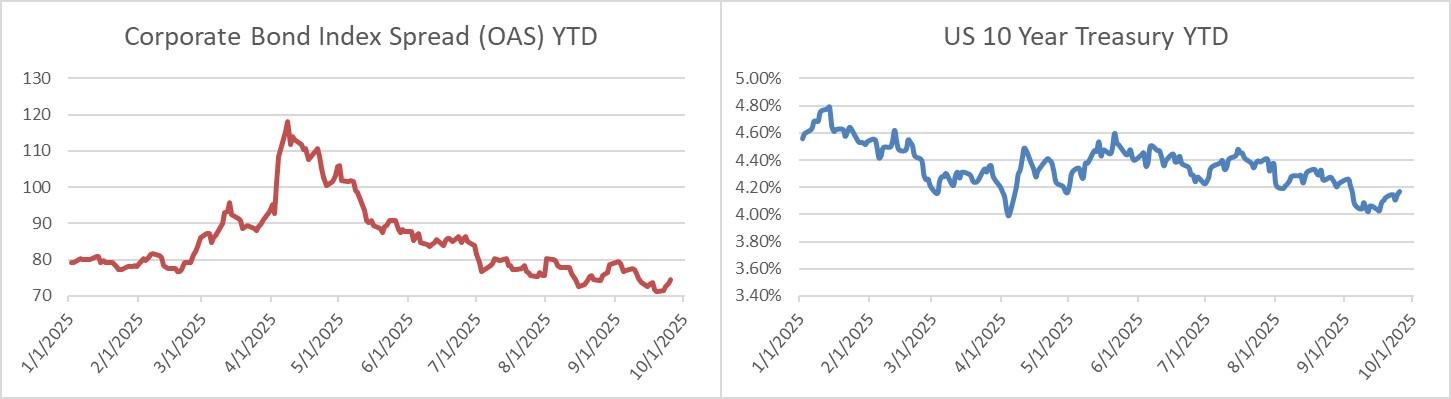

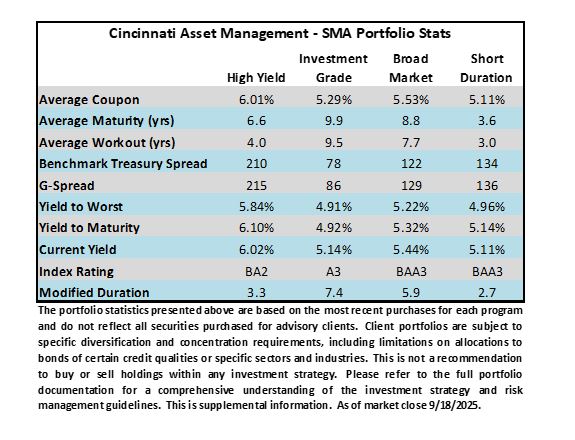

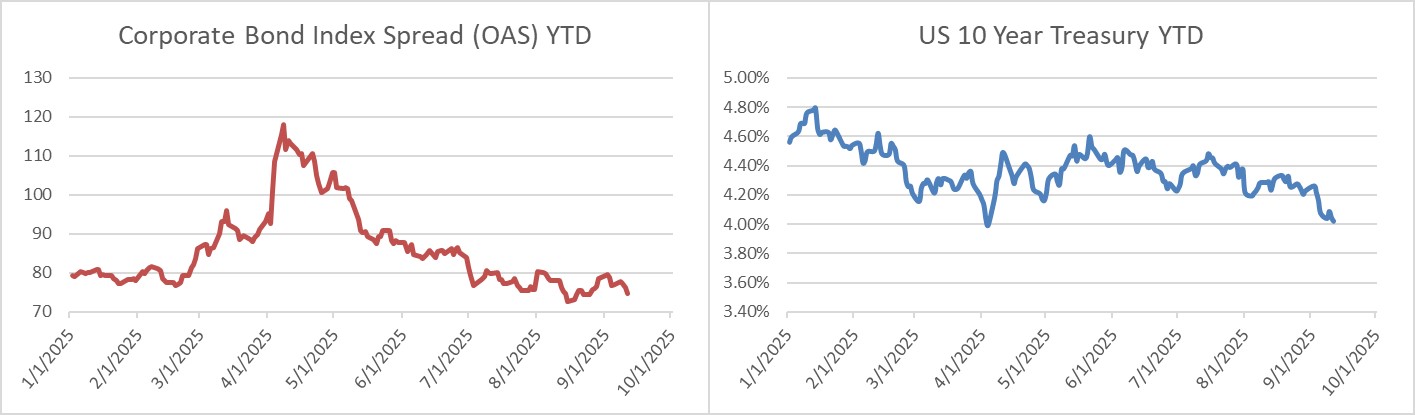

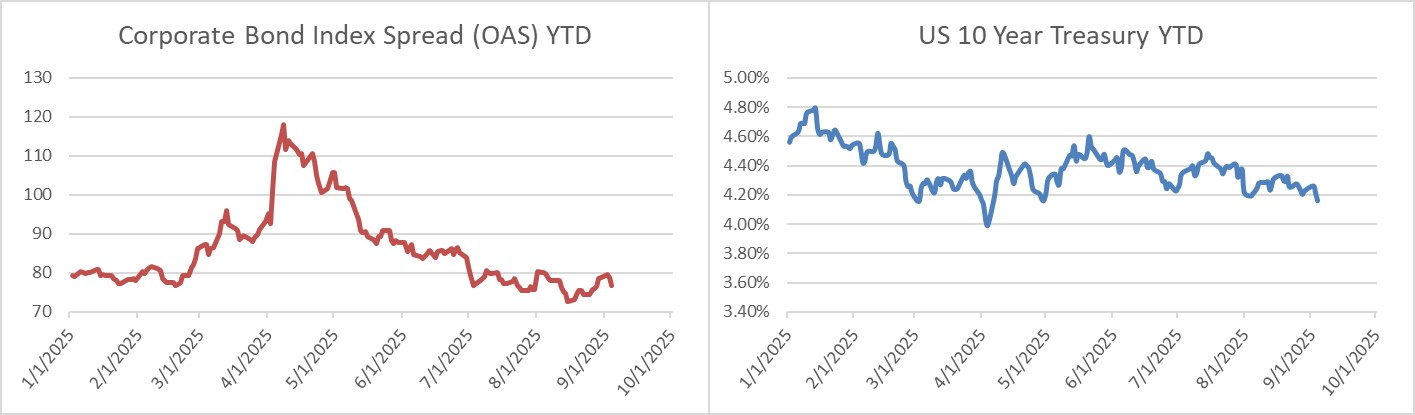

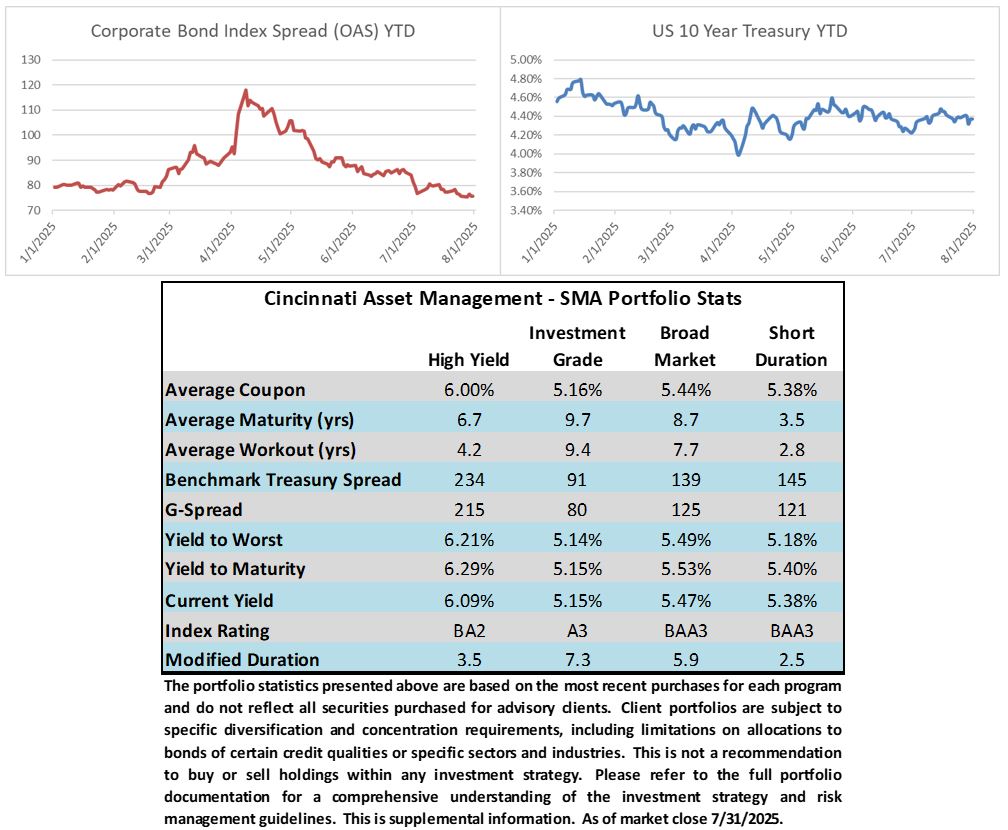

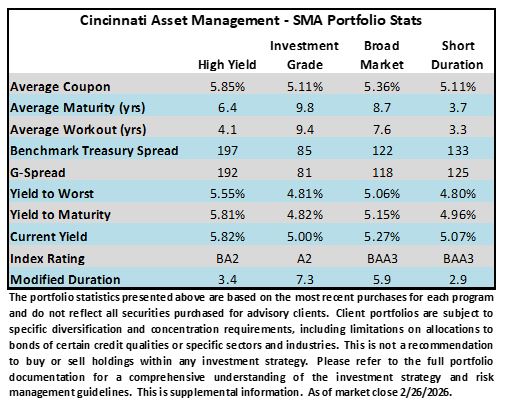

Credit spreads moved wider this week. The OAS on the Corporate Index closed at 82 on Thursday February 26th after closing the week prior at 77. The 10yr Treasury closed last week at 4.08% and had closed at 4.0% on Thursday before breaching 4% on Friday morning. If the current level holds, today will be the first time the 10yr has closed below 4% since the end of November. Through Thursday, the Corporate Bond Index year-to-date total return was +1.36% while the yield to maturity for the index was 4.75%.

Points of Interest

There was a lot happening in the market this week as AI-related woes continued to weigh heavily on certain sectors of the equity market, with software companies leading the way lower. The equity malaise, along with geopolitical worries surrounding Iran, sparked a flight to quality which sent Treasury yields lower. Next week investors will receive important economic data including Employment and Retail Sales from USA and Europe. We also get US ISM Services and a flurry of earnings reports from major retailers (COST, TGT) that will help investors gauge the pulse of the American consumer.

Primary Market

New issue supply sailed past the $50bln estimate this week as companies priced more than $63bln in the primary market. Although spreads have moved wider they have not fully offset the move lower in Treasuries making the funding environment incrementally more attractive for would be issuers. Next week is expected to be another big one as syndicate desks are looking for $70bln of new debt. Year-to-date new issue supply stood at $399.6bln through the end of the week.

Flows

According to LSEG Lipper, for the week ended February 25th, short and intermediate investment-grade bond funds reported a net inflow of +$1.75bln. This was the 13th consecutive week of inflows, although it was less volume than the past few weeks. 2026 year-to-date flows into investment grade were +$31.3bln. The pace of flows is double the number of YTD flows to this point in 2025.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.