CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

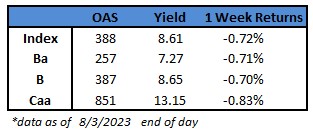

- US junk bonds are headed for the worst weekly loss in six, as risk appetite wobbled on Fitch’s downgrade of US government debt, higher longer-dated Treasury yields and a Senior Loan Officer Opinion Survey that showed tightening lending standards. While it was business as usual for the primary market, the week-to-date losses, at 0.72%, span the ratings spectrum. BBs, the top ratings in the junk universe, are on track for the biggest weekly loss in almost four months.

- The high yield index yield rose to a three-week high of 8.61%.

- BB yields jumped 22 basis points to 7.27%, a four-week high. CCC yields rose 31bps to 13.15%, also a four-week high.

- CCCs are also poised for the biggest weekly loss in six, with negative returns of 0.83% week-to-date.

- After reaching year-to-date tights at the end of July, spreads widened sharply amid a significant increase in long-dated Treasury yields, Brad Rogoff and Dominique Toublan wrote this morning. These developments, if sustained, could pose a challenge to the soft-landing narrative, they wrote.

- The broader risk-off sentiment initially fueled by Fed survey of senior loan officers renewed concerns of a possible recession and a spike in default rates. The selloff gained momentum after Fitch action on US debt.

- Investors pulled over $1b from US high yield funds for the week ended Aug. 2, the biggest weekly outflow from high- yield funds since May.

- However, US borrowers were largely undeterred. The primary market priced more than $3b this week. And banks, led by Citigroup and Bank of America, are readying to offload some of the debt that helped fund Apollo Global Management’s buyout of the auto-parts maker Tenneco as early as next week.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.