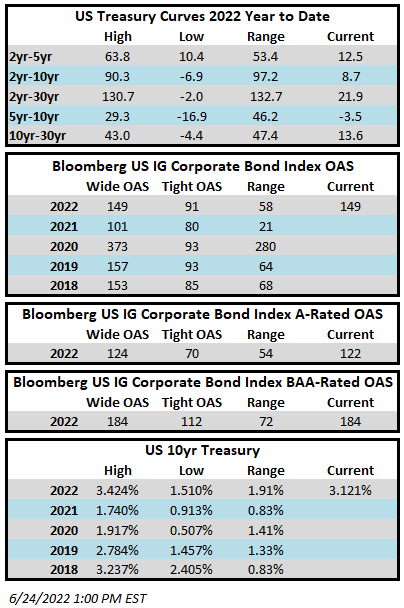

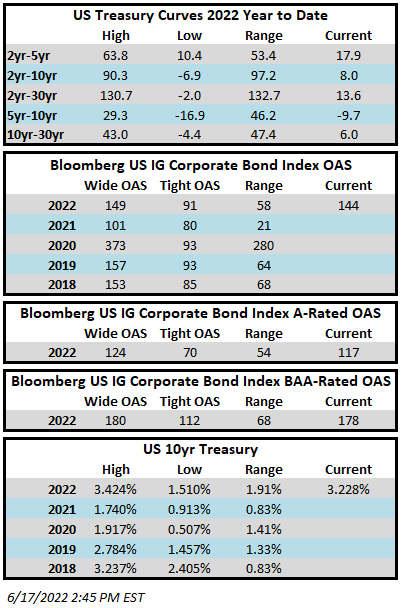

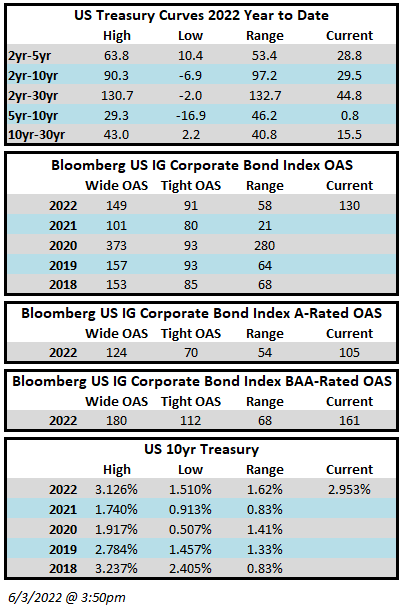

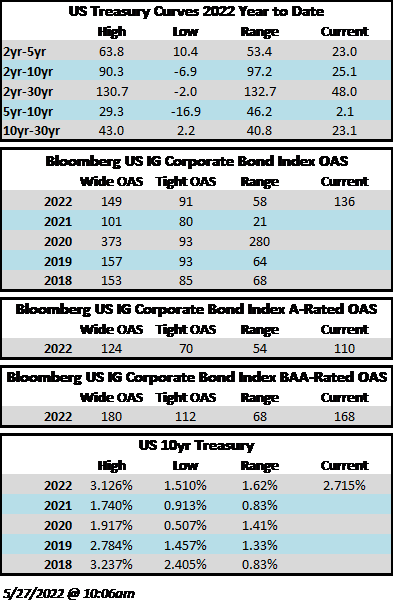

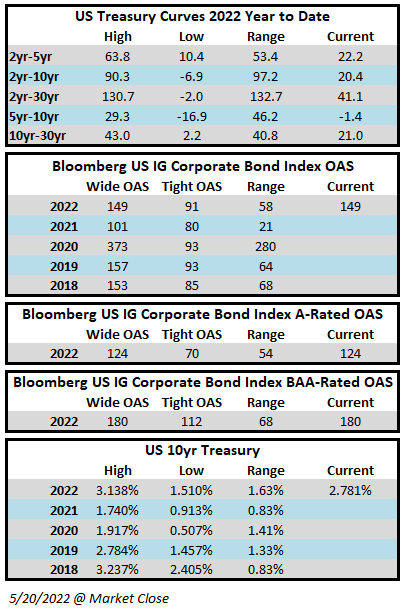

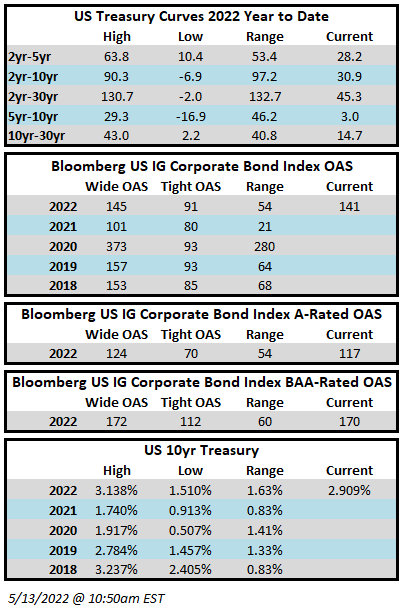

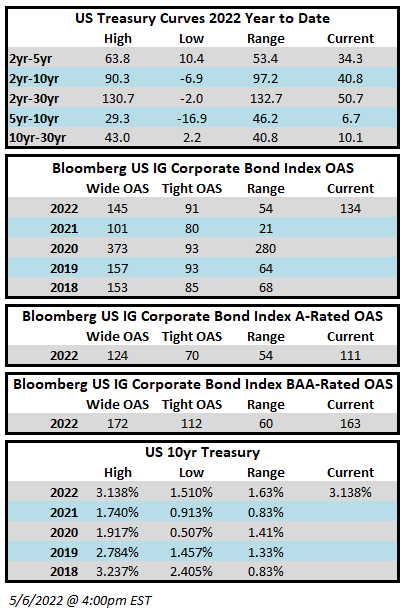

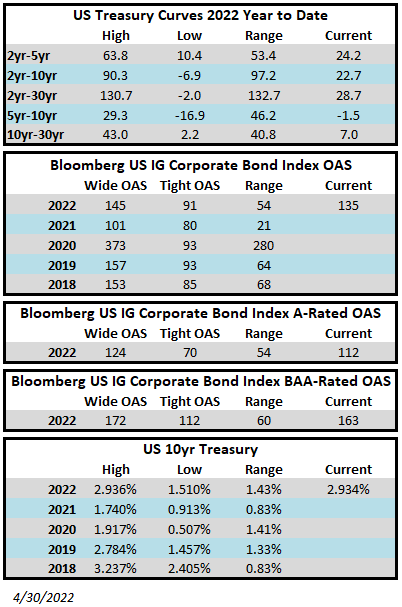

Investment grade credit has had a week of mixed performance. The Bloomberg US Corporate Bond Index closed at 149 on Thursday June 23 after having closed the week prior at 144. The market tone has been good for risk assets on Friday and it looks likely that spreads will finish the week on a positive note. The 10yr Treasury is yielding 3.12% as we go to print after having closed the week prior at 3.23%. The 10yr is down substantially from just 10 days ago when it closed at 3.47% on June 14. Through Thursday the Corporate Index had a negative YTD total return of -14.42% while the YTD S&P500 Index return was -19.77% and the Nasdaq Composite Index return was -27.93%.

New issue activity returned this week but was relatively low volume as IG issuers brought just over $10bln in new debt to market. The consensus expectation is that there will be be about $15bln in issuance next week but it would not surprise us to see less or more than that figure, depending on market conditions. There has been $708bln of new issuance YTD which trails 2021’s pace by 9% according to data compiled by Bloomberg. It looks as though June will fall short of the $90bln estimate for new debt, with just $61bln priced thus far during the month.

Investment grade credit saw another outflow on the week. Per data compiled by Wells Fargo, outflows for the week of June 16–June 22 were -$9.0bln which brings the year-to-date total to -$107.2bln.