(Bloomberg) High Yield Market Highlights

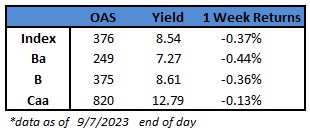

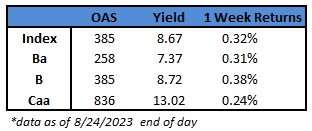

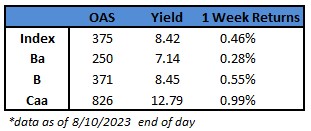

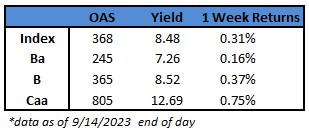

- US junk bonds are coming off the biggest one-day gains in more than two weeks despite a surge in new debt sales, pushing the market toward a modest 0.31% gain for the week after advancing in three of the last four sessions.

- The gains lured US borrowers into the market, crowding the primary calendar and pushing the week’s supply tally to almost $10b, the most since November 2021.

- The positive returns extend across all high-yield ratings groups, with CCCs, the riskiest segment, on track to be the best performing for the week after gaining for six straight sessions. The week-to-date gains are at 0.75% vs 0.16% for BBs and 0.37% for single Bs.

- US companies are rushing to take advantage of current risk-on sentiment and stable market as they look to get ahead of any further increases in cost of debt as central banks embrace a higher-for-longer regime.

- Leveraged credit companies have capitalized on the recovery in primary markets to address the wall of maturing debt, Morgan Stanley’s analysts Vishwas Patkar, Joyce Jiang and Karen Chen wrote this morning.

- 2024 maturities across high-yield bonds and loans have dropped by 50% to about $70b, while 2025 maturities have declined by 34% to about $164b, Morgan Stanley wrote.

- Across the high-yield market, the reduction in maturities has been broad-based across ratings and sectors, whereas in loans, the B3/lower cohorts have lagged, now comprising a major share of what’s due in 2024, they wrote.

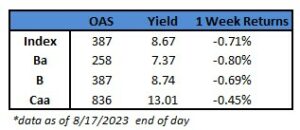

- As junk bonds recovered from last week’s losses, CCC yields dropped to a two-week low of 12.69%. Yields fell across the risk spectrum. The broader high yield index yields also fell to a two-week low of 8.48%.

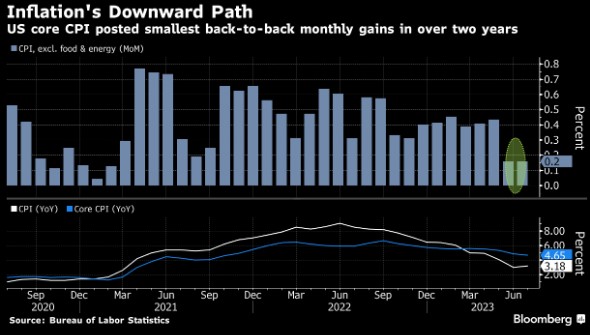

(Bloomberg) US Core CPI Picks Up, Keeping Another Fed Hike in Play This Year

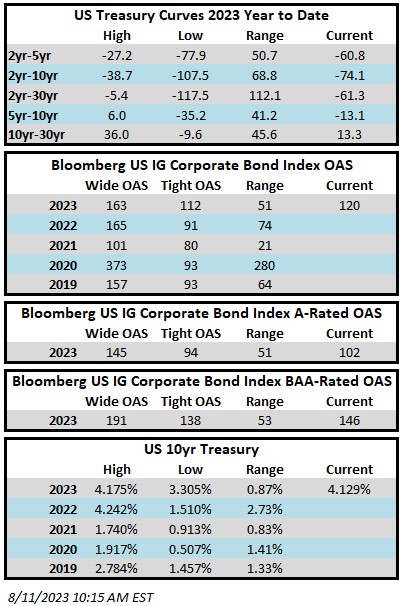

- Underlying US inflation ran at a faster-than-expected monthly pace in August, leaving the door open for additional interest-rate hikes from the Federal Reserve.

- The so-called core consumer price index, which excludes food and energy costs, advanced 0.3% from July, marking the first acceleration since February, Bureau of Labor Statistics data showed Wednesday. From a year ago, it increased 4.3%, in line with estimates and marking the smallest advance in nearly two years.

- Economists favor the core gauge as a better indicator of underlying inflation than the overall CPI. That measure rose 0.6% from the prior month, the most in over a year and reflecting higher energy prices. Gasoline costs accounted for over half of the advance in the overall measure in August, according to BLS.

- The report adds to concerns that the renewed momentum in the economy is reigniting price pressures. While Fed officials have been growing more optimistic they can tame inflation without a recession, a reacceleration in price growth could force them to push interest rates even higher — with the risk of sparking a downturn in the process.

- The CPI is one of the last major reports the Fed will see before its meeting next week, in which policymakers are largely expected to hold rates steady. Chair Jerome Powell said last month interest rates will stay high and could rise even further should the economy and inflation fail to cool.

- For most Americans, household budgets are still under strain. Energy costs broadly rose, especially gasoline, which rose more than 10% last month. Utility costs also increased. Grocery prices also rose, but at the slowest annual pace in two years.

- While inflation expectations have remained stable and the job market largely resilient, Americans are growing more pessimistic about the economy. Prices, especially for essentials, are still elevated, which has forced many to rely on credit cards or savings to support spending.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.