CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

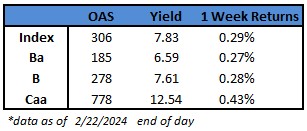

- US junk bonds notched their biggest one-day gains in more than four weeks and are poised for a rebound off last week’s losses to score the biggest weekly gains in four, as equities hit an all-time high, driving spreads to a more than two-year low of 306 basis points.

- With the Federal Reserve signaling caution about its next move, credit markets remain quite “upbeat,” with strong “yield-driven” demand, Barclays analysts Brad Rogoff and Dominique Toublan wrote this morning.

- While inflation risks remain in focus, growth is resilient and corporate earnings are still strong across cyclicals and noncyclicals, they wrote, adding that higher yields continue to compress spreads.

- Dollar prices in the junk bond market are still low, making yields attractive to investors and supporting strong demand.

- Spreads were crushed across ratings, with BB spreads tumbling to 185 basis points, the lowest since Jan. 2020.

- Single B spreads plummeted to 278 basis points, the lowest since July 2007.

- CCCs spreads dropped to a more than eight week low of 778 basis points, the lowest since December.

- The gains were across the board as risk assets shrugged off inflation concerns and rallied on a resilient economy and strong labor market.

- Yields dropped seven basis points to 7.83% and spreads moved closer to 300 basis points.

- US borrowers are capitalizing on demand supported by low spreads and higher yields.

- The primary market has priced more than $4b in new bonds this week, putting issuance at $23b for the month.

- Year-to-date supply is at $54b, up 59% year-over-year.

- Robust corporate earnings, combined with strong macro data, have pushed back recession concerns and bolstered risk assets.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.