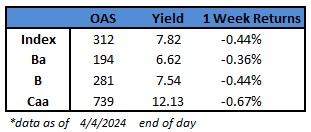

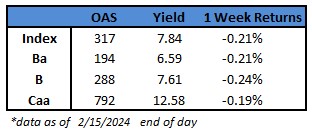

- The negative returns in the US high-yield market spanned across ratings. CCCs, the riskiest segment of the junk bond market, are expected to rack up the biggest weekly loss since early January.

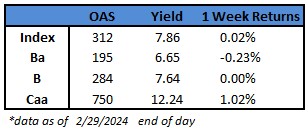

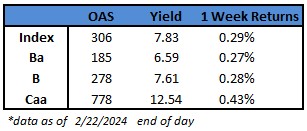

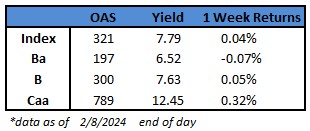

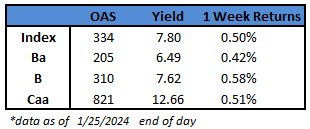

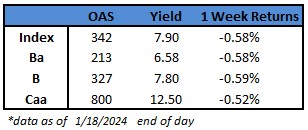

- Yields jumped 16 basis points so far this week to 7.82%, the biggest weekly increase in 11 weeks. Spreads widened 13 basis points week-to-date to close at 312

- CCC yields climbed 26 basis points for the week so far to 12.13%, the largest in 13 weeks

- Single B and BB yields rose by 16 and 13 basis points, respectively, to 7.54% and 6.62%

- While worries about the Fed delaying easing interest-rates spurred losses across risk assets, the extent of these losses moderated a bit after Fed Chair Jerome Powell suggested that recent inflation readings, though higher than expected, didn’t “materially change” the overall picture. He also reiterated that it will likely be appropriate to begin lowering rates “at some point this year”

(Bloomberg) US Jobs Roar Again as Payrolls Jump 303,000, Unemployment Drops

- US payrolls rose in March by the most in nearly a year and the unemployment rate dropped, pointing to a strong labor market that’s powering the economy.

- Nonfarm payrolls advanced 303,000 last month following a combined 22,000 upward revision to job gains in the prior two months, a Bureau of Labor Statistics report showed Friday. The rise exceeded all expectations in a Bloomberg survey of economists.

- The unemployment rate fell to 3.8%, with more people joining the workforce and able to find a job.

- Job growth in March was led by faster hiring in health care, construction, as well as leisure and hospitality, which has now bounced back above its pre-pandemic level. A measure of the breadth of job gains increased.

- “The US labor market appears to be strengthening, not slowing, and risks delaying Fed easing,” Sal Guatieri, senior economist at BMO Capital Markets, said in a note.

- The labor market has been the stalwart of the US economy, giving Americans the wherewithal to keep spending in the face of high prices and borrowing costs. While Fed officials have flagged moderation in job gains over the past year as a possible precursor to interest-rate cuts, Friday’s data may raise questions over the extent of that cooling and its implications for inflation.

- An aggregate measure of weekly payrolls — which provides a broader reading of changes in earnings, hours and employment — rose 0.8%, matching the biggest monthly increase since January 2023.

- Fed Chair Jerome Powell said Wednesday that labor supply and demand have come into better balance, nodding in part to more immigration. Policymakers have stressed they’re in no rush to lower borrowing costs and that incoming data will guide that decision.

- Officials will see fresh figures on consumer and producer prices next week, followed by the March reading of their preferred inflation gauge — the personal consumption expenditures price index — before their April 30-May 1 meeting.

- The jobs report is composed of two surveys: one of businesses that generates the payrolls and wage data, and another smaller one of households used to produce the unemployment rate.

- The household survey also publishes its own measure of employment, which surged nearly a half million in March after declining in the prior three months. Many economists have discounted the recent weakness in this metric given that other indicators remain strong, such as unemployment claims and consumer spending.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.