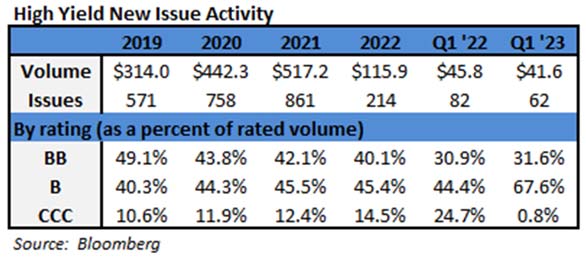

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$3.0 billion and year to date flows stand at -$1.8 billion. New issuance for the week was $3.5 billion and year to date issuance is at $31.0 billion.

(Bloomberg) High Yield Market Highlights

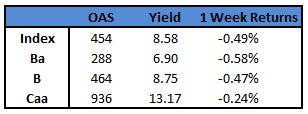

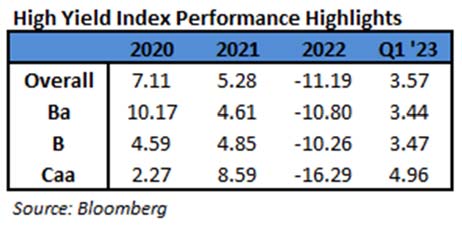

- US junk bonds are headed toward their second consecutive week of losses after declining in nine of the last 12 sessions. The losses spanned across all high yield ratings on worries strong data – including retail sales and rising consumer prices – will keep the Federal Reserve on the path of tight monetary policy for longer than previously expected. The January gains faded after a series of Federal Reserve officials said that interest rates may need to move to a higher level than anticipated. Federal Reserve Bank of Cleveland President Loretta Mester joined the chorus on Thursday saying there was a compelling case for rolling out another 50 basis-point interest-rate hike.

- “At this juncture, the incoming data have not changed my view that we will need to bring the fed funds rate above 5% and hold it there for some time,” she said in remarks prepared for an event organized by the Global Interdependence Center and the University of South Florida Sarasota-Manatee.

- Federal Reserve Bank of St. Louis President James Bullard said he would not rule out supporting a half-percentage-point interest-rate hike at the Fed’s March meeting, rather than the quarter-point other officials have signaled may be appropriate.

- He said he wanted to bring the Fed’s policy rate up to 5.375% as soon as possible.

- Mester and Bullard follow a long line of Fed speakers this week – Thomas Barkin, Dallas Fed President Lorie Logan and Philadelphia Fed President Patrick Harker – echoing similar views.

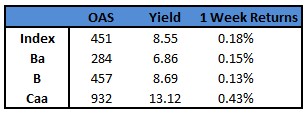

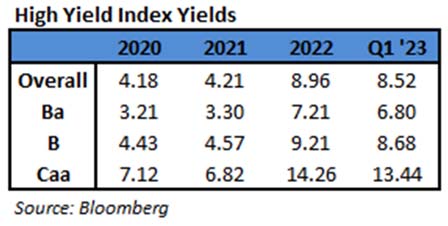

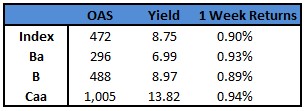

- Junk bond yields surged to a six-week high of 8.54% and are on track to rise for the second straight week this month as investors pulled cash out of US high yield funds.

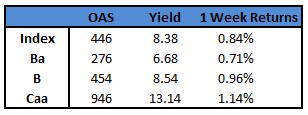

- While the broad junk bond rally has lost momentum, CCCs continue to be the best asset class in US fixed income, with year-to-date gains of 6.1% compared with investment grade returns of 1.3%.

- As the broader rally wanes, BB yields jumped to a six-week high of 7.10%.

(Bloomberg) US Inflation Stays Elevated, Adding Pressure for More Fed Hikes

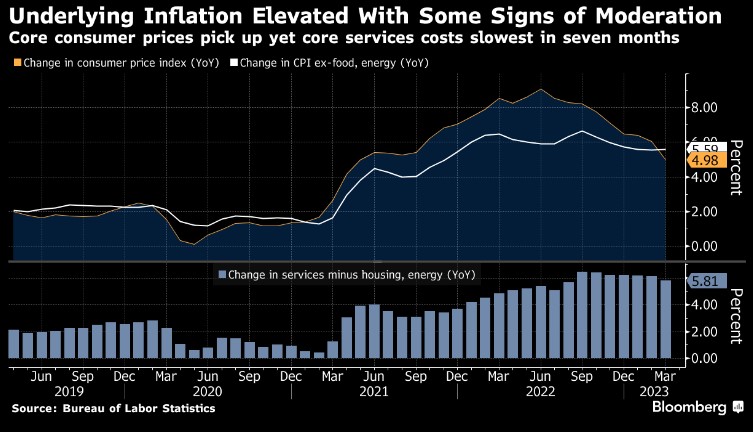

- US consumer prices rose briskly at the start of the year, a sign of persistent inflationary pressures that could push the Federal Reserve to raise interest rates even higher than previously expected.

- The overall consumer price index climbed 0.5% in January, the most in three months and bolstered by energy and shelter costs, according to data out Tuesday from the Bureau of Labor Statistics. The measure was up 6.4% from a year earlier.

- Excluding food and energy, the so-called core CPI advanced 0.4% last month and was up 5.6% from a year earlier. Economists see the gauge as a better indicator of underlying inflation than the headline measure.

- The median estimates in a Bloomberg survey of economists called for a 0.5% monthly advance in the CPI and a 0.4% gain in the core measure.

- Both annual measures came in higher than expected and showed a much slower deceleration than in recent months.

- The figures, when paired with January’s blowout jobs report and signs of enduring consumer resilience, underscore the durability of the economy — and price pressures — despite aggressive Fed policy. The data support officials’ recent assertions that they need to hike rates further and keep them elevated for some time, and possibly to a higher peak level than previously expected.

- The path to stable prices will likely be both long and bumpy. The goods disinflation that has driven the slide in overall inflation in recent months appears to be losing steam, and the strength of the labor market continues to pose upside risks to wage growth and service prices.

- The details of the report showed shelter was “by far” the largest contributor to the monthly advance, accounting for almost half of the rise. Used car prices — a key driver of disinflation in recent months — fell for a seventh month. Energy prices rose for the first time in three months.

- Shelter costs, which are the biggest services component and make up about a third of the overall CPI index, rose 0.7% last month. Owners’ equivalent rent and rent of primary residence increased by the same amount, while hotel stays also climbed.

- Because of the way the housing metrics are calculated, there’s a significant lag between real-time price changes and the government statistics.

- The January report incorporated new weights for the consumer basket to try to more accurately capture Americans’ spending habits. The shelter components are now a larger share of the overall index while used cars make up a smaller portion.

- Americans have been shifting more of their spending toward services, and the Fed — particularly Chair Jerome Powell — closely looks at those excluding energy and shelter as a sign of more durable inflation.

- So-called core services ex-housing rose 0.3%, a slight easing from the prior month, according to Bloomberg calculations. Wages are thought to be a key driver of growth in this category.

- While a strong jobs market has underpinned wage growth in recent months, inflation eroded those gains at the start of the year. A separate report Tuesday showed inflation-adjusted average hourly earnings fell 0.2% from the prior month, the biggest drop since June. Pay is down 1.8% from a year earlier.

- Economists largely expect the CPI to fall rather sharply by the end of 2023, but forecasters are split as to whether such a decline can occur without tipping the economy into recession. Much of that hinges on just how far the Fed will go. Policymakers will have February’s CPI and jobs report in hand before they meet next month.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.