Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were +$1.3 billion and year to date flows stand at $35.2 billion. New issuance for the week was $15.3 billion and year to date issuance is at $184.8 billion.

(Bloomberg) High Yield Market Highlights

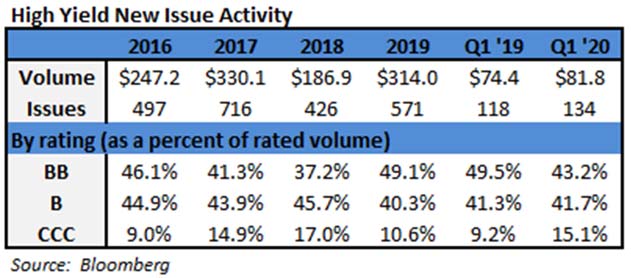

- S. junk bond sales for June may top $45 billion by the end of Friday, making this one of the busiest months on record for issuance. Eldorado Resorts Inc. is expected to round out a busy week with billions of dollars of debt for its acquisition of Caesars Entertainment Corp.

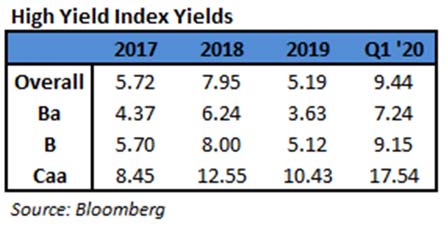

- The issuance surge comes even as junk bond spreads and yields have come under pressure amid stock volatility and fears of a fresh outbreak of the coronavirus

- Spreads widened 16bps to 577bps more than Treasuries Thursday, yields rose 15bps to 6.42% and the index posted a loss of 0.33%

- But Barclays Plc strategists led by Brad Rogoff see spreads grinding tighter with the economic recovery expected to be faster than in previous contractions and the bar for a new round of widespread lockdowns high

- Stock futures are higher on a breakthrough in trade negotiations between America and China

- Investors are still putting cash into high-yield funds, albeit at a slower rate, with an inflow of $1.3b for the week. This was the 12th consecutive week of inflows

- The new issue market is still cranking out deals.

(Bloomberg) Fed Will Begin Buying Broad Portfolio Of U.S. Corporate Bonds

- The Federal Reserve said Monday that it will begin buying individual corporate bonds under its Secondary Market Corporate Credit Facility, an emergency lending program that to date has purchased only exchange-traded funds.

- The central bank also added a twist to its buying strategy, saying it would follow a diversified market index of U.S. corporate bonds created expressly for the facility.

- “This index is made up of all the bonds in the secondary market that have been issued by U.S. companies that satisfy the facility’s minimum rating, maximum maturity and other criteria,” the Fed said in a statement. “This indexing approach will complement the facility’s current purchases of exchange-traded funds.”

- The SMCCF is one of nine emergency lending programs announced by the Fed since mid-March aimed at limiting the damage to the U.S. economy by the coronavirus pandemic. With a capacity of $250 billion it has so far invested about $5.5 billion in ETFs that purchase corporate bonds.

(Bloomberg) Delta Air CEO Sees Hitting Break-Even Around Spring of Next Year

- Delta Air Lines Inc. hopes to reach its break-even point by next spring as rising demand prompts the carrier to continue increasing flying capacity, Chief Executive Officer Ed Bastian said.

- “We are in the process of recovery, there’s no doubt about it,” Bastian said Thursday on Bloomberg Television. “There are clear signs the momentum we have is meaningful and continuing to build.”

- The Atlanta-based airline plans to add around 1,000 flights a day to its schedule in July and again in August, he said. U.S. airlines that had slashed flying have begun to put more planes in the sky as states lift stay-at- home orders and other limits on activity. Delta expects to operate about 30% of its year-earlier flying schedule by the end of September.

- “We’re at 15% of revenues today and we hope to get to 30% over the next two or three months, keeping costs at that 50% level,” Bastian said in the interview, with David Westin. “I would imagine by the spring next year, we’d be at a point where we’re break-even.”

- The U.S. Labor Day holiday in early September will be “an important milestone and pivot point” because it’s typically when business travel starts to build after summer, Bastian said.

- Delta is on track to burn about $30 million in cash this month, better than its target of reducing the figure to $40 million from $100 million earlier in the pandemic, Bastian said.

- He expects to reach zero by year-end. The airline has cut operating expenses by 55% since the coronavirus outbreak began to affect travel in March.

- Bastian said he doesn’t expect widespreadlayoffs at Delta after Sept. 30, when prohibitions against job cuts that are part of federal financial aid expire. About 40,000 employees have taken voluntary leaves, the company said at its annual meeting later Thursday.