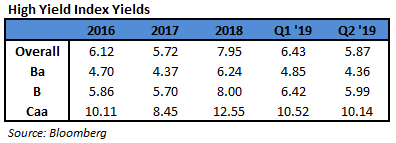

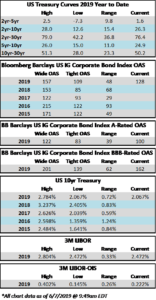

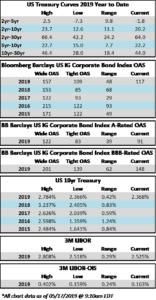

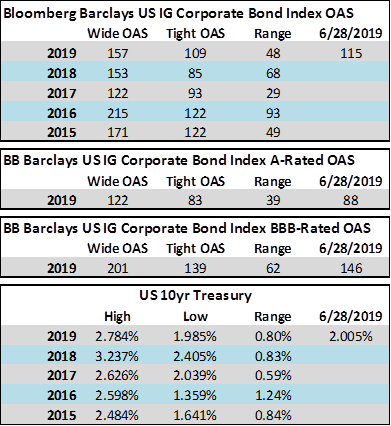

The investment grade credit market continued to perform well during the second quarter of the year. The Bloomberg Barclays US Corporate Index opened the quarter at an option adjusted spread of 119 and traded as tight as 109 by mid-April before ending the last trading day of June at a spread of 115. Lower quality credit modestly outperformed during the quarter with the BBB-rated portion of the index tightening by 7 basis points relative to the A-rated portion which tightened by 3 basis points. The bigger story of this quarter was lower Treasury yields as the 10yr Treasury finished the quarter 40 basis points lower than where it started. The 10yr ended the first 6 months of 2019 at 2.005% after closing as high as 2.78% in the first few weeks of January. Tighter spreads and lower Treasuries have combined to yield strong performance for investment grade creditors. The Bloomberg Barclays US Corporate Index posted a total return of +9.85% through the first 6 months of the year. This compares to CAM’s gross return of +9.20% for the Investment Grade Strategy.

When Doves Cry

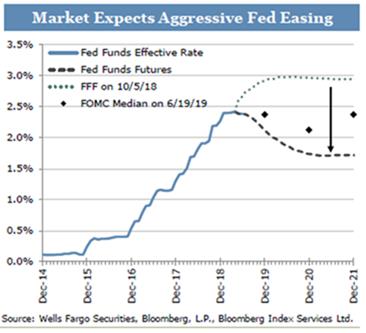

As longtime clients and readers know, at Cincinnati Asset Management we avoid speculating on the direction of interest rates. Instead we direct our efforts to bottom up credit research, thoroughly studying individual credits and diligently following industry trends, then opportunistically sourcing bonds which can add the most value to the overall portfolio. By positioning the portfolio with intermediate maturities ranging from five to ten years, we mitigate a significant portion of interest rate risk as investors are generally rewarded over medium and longer term time horizons by avoiding tactical positioning and the downside that can come about from being too short or too long with duration bets gone awry. However, while we may be interest rate agnostic, we are not interest rate blind. We would be remiss if we did not comment on the policy actions that we have seen out of the Federal Reserve thus far in 2019. Simply put, the Fed continues to exceed the dovish expectations of the market, a remarkable feat given the extent that the market is pricing in rate cuts, with Fed Funds futures data implying a 100% probability of a rate cut at next FOMC decision on July 31i. We take this as a sign from the Fed that it is extremely concerned with managing a so called “soft landing” when the current economic expansion finally runs out of steam.

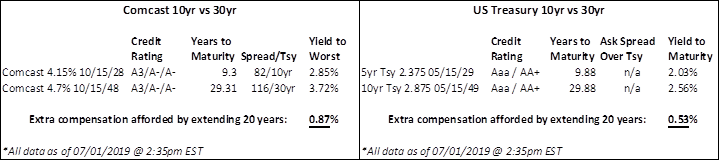

The actions of the Fed do not occur in a vacuum and they can have a significant impact on risk assets such as corporate credit. Lower Fed Funds rates coupled with the potential for future slowing economic growth can lead to lower risk-free rates (Treasury rates). When risk-free rates are low, yield starved investors from around the globe turn to large liquid markets in order to satiate their thirst for income thus setting their sights on the corporate credit market. Defaults remain nearly non-existent in the investment grade universe, and when coupled with a still growing economy, this can be a recipe for complacency and a tendency to “reach” for yield. Investors can reach for yield in two ways in IG credit; they can either extend duration or they can take on additional credit risk, but they usually do both. These are ill-advised strategies in our view, especially for investors concerned with capital preservation over a long time horizon. As far as extending duration is concerned, the compensation afforded for extending from a 10yr bond to a 30yr bond typically pales in comparison to the additional interest rate risk that is incurred. What most investors fail to realize is that most duration extensions also contain a significant dose of credit risk. Take the following example with Comcast’s 10yr and 30yr bonds:

An investor receives just 87 basis points of extra compensation for purchasing Comcast’s 30yr bond versus its 10yr bond, and in exchange, the investor takes on an additional 9.4yrs of duration risk. This means that if there is a linear shift in the yield curve and interest rates increase by 100 basis points, the investor in the 30yr bond will capture an additional nine points of downside. However, duration alone does not tell the whole story, as this is not just a story about interest rate risk as much as it is also a story about credit risk. Our hypothetical investor could purchase the risk-free rate instead of the corporate bond, and as you can see from the example above, the spread between the 10 and 30 year Treasury is 53 basis points. If we subtract this 53 basis points from the 87 basis points in spread between the Comcast 10yr and 30yr the difference is 34 basis points. Therefore, 34 basis points is the compensation that the investor receives for the additional credit risk incurred for the purchase of the 30yr Comcast bond in lieu of the 10yr Comcast bond. We like Comcast as an in investment. It is a best-in-class operator in its industry and it generates tremendous free cash flow. But we do not like it enough to lend it money for an additional 20 years in exchange for just 34 basis points of compensation for that credit risk. It simply does not make much sense to us from a risk-reward standpoint.

If you have not yet nodded off from this exercise in corporate credit, the other aforementioned avenue for increasing yield is to simply take on more credit risk by buying shorter maturity bonds of companies with marginal credit metrics. Usually the bonds of companies with marginal credit metrics will offer outsize compensation relative to the bonds of companies with stable or improving credit metrics. There is almost always a reason that the bonds of a marginal company will offer more yield but an investor really has to dig into the numbers and the industry to understand why. Sometimes it may simply be a case of a company that has too much debt or perhaps the business is showing signs of deterioration. Sometimes these investments may well work out but it only takes one or two permanent impairments (downgrade to high yield, structural subordination, default or fraud) to severely impact the performance of a bond portfolio. Taking on more credit risk is not worth it in the current environment in our opinion and is one of the reasons we are significantly structurally underweight the BBB and lower-rated portion of the investment grade universe. We cannot accurately predict when the business cycle will contract but we most assuredly are viewing all new and current investments through a late-cycle lens as we populate the portfolio with companies that have durable business models and the ability to generate free cash flow and comfortably service debt in a recessionary environment.

BBB, Leading the Way

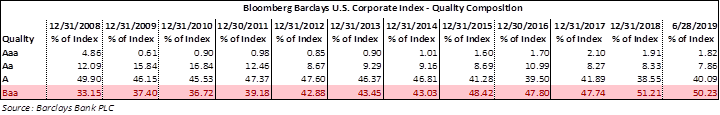

The lowest quality component of the investment grade universe has significantly outperformed the higher quality portion thus far in 2019. The OAS for the index as a whole was 38 basis points tighter through the end of the second quarter. If we segment that by credit quality, the A-rated portion of the index was 30 basis points tighter while the BBB-rated portion of the index was 51 basis points tighter.

Much has been written about the growth of BBB-rated credit, and for good reason. At the end of 2008 it represented 33.15% of the index but at the end of 2018 that figure had swollen to 51.21%. We cap the exposure of our portfolios to BBB-rated credit at 30%, thus we are much more conservatively positioned than the index. We think that this conservative positioning is especially crucial in times like these and we have no intention of increasing our exposure in the near term.

What Happened to Regulators Looking out for the Little Guy?

We typically avoid commenting on regulatory matters but an SEC proposal that was greenlighted in the second quarter has us flummoxed. Regulators recently approved a pilot program that shows a blatant disregard for retail investors and financial advisorsii. Trade disclosure in the corporate bond market has come a very long way in the past 15 years. It is still an over-the-counter market but there was a time in the not too distant past when it was rife with opacity in that there was simply no record of the price at which a bond was traded. The market has slowly but surely evolved and today there is an electronic record of where all corporate bonds trade within 15 minutes of when the trade was completed.

An SEC committee comprised mostly of the largest asset managers and broker dealers on the street voted to enact a 1-year pilot proposal that would roll back much of the progress that has been made with trade disclosureiii. The proposal centers on “block” or large bond trades. The current rule for IG corporate bonds caps trade size dissemination at $5 million but the trade must be posted within 15 minutes. So, as the rule stands today, a trade could have been completed for $50 million of a specific bond issue but unless you are privy to the details you will only know that at least $5 million traded and you will know at what price and you will know this information within 15 minutes of trade completion. This provides some (and we would argue more than adequate) protection to dealers who can buy a large block of a bond from an asset manager and then sell the bond to other asset managers over time without other market participants knowing that the dealer owns a large amount of that particular bond issue. The pilot proposal would increase the dissemination cap to $10 million, and unbelievably, would allow for up to a 48-hour delay (!) before the trade is reported. We oppose the proposal in its entirety as we believe markets are more efficient with more, not less, information, but we take particular issue with the reporting delay. Ironically, the proposal arguably helps us at CAM because it makes the professional management we provide even more valuable. It will not impact our ability to affect best execution because we are in the corporate market all day every day and have many resources and relationships at our disposal to determine where bonds should trade but the proposal is debilitating to the ability of an individual investor or advisor to engage in price discovery.

To understand the potential real-world implications imagine a scenario where Cincinnati Asset Management (CAM) sells $12 million of a particular bond to a dealer at $100. Remember, the trade does not need to be posted for two days. In the interim you, the reader, log into your brokerage account intending to purchase that same bond. You see a price of $105 offered to you, and see no other trades have posted for this particular bond. CAM’s hypothetical $12 million trade has yet to be reported, and you have no way of knowing about it. That $105 price looks fair to you so you purchase the bond. Shortly thereafter the broker-dealer sells the bonds they bought from CAM at $100.25 and both trades are publicly posted. Now you can see that the bond just traded $100-$100.25 and suddenly it appears that you overpaid. But how could you have known if you are not armed with adequate information? This is the proposal in a nutshell – temporarily hiding data from public view for the benefit of a privileged few.

As far as we can tell the only purpose of this proposal is to provide liquidity to large asset managers at the expense of small investors and to enrich the largest broker dealers on the street. Even if it may help us we are still against this proposal as it stands today because it is simply unfair and it is a step back for the corporate credit market. We believe that transparency is necessary for healthy and fully functioning capital markets and that this transparency is the only way to make the market fair to investors of all types, both large and small.

Looking Ahead

As we turn the page to the second half of the year we see more uncertainty ahead. Global trade continues to dominate the headlines and investors are becoming increasingly concerned about economic growth in the Eurozone. As we go to print with this letter the German 10yr Bund is trading at a record low of -0.36%iv. Geopolitical risk too is at the forefront as tensions between the U.S. and Iran remain high. Although the investment grade credit market has performed quite well to start the year we plan to remain conservative in the positioning of our portfolio. We welcome any questions, comments or concerns. Thank you for your continued interest and support.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

i Bloomberg, July 1, 2019, 2:08 PM EDT, World Interest Rate Probability (WIRP)

ii FINRA Requests Comment on a Proposed Pilot Program to Study Recommended Changes to Corporate Bond Block Trade Dissemination, April 12, 2019, https://www.finra.org/industry/notices/19-12, Accessed July 1, 2019

iii The Wall Street Journal, June 27, 2019, Bond Fight Pits Main Street Against Wall Street

iv CNBC, July 2, 2019, German 10-year bund yield falls to record low, US Treasurys stable amid softer GDP outlook